Answered step by step

Verified Expert Solution

Question

1 Approved Answer

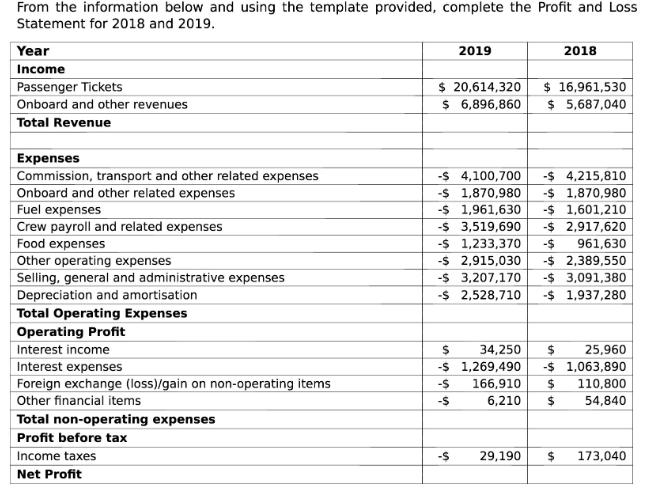

From the information below and using the template provided, complete the Profit and Loss Statement for 2018 and 2019. Year Income Passenger Tickets Onboard

From the information below and using the template provided, complete the Profit and Loss Statement for 2018 and 2019. Year Income Passenger Tickets Onboard and other revenues Total Revenue Expenses Commission, transport and other related expenses Onboard and other related expenses Fuel expenses Crew payroll and related expenses Food expenses Other operating expenses Selling, general and administrative expenses Depreciation and amortisation Total Operating Expenses Operating Profit Interest income Interest expenses Foreign exchange (loss)/gain on non-operating items Other financial items Total non-operating expenses Profit before tax Income taxes Net Profit 2019 $ 20,614,320 $ 6,896,860 -$ 2018 -$ 4,100,700 -$ 4,215,810 -$ 1,870,980 -$ 1,870,980 -$ 1,961,630 -$ 1,601,210 -$ 3,519,690 -$ 1,233,370 -$ 2,917,620 -$ 961,630 -$2,389,550 -$ 2,915,030 -$ 3,207,170 -$ 3,091,380 -$ 2,528,710 -$ 1,937,280 $ 16,961,530 $ 5,687,040 $ 34,250 25,960 -$ 1,269,490 -$ 1,063,890 -S -$ 29,190 166,910 $ 110,800 6,210 $ 54,840 $ 173,040

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Profit and Loss Statement for 2018 and 2019 Year 2019 2018 Total Revenue add all inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started