Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Why is the after-tax cost of debt rather than the before-tax cost used to calculate the WACC? 2. Is a tax adjustment made to

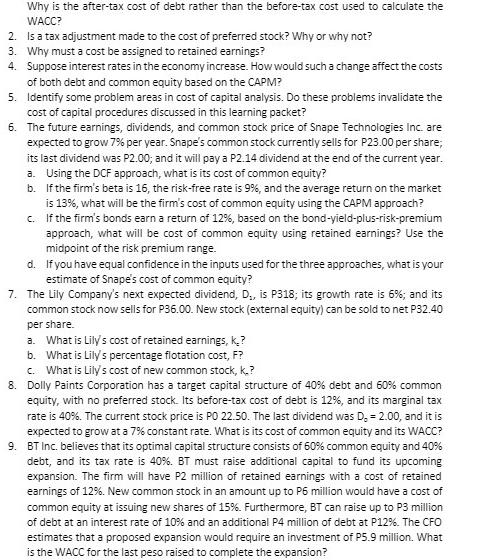

Why is the after-tax cost of debt rather than the before-tax cost used to calculate the WACC? 2. Is a tax adjustment made to the cost of preferred stock? Why or why not? 3. Why must a cost be assigned to retained earnings? 4. Suppose interest rates in the economy increase. How would such a change affect the costs of both debt and common equity based on the CAPM? 5. Identify some problem areas in cost of capital analysis. Do these problems invalidate the cost of capital procedures discussed in this learning packet? 6. The future earnings, dividends, and common stock price of Snape Technologies Inc. are expected to grow 7% per year. Snape's common stock currently sells for P23.00 per share; its last dividend was P2.00; and it will pay a P2.14 dividend at the end of the current year. a. Using the DCF approach, what is its cost of common equity? b. If the firm's beta is 16, the risk-free rate is 9%, and the average return on the market is 13%, what will be the firm's cost of common equity using the CAPM approach? C. If the firm's bonds earn a return of 12%, based on the bond-yield-plus-risk-premium approach, what will be cost of common equity using retained earnings? Use the midpoint of the risk premium range. d. If you have equal confidence in the inputs used for the three approaches, what is your estimate of Snape's cost of common equity? 7. The Lily Company's next expected dividend, D., is P318; its growth rate is 6%; and its common stock now sells for P36.00. New stock (external equity) can be sold to net P32.40 per share. a. What is Lily's cost of retained earnings, k.? b. What is Lily's percentage flotation cost, F? c. What is Lily's cost of new common stock, k.? 8. Dolly Paints Corporation has a target capital structure of 40% debt and 60% common equity, with no preferred stock. Its before-tax cost of debt is 12%, and its marginal tax rate is 40%. The current stock price is PO 22.50. The last dividend was D, = 2.00, and it is expected to grow at a 7% constant rate. What is its cost of common equity and its WACC? 9. BT Inc. believes that its optimal capital structure consists of 60% common equity and 40% debt, and its tax rate is 40%. BT must raise additional capital to fund its upcoming expansion. The firm will have P2 million of retained earnings with a cost of retained earnings of 12%. New common stock in an amount up to P6 million would have a cost of common equity at issuing new shares of 15%. Furthermore, BT can raise up to P3 million of debt at an interest rate of 10% and an additional P4 million of debt at P12%. The CFO estimates that a proposed expansion would require an investment of P5.9 million. What is the WACC for the last peso raised to complete the expansion?

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 The aftertax cost of debt is used to calculate the weighted average cost of capital WACC because interest expenses on debt are taxdeductible When a company pays interest on its debt it can deduct th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started