Question

From year 3 on the unlevered cash flow is expected to perpetually grow at 3.00% (that is, the unlevered cash flow of year 4 will

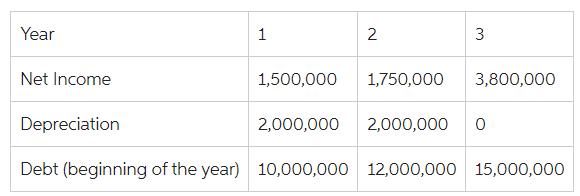

From year 3 on the unlevered cash flow is expected to perpetually grow at 3.00% (that is, the unlevered cash flow of year 4 will be 5% higher than in year 3 and so on). The depreciation will stay equal to 0 from year 3 on, and also debt will stay perpetually at 15,000,000 starting at the beginning of year 3. The debt variations are all scheduled beforehand, hence there is no uncertainty about them.

The interest rate is 2.55%, the unlevered return on equity is 7.50% and the depreciation tax shield is as risky as the company’s debt. The tax rate is 40%.

a) What is the levered cash flow to equity holders in each one of the first three years?

b) What is the levered value of the company’s assets?

Year 1 2 3 Net Income 1,500,000 1,750,000 3,800,000 Depreciation 2,000,000 2,000,000 0 Debt (beginning of the year) 10,000,000 12,000,000 15,000,000

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a The levered cash flow to equity holders in each one of the first three years is as follows Year 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started