Answered step by step

Verified Expert Solution

Question

1 Approved Answer

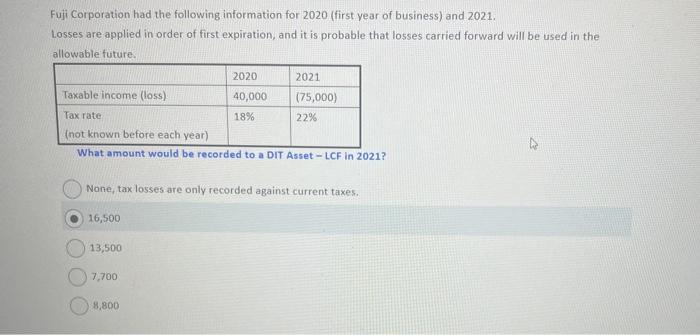

Fuji Corporation had the following information for 2020 (first year of business) and 2021. Losses are applied in order of first expiration, and it

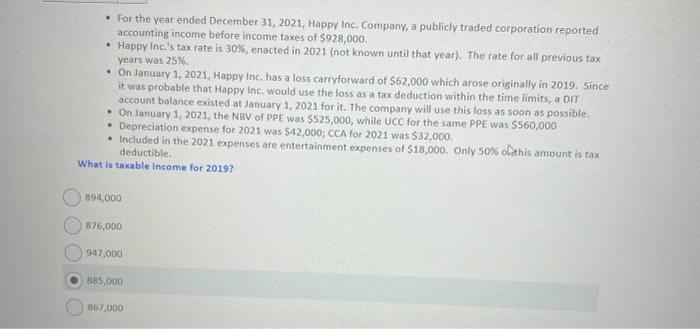

Fuji Corporation had the following information for 2020 (first year of business) and 2021. Losses are applied in order of first expiration, and it is probable that losses carried forward will be used in the allowable future. Taxable income (loss) Tax rate (not known before each year) What amount would be recorded to a DIT Asset-LCF in 2021? 16,500 None, tax losses are only recorded against current taxes. 13,500 2020 40,000 18% 7,700 2021 (75,000) 22% 8,800 . For the year ended December 31, 2021, Happy Inc. Company, a publicly traded corporation reported accounting income before income taxes of $928,000. Happy Inc.'s tax rate is 30%, enacted in 2021 (not known until that year). The rate for all previous tax years was 25%. On January 1, 2021, Happy Inc. has a loss carryforward of $62,000 which arose originally in 2019. Since it was probable that Happy Inc. would use the loss as a tax deduction within the time limits, a DIT account balance existed at January 1, 2021 for it. The company will use this loss as soon as possible. On January 1, 2021, the NBV of PPE was $525,000, while UCC for the same PPE was $560,000 Depreciation expense for 2021 was $42,000; CCA for 2021 was $32,000. Included in the 2021 expenses are entertainment expenses of $18,000. Only 50% of this amount is tax deductible. What is taxable income for 2019? 894,000 876,000 947,000 885,000 867,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below SOLUTION To calculate the taxable incom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started