Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FTR Bhd provided a rental income of RM700,000 per annum for letting out one of its properties to BCX Bhd. 4) All dividends in

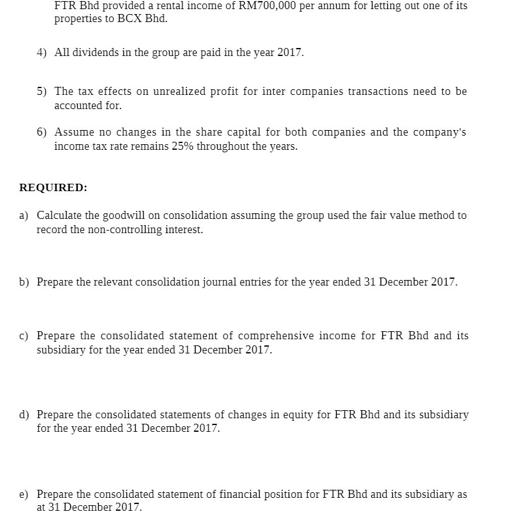

FTR Bhd provided a rental income of RM700,000 per annum for letting out one of its properties to BCX Bhd. 4) All dividends in the group are paid in the year 2017. 5) The tax effects on unrealized profit for inter companies transactions need to be accounted for. 6) Assume no changes in the share capital for both companies and the company's income tax rate remains 25% throughout the years. REQUIRED: a) Calculate the goodwill on consolidation assuming the group used the fair value method to record the non-controlling interest. b) Prepare the relevant consolidation journal entries for the year ended 31 December 2017. c) Prepare the consolidated statement of comprehensive income for FTR Bhd and its subsidiary for the year ended 31 December 2017. d) Prepare the consolidated statements of changes in equity for FTR Bhd and its subsidiary for the year ended 31 December 2017. e) Prepare the consolidated statement of financial position for FTR Bhd and its subsidiary as at 31 December 2017.

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a Calculation of goodwill on consolidation using fair value method FIR Bhd Share capital 1000000 sharesRM1000000 Retained earningsRM550000 Total equit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started