Answered step by step

Verified Expert Solution

Question

1 Approved Answer

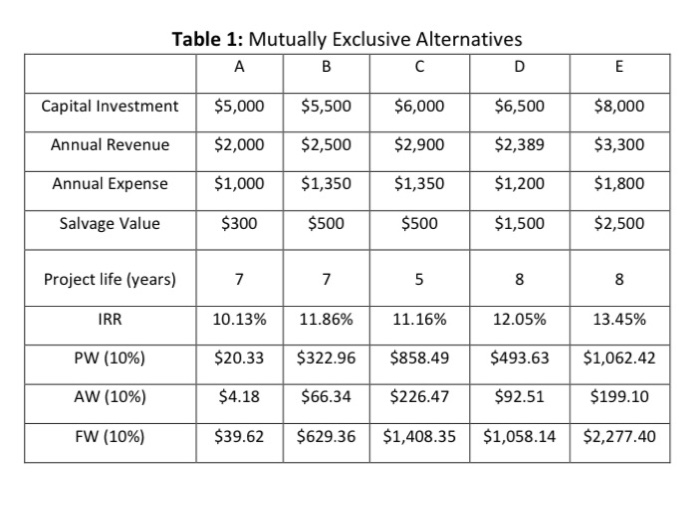

From the table 1 above, If the MARR= 12 %, select the correct choice a) We cannot compare projects based on the PW. b) Since

From the table 1 above, If the MARR= 12 %, select the correct choice

a) We cannot compare projects based on the PW.

b) Since FW of project E is the highest, it is the best alternative.

c) Since the life of projects are different, we can only compare projects based on the AW. d) We cannot compare projects based on IRR when they have different life.

e) If company decreases MARR to 8 %, number of available alternatives decreases.

Justify:_______________________________________________________________________

from the table

Table 1: Mutually Exclusive Alternatives . B D E Capital Investment $5,000 $5,500 $6,000 $6,500 $8,000 Annual Revenue $2,000 $2,500 $2,900 $2,389 $3,300 Annual Expense $1,000 $1,350 $1,350 $1,200 $1,800 Salvage Value $300 $500 $500 $1,500 $2,500 Project life (years) 7 7 5 8 8 IRR 10.13% 11.86% 11.16% 12.05% 13.45% PW (10%) $20.33 $322.96 $858.49 $493.63 $1,062.42 AW (10%) $4.18 $66.34 $226.47 $92.51 $199.10 FW (10%) $39.62 $629.36 $1,408.35 $1,058.14 $2,277.40 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started