Answered step by step

Verified Expert Solution

Question

1 Approved Answer

From the information given below, you are required to prepare the consolidated statement of financial position as at 31 December x6. Oliver acquired 1.6

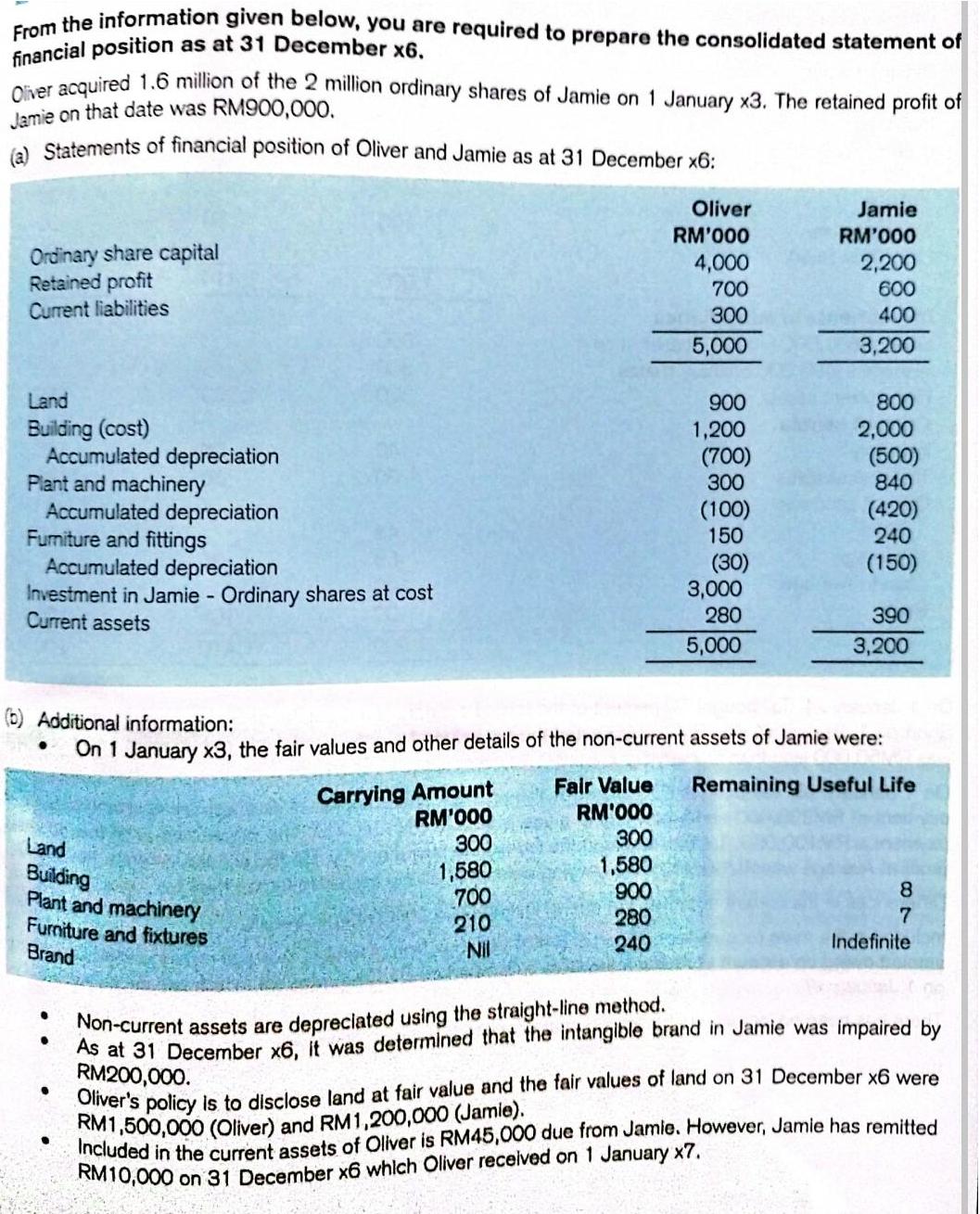

From the information given below, you are required to prepare the consolidated statement of financial position as at 31 December x6. Oliver acquired 1.6 million of the 2 million ordinary shares of Jamie on 1 January x3. The retained profit of Jamie on that date was RM900,000. (a) Statements of financial position of Oliver and Jamie as at 31 December x6: Ordinary share capital Retained profit Current liabilities Land Building (cost) Accumulated depreciation Plant and machinery Accumulated depreciation Furniture and fittings Accumulated depreciation Investment in Jamie - Ordinary shares at cost Current assets Land Building Plant and machinery Furniture and fixtures Brand Carrying Amount RM'000 300 1,580 700 210 Nil Fair Value RM'000 Oliver RM'000 4,000 700 300 5,000 300 1,580 900 280 240 900 1,200 (700) 300 (100) 150 (30) (b) Additional information: On 1 January x3, the fair values and other details of the non-current assets of Jamie were: Remaining Useful Life 3,000 280 5,000 Jamie RM'000 2,200 600 1400 3,200 800 2,000 (500) 840 (420) 240 (150) 390 3,200 8 7 Indefinite Non-current assets are depreciated using the straight-line method. As at 31 December x6, it was determined that the intangible brand in Jamie was impaired by RM200,000. Oliver's policy is to disclose land at fair value and the fair values of land on 31 December x6 were RM1,500,000 (Oliver) and RM1,200,000 (Jamie). Included in the current assets of Oliver is RM45,000 due from Jamie. However, Jamie has remitted RM10,000 on 31 December x6 which Oliver received on 1 January x7.

Step by Step Solution

★★★★★

3.43 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Expert Answer General Guidance The answer provided below has been developed in a clear step by step ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started