Answered step by step

Verified Expert Solution

Question

1 Approved Answer

From the records of an oil distributing company, the following summarized information is available for the month of March 2019: Sales for the month: N1.925,000

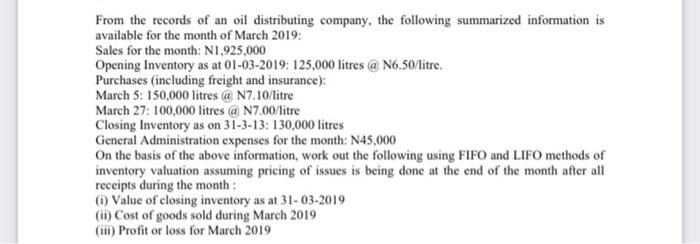

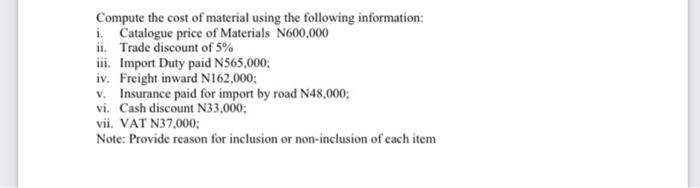

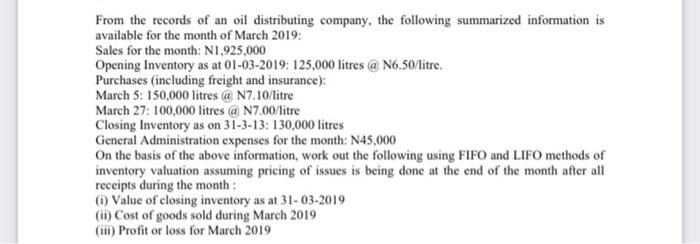

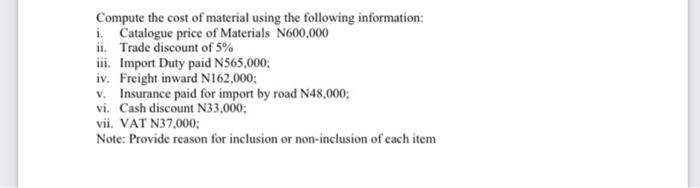

From the records of an oil distributing company, the following summarized information is available for the month of March 2019: Sales for the month: N1.925,000 Opening Inventory as at 01-03-2019: 125,000 litres a N6.50/litre. Purchases (including freight and insurance): March 5: 150,000 litres a N7.10/litre March 27: 100,000 litres @ N7.00/litre Closing Inventory as on 31-3-13: 130,000 litres General Administration expenses for the month: N45,000 On the basis of the above information, work out the following using FIFO and LIFO methods of inventory valuation assuming pricing of issues is being done at the end of the month after all receipts during the month : (1) Value of closing inventory as at 31-03-2019 (ii) Cost of goods sold during March 2019 (iii) Profit or loss for March 2019 Compute the cost of material using the following information: i. Catalogue price of Materials N600,000 ii. Trade discount of 5% iii. Import Duty paid N565,000 iv. Freight inward N162,000; v. Insurance paid for import by road N48.000; vi. Cash discount N33.000; vii. VAT N37,000; Note: Provide reason for inclusion or non-inclusion of each item

From the records of an oil distributing company, the following summarized information is available for the month of March 2019: Sales for the month: N1.925,000 Opening Inventory as at 01-03-2019: 125,000 litres a N6.50/litre. Purchases (including freight and insurance): March 5: 150,000 litres a N7.10/litre March 27: 100,000 litres @ N7.00/litre Closing Inventory as on 31-3-13: 130,000 litres General Administration expenses for the month: N45,000 On the basis of the above information, work out the following using FIFO and LIFO methods of inventory valuation assuming pricing of issues is being done at the end of the month after all receipts during the month : (1) Value of closing inventory as at 31-03-2019 (ii) Cost of goods sold during March 2019 (iii) Profit or loss for March 2019 Compute the cost of material using the following information: i. Catalogue price of Materials N600,000 ii. Trade discount of 5% iii. Import Duty paid N565,000 iv. Freight inward N162,000; v. Insurance paid for import by road N48.000; vi. Cash discount N33.000; vii. VAT N37,000; Note: Provide reason for inclusion or non-inclusion of each item

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started