Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Full explanation including formulas July Polo Limited is a manufacturing company busy preparing its monthly budgets. The company produces and sells one product. Budgeted sales

Full explanation including formulas

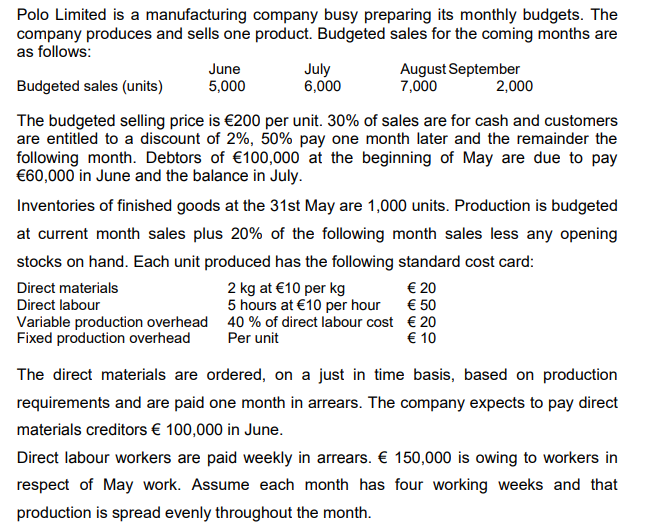

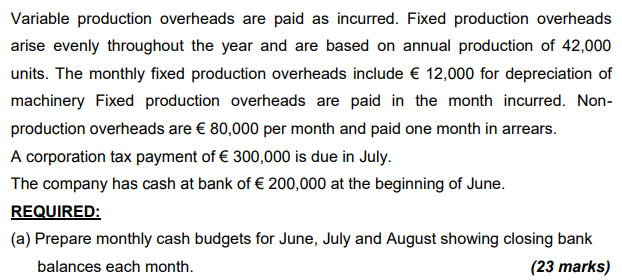

July Polo Limited is a manufacturing company busy preparing its monthly budgets. The company produces and sells one product. Budgeted sales for the coming months are as follows: June August September Budgeted sales (units) 5,000 6,000 7,000 2,000 The budgeted selling price is 200 per unit. 30% of sales are for cash and customers are entitled to a discount of 2%, 50% pay one month later and the remainder the following month. Debtors of 100,000 at the beginning of May are due to pay 60,000 in June and the balance in July. Inventories of finished goods at the 31st May are 1,000 units. Production is budgeted at current month sales plus 20% of the following month sales less any opening stocks on hand. Each unit produced has the following standard cost card: Direct materials 2 kg at 10 per kg 20 Direct labour 5 hours at 10 per hour 50 Variable production overhead 40% of direct labour cost 20 Fixed production overhead Per unit 10 The direct materials are ordered, on a just in time basis, based on production requirements and are paid one month in arrears. The company expects to pay direct materials creditors 100,000 in June. Direct labour workers are paid weekly in arrears. 150,000 is owing to workers in respect of May work. Assume each month has four working weeks and that production is spread evenly throughout the month. Variable production overheads are paid as incurred. Fixed production overheads arise evenly throughout the year and are based on annual production of 42,000 units. The monthly fixed production overheads include 12,000 for depreciation of machinery Fixed production overheads are paid in the month incurred. Non- production overheads are 80,000 per month and paid one month in arrears. A corporation tax payment of 300,000 is due in July. The company has cash at bank of 200,000 at the beginning of June. REQUIRED: (a) Prepare monthly cash budgets for June, July and August showing closing bank balances each month. (23 marks) July Polo Limited is a manufacturing company busy preparing its monthly budgets. The company produces and sells one product. Budgeted sales for the coming months are as follows: June August September Budgeted sales (units) 5,000 6,000 7,000 2,000 The budgeted selling price is 200 per unit. 30% of sales are for cash and customers are entitled to a discount of 2%, 50% pay one month later and the remainder the following month. Debtors of 100,000 at the beginning of May are due to pay 60,000 in June and the balance in July. Inventories of finished goods at the 31st May are 1,000 units. Production is budgeted at current month sales plus 20% of the following month sales less any opening stocks on hand. Each unit produced has the following standard cost card: Direct materials 2 kg at 10 per kg 20 Direct labour 5 hours at 10 per hour 50 Variable production overhead 40% of direct labour cost 20 Fixed production overhead Per unit 10 The direct materials are ordered, on a just in time basis, based on production requirements and are paid one month in arrears. The company expects to pay direct materials creditors 100,000 in June. Direct labour workers are paid weekly in arrears. 150,000 is owing to workers in respect of May work. Assume each month has four working weeks and that production is spread evenly throughout the month. Variable production overheads are paid as incurred. Fixed production overheads arise evenly throughout the year and are based on annual production of 42,000 units. The monthly fixed production overheads include 12,000 for depreciation of machinery Fixed production overheads are paid in the month incurred. Non- production overheads are 80,000 per month and paid one month in arrears. A corporation tax payment of 300,000 is due in July. The company has cash at bank of 200,000 at the beginning of June. REQUIRED: (a) Prepare monthly cash budgets for June, July and August showing closing bank balances each month. (23 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started