Question

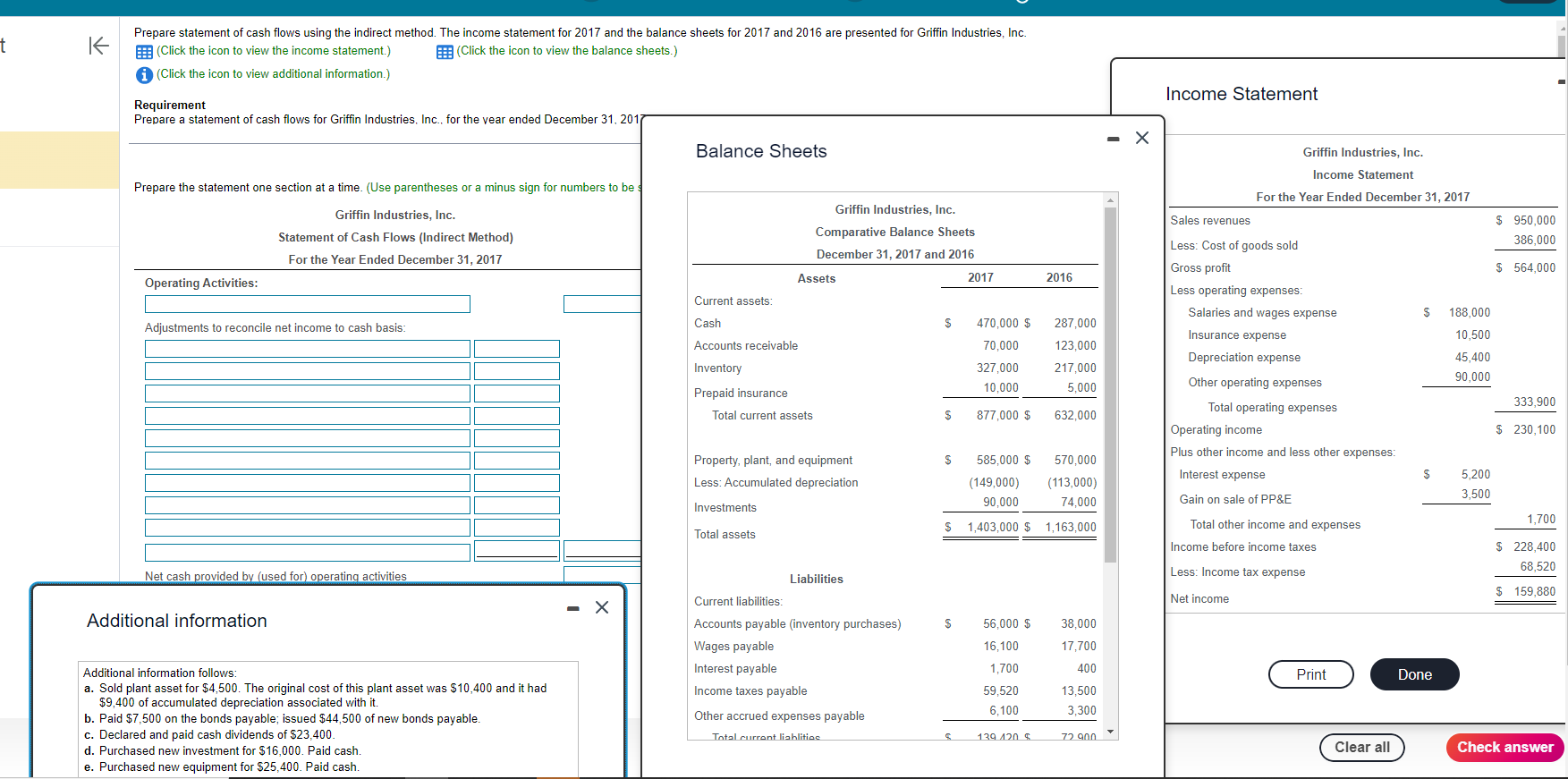

Full balance sheet Griffin Industries, Inc. Comparative Balance Sheets December 31, 2017 and 2016 Assets 2017 2016 Current assets: Cash $470,000 $287,000 Accounts receivable 70,000

Full balance sheet

Griffin Industries, Inc.

Comparative Balance Sheets

December 31, 2017 and 2016

Assets

2017

2016

Current assets:

Cash

$470,000

$287,000

Accounts receivable

70,000

123,000

Inventory

327,000

217,000

Prepaid insurance

10,000

5,000

Total current assets

$877,000

$632,000

Property, plant, and equipment

$585,000

$570,000

Less: Accumulated depreciation

(149,000)

(113,000)

Investments

90,000

74,000

Total assets

$1,403,000

$1,163,000

Liabilities

Current liabilities:

Accounts payable (inventory purchases)

$56,000

$38,000

Wages payable

16,100

17,700

Interest payable

1,700

400

Income taxes payable

59,520

13,500

Other accrued expenses payable

6,100

3,300

Total current liablities

$139,420

$72,900

Long-term liabilities

64,000

27,000

Total liabilities

$203,420

$99,900

Stockholders' equity

Common stock

$603,000

$603,000

Retained earnings

596,580

460,100

Total stockholders' equity

$1,199,580

$1,063,100

Total liabilities and equity

$1,403,000

$1,163,000

Additional information Additional information follows: a. Sold plant asset for $4,500. The original cost of this plant asset was $10,400 and it had $9,400 of accumulated depreciation associated with it. b. Paid $7,500 on the bonds payable; issued $44,500 of new bonds payable. c. Declared and paid cash dividends of $23,400. d. Purchased new investment for $16,000. Paid cash. e. Purchased new equipment for $25,400. Paid cashStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started