Answered step by step

Verified Expert Solution

Question

1 Approved Answer

From the information provided, analyse the liquidity and asset utilisation of Bamboocha Enterprises Ltd. Your analysis must include the calculation of relevant ratios for

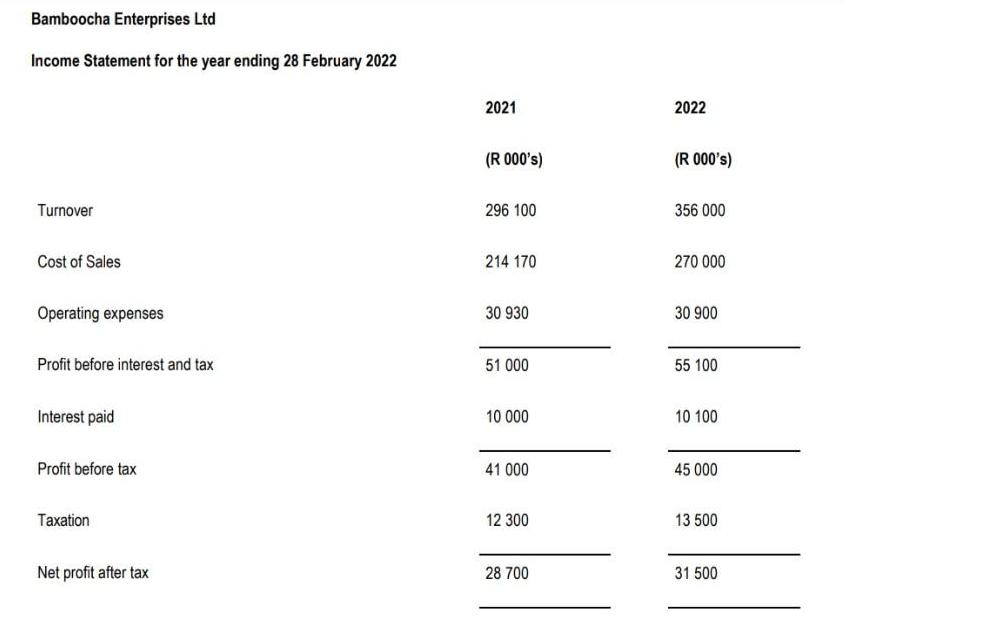

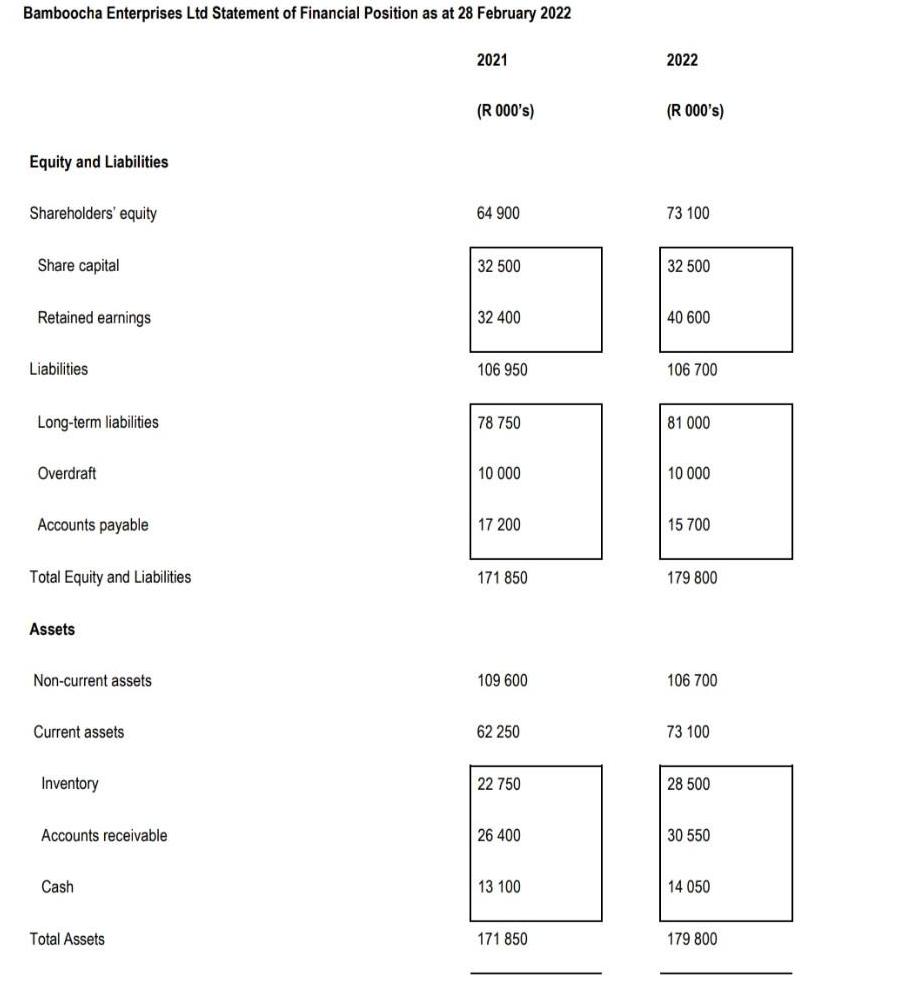

From the information provided, analyse the liquidity and asset utilisation of Bamboocha Enterprises Ltd. Your analysis must include the calculation of relevant ratios for both 2021 and 2022, an interpretation of each ratio used, and a year-on-year comparison should be provided. Bamboocha Enterprises Ltd Income Statement for the year ending 28 February 2022 2021 2022 (R 000's) (R 000's) Turnover 296 100 356 000 Cost of Sales 214 170 270 000 Operating expenses 30 930 30 900 Profit before interest and tax 51 000 55 100 Interest paid 10 000 10 100 Profit before tax 41 000 45 000 Taxation 12 300 13 500 Net profit after tax 28 700 31 500 Bamboocha Enterprises Ltd Statement of Financial Position as at 28 February 2022 2021 2022 (R 000's) (R 000's) Equity and Liabilities Shareholders' equity 64 900 73 100 Share capital 32 500 32 500 Retained earnings 32 400 40 600 Liabilities 106 950 106 700 Long-term liabilities 78 750 81 000 Overdraft 10 000 10 000 Accounts payable 17 200 15 700 Total Equity and Liabilities 171 850 179 800 Assets Non-current assets 109 600 106 700 Current assets 62 250 73 100 Inventory 22 750 28 500 Accounts receivable 26 400 30 550 Cash 13 100 14 050 Total Assets 171 850 179 800

Step by Step Solution

★★★★★

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

2021 2022 Comments 1 Liquidity Ratio a Current Ratio Current Assets Current Li...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started