Answered step by step

Verified Expert Solution

Question

1 Approved Answer

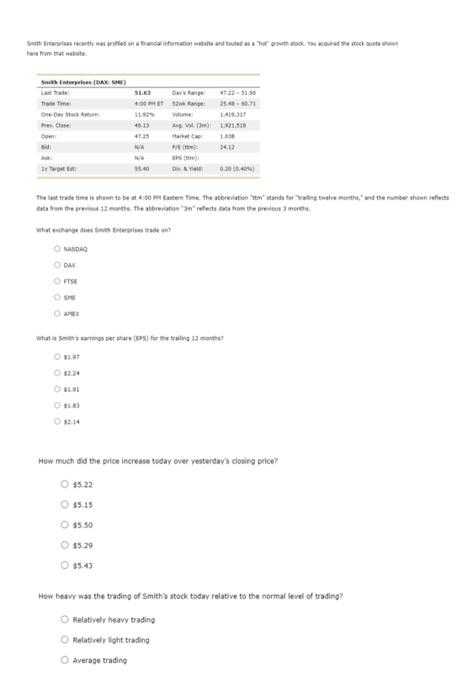

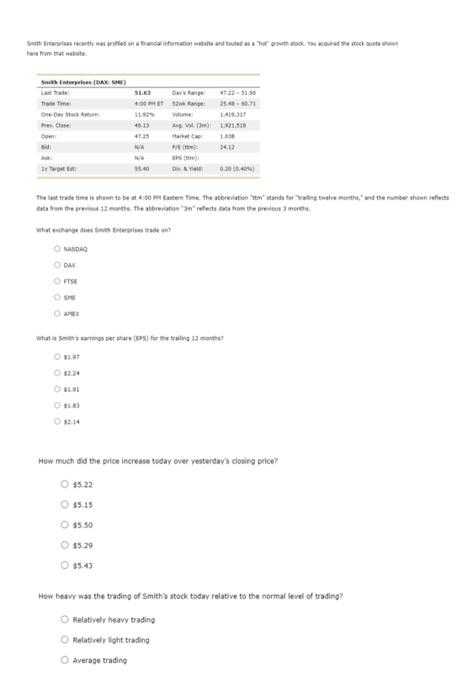

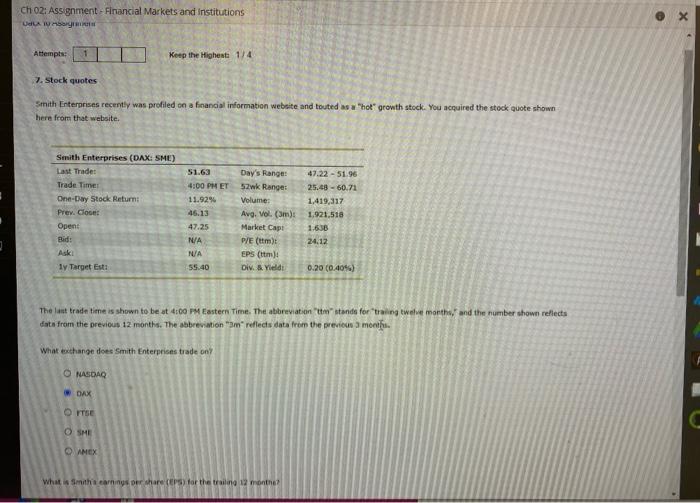

from the Simits Enterprises (SME) 51. The Ta One-Stock 11. 46.13 25.4 LA Av 1.2.10 NA av tre . D&Y 0.20 0.40 The last trade

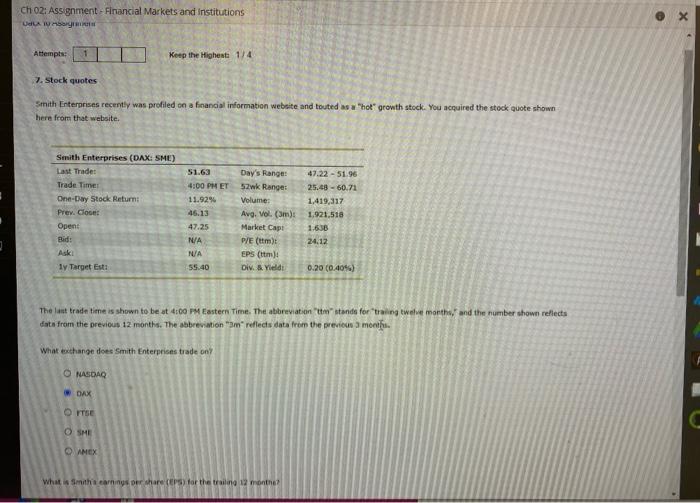

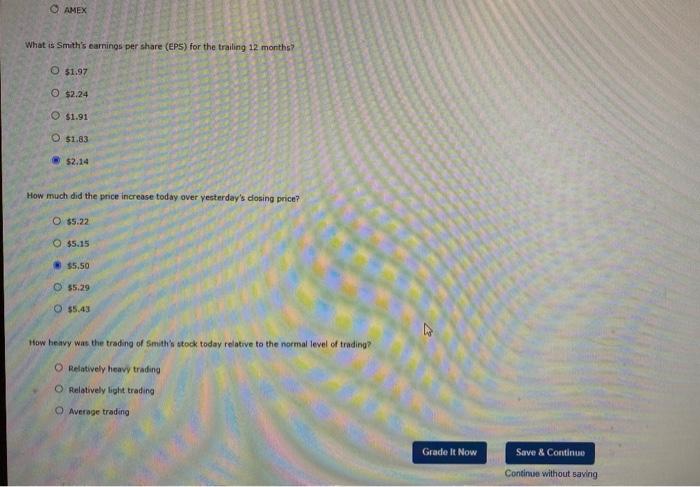

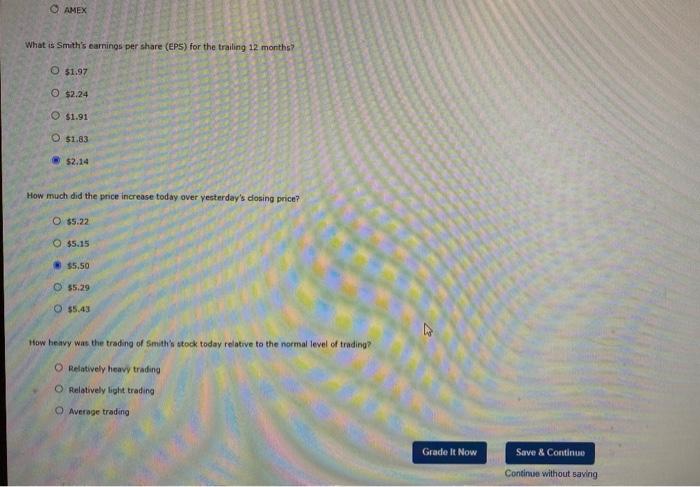

from the Simits Enterprises (SME) 51. The Ta One-Stock 11. 46.13 25.4 LA Av 1.2.10 NA av tre . D&Y 0.20 0.40 The last trade time is shown to be 40 te Time the abbreviation and for trave month and the number show roots Data from the 11 months. The station refeste data from the resort NASDAQ DAK How much did the price increase today over yesterday's closing price? 55.22 $5.15 $550 $5.29 How heavy was the trading of Smith's stock today relative to the normal level of trading? Relatively heavy trading Relatively light trading Average trading Ch 02: Assignment Financial Markets and Institutions OLAW X Attempts: Keep the Highesti 1/4 7. Stock quotes Smith Enterprises recently was profiled on a financial information website and touted a "hot" growth stock. You acquired the stock quote shown here from that website. Smith Enterprises (DAX: SME) Last Trade: Trade Times One-Day Stock Return; Prev. Close Open Bid: 4:00 PM ET 11.92% 46.13 47.25 N/A Day's Range: 52wk Range: Volume: Avg. vol. (m): Market Capt P/E (mit EPS (tm) Div. & Yield 47.22 - 51.90 25.48 - 60.71 1.419,317 1,921,518 1.6.36 24.12 TUA 1y Target Esta 55.40 0.20 (0.404.) The last trade time is shown to be at 4:00 PM Eastern Time. The abbreviation stands for "traling twelve month and the number shown reflects data from the previous 12 months. The abbreviation "m" reflects data from the previous a month. What exchange does Smith Enterprises trade on? O NASDAQ DAX O SME AMEX What is Smith anys per share (ES) for the trailing 12 monthe? O AMEX What is Smith's earnings per share (EPS) for the trailing 12 months O $1.97 O $2.24 $1.91 $1.83 $2.14 How much did the price increase today over yesterday's dosing price? O $5.22 O $5.15 $5.50 $5.29 How heavy was the trading of Smith's stock today relative to the normal level of trading? O Relatively heavy trading O Relatively light trading Average trading Grade It Now Save & Continuo Continue without saving

from the Simits Enterprises (SME) 51. The Ta One-Stock 11. 46.13 25.4 LA Av 1.2.10 NA av tre . D&Y 0.20 0.40 The last trade time is shown to be 40 te Time the abbreviation and for trave month and the number show roots Data from the 11 months. The station refeste data from the resort NASDAQ DAK How much did the price increase today over yesterday's closing price? 55.22 $5.15 $550 $5.29 How heavy was the trading of Smith's stock today relative to the normal level of trading? Relatively heavy trading Relatively light trading Average trading Ch 02: Assignment Financial Markets and Institutions OLAW X Attempts: Keep the Highesti 1/4 7. Stock quotes Smith Enterprises recently was profiled on a financial information website and touted a "hot" growth stock. You acquired the stock quote shown here from that website. Smith Enterprises (DAX: SME) Last Trade: Trade Times One-Day Stock Return; Prev. Close Open Bid: 4:00 PM ET 11.92% 46.13 47.25 N/A Day's Range: 52wk Range: Volume: Avg. vol. (m): Market Capt P/E (mit EPS (tm) Div. & Yield 47.22 - 51.90 25.48 - 60.71 1.419,317 1,921,518 1.6.36 24.12 TUA 1y Target Esta 55.40 0.20 (0.404.) The last trade time is shown to be at 4:00 PM Eastern Time. The abbreviation stands for "traling twelve month and the number shown reflects data from the previous 12 months. The abbreviation "m" reflects data from the previous a month. What exchange does Smith Enterprises trade on? O NASDAQ DAX O SME AMEX What is Smith anys per share (ES) for the trailing 12 monthe? O AMEX What is Smith's earnings per share (EPS) for the trailing 12 months O $1.97 O $2.24 $1.91 $1.83 $2.14 How much did the price increase today over yesterday's dosing price? O $5.22 O $5.15 $5.50 $5.29 How heavy was the trading of Smith's stock today relative to the normal level of trading? O Relatively heavy trading O Relatively light trading Average trading Grade It Now Save & Continuo Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started