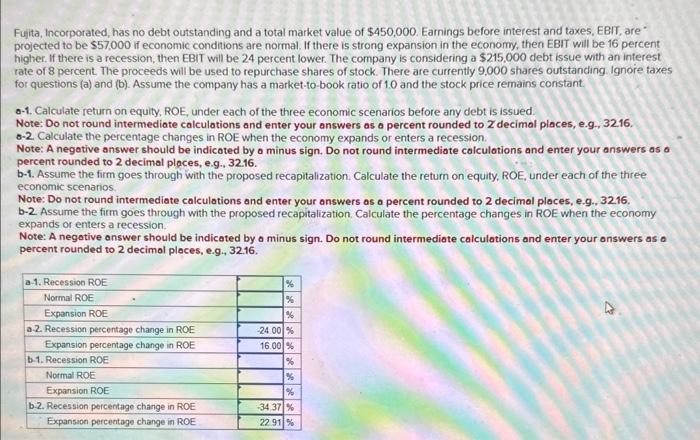

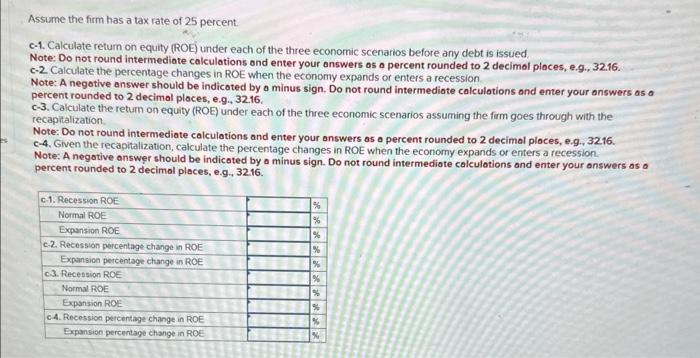

Fugita, Incorporated, has no debt outstanding and a total market value of $450,000. Earnings before interest and taxes, EBIT, are projected to be $57,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 16 percent higher. If there is a recession, then EBIT will be 24 percent lower. The company is considering a $215,000 debt issue with an interest rate of 8 percent. The proceeds will be used to repurchase shares of stock. There are currently 9.000 shares outstanding. Ignore taxes for questions (a) and (b). Assume the company has a market-to-book ratio of 1.0 and the stock price remains constant. o-1. Calculate return on equity, ROE, under each of the three economic scenarios before any debt is issued. Note: Do not round intermediate calculations and enter your answers as o percent rounded to Z decimal places, e.g., 32.16. o-2. Calculate the percentage changes in ROE when the economy expands or enters a recession. Note: A negative answer should be indicoted by o minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal ploces, e.g. 32.16. b-1. Assume the firm goes through with the proposed recapitalization. Calculate the return on equity, ROE, under each of the three economic scenarios. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 3216. b-2. Assume the firm goes through with the proposed recapitalization. Calculate the percentage changes in ROE when the economy expands or enters a recession. Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g. 32.16. Assume the firm has a tax rate of 25 percent. c-1. Calculate retum on equity (ROE) under each of the three economic scenarios before any debt is issued Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimol ploces, e.9., 32.16. c-2. Calculate the percentage changes in ROE when the economy expands or enters a recession. Note: A negative answer should be indicated by o minus sign. Do not round intermediote calculotions and enter your answers as a percent rounded to 2 decimal ploces, e.9. 32.16. c-3. Calculate the return on equity (ROE) under each of the three economic scenarios assuming the firm goes through with the recapitalization. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimol places, e.g. 3216 . c-4. Given the recapitalization, calculate the percentage changes in ROE when the economy expands or enters a recession. Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g. 32.16