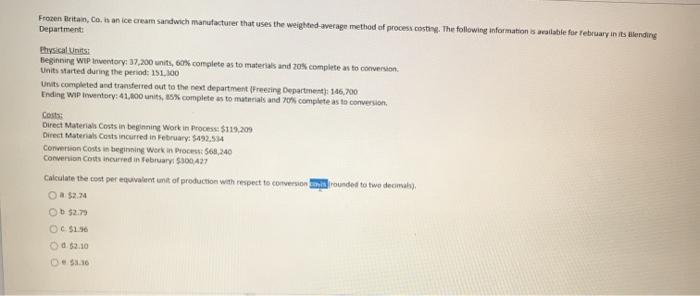

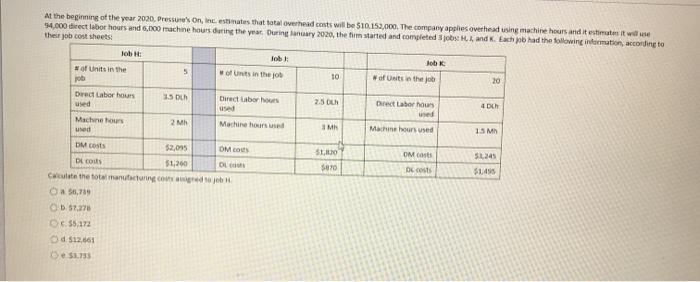

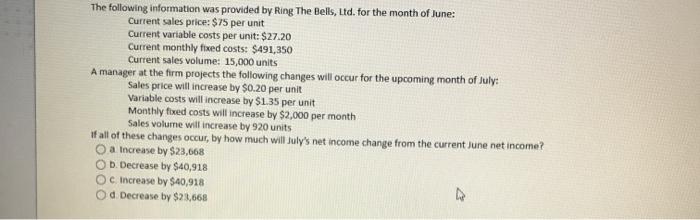

Frozen Britain, Co. in an ice cream sandwich manufacturer that uses the weighted average method of process castage. The following information is rentable for February in its blending Departments Physical Units Beginning inventory: 37,200 units, 60% complete as to materials and 20% complete as to conversion Units started during the periode 151.100 Units completed and transferred out to the next department (Freering Department): 146.700 Ending WIP inventory: 41,600 units, 35% complete sto materials and 70% complete as to conversion Direct Materials Costs in beginning Work in Process $119,209 Direct Materials costs incurred in February: $492.534 Conversion Costs te beginning Work in Proce568,240 Convention Costs incurred in February $300427 Calculate the cost per equivalent unit of production with respect to conversion rounded to two dema) a $2.74 OC $1.56 Od $2.10 At the beginning of the year 2020. Pressure on, Inc., estimates that total overhead costs will be 510.152,000. The company applies overhead using machine hours and it estimat it will 54.000 direct labor hours and 6.000 machine hours during the year Durianuary 2020, the started and completed jobs Hand K. Each had the following information according to the job.cost sheets Job H: Job Job of Units in the 5 w of Units in the 10 #of Onits in the job 20 Job Direct Labor hours 1.5 L Direct labore 2.5 h Director hours used 4 DL M Machineboursused 15 M $1,100 DMC 5145 $1,455 3870 Dosts Machines 2 h Machine hours used used DM COSE $2,095 DMC DLC $1,260 OL Calculate the total manufacturing Congreb O 56789 0.57.276 C. 55.172 d. $12,061 51.733 The following information was provided by Ring The Bells, Ltd. for the month of June: Current sales price: $75 per unit Current variable costs per unit: $27.20 Current monthly fixed costs: $491,350 Current sales volume: 15,000 units A manager at the firm projects the following changes will occur for the upcoming month of July: Sales price will increase by $0.20 per unit Variable costs will increase by $1.35 per unit Monthly fixed costs will increase by $2,000 per month Sales volume will increase by 920 units If all of these changes occur, by how much will July's net income change from the current June net income? O a Increase by $23,668 D. Decrease by $40,918 C. Increase by $40,918 d Decrease by $23,668