Answered step by step

Verified Expert Solution

Question

1 Approved Answer

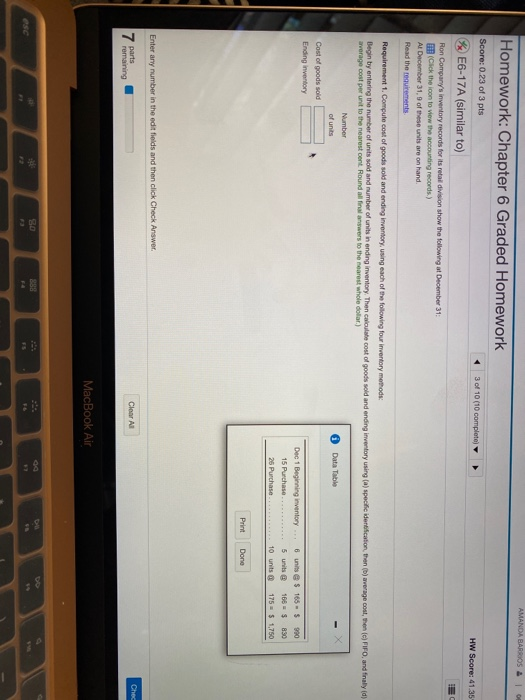

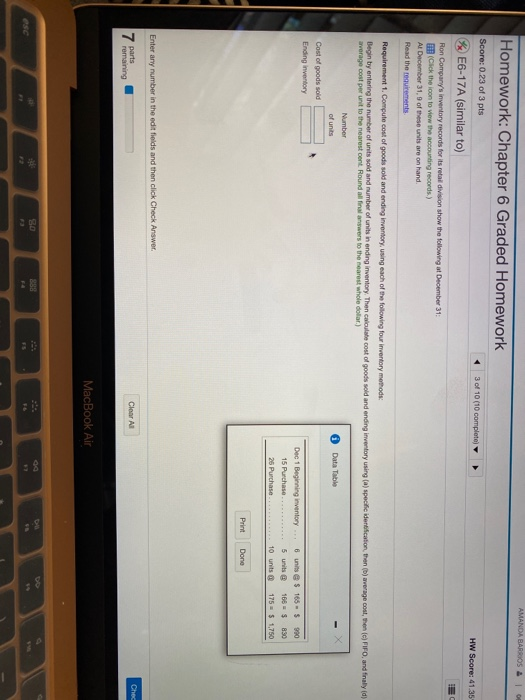

full question please not jusr costs of goods sold & ending inventory 1st pic question 2nd pic what they are going to ask me in

full question please not jusr costs of goods sold & ending inventory

1st pic question

2nd pic what they are going to ask me in the other parts

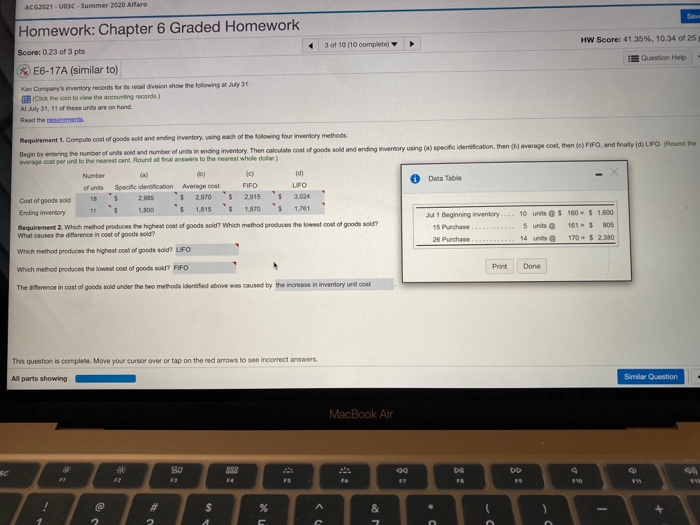

they are the same problem, please solve the one that hasnt been solved.

AMANDA BARRIOS IO Homework: Chapter 6 Graded Homework Score: 0 23 of 3 pts 3 of 10 (10 complete HW Score: 41.35 E6-17A (similar to) Ron Company's inventory records for its retal division show the following at December 313 (Click the icon to view the accounting records.) AL December 31,9 of these units are on hand. Read the requirements Requirement 1. Compute cost of goods sold and ending inventory, using each of the following four inventory methods Begin by entering the number of units sold and number of units in ending inventory. Then calculate cost of goods sold and ending inventory using a specific identification, then (D) average cost, then (c) FIFO and finally id) average cost per unit to the nearest cent. Round all final answers to the nearest whole dollar) Number Data Table of units Cost of goods sold Ending inventory Dec 1 Beginning inventory 6 units @ $ 165 - $ 990 15 Purchase 5 units 166 $ 830 25 Purchase 10 units 175 - $ 1,750 Print Done Enter any number in the edit fields and then click Check Answer. Chec Clear Al 7 Parts remaining MacBook Air 30 F AC62021 - UOBC - Summer 2020 Alfaro San HW Score: 41.35%, 10.34 of 25 3 of 10 (10 complete Question Help Homework: Chapter 6 Graded Homework Score: 0.23 of 3 pts E6-17A (similar to) Kon Company's inventory records for the retail division show the following July 31 Click the icon to view the accounting records) Al July 31, 11 of these units are on hand Read the moviments Requirement 1. Compute cost of goods sold and ending inventory, using each of the following four inventory methods Begin by entering the number of its sold and number of unitsin ending inventory. Then calculate cost of goods sold and ending inventory using a specific identification, then (b) average cost, then (c) FIFO, and finally id) UFO (Round the average cost per unit to the nearest cent Roundt fra answers to the nearest whole dar) Number (a) (c) d) of units Specific identification Average cost FIFO Data Table UFO Cost of goods sold 18 $ 2.885 2.970 $ 2915 $ 3,024 Ending inventory 11 1.000 5 1,815 $ 1.870 $ 1,761 Jul 1 Beginning inventory... 10 units@ $ 160 - $ 1,600 Requirement 2. Which method produces the highest cost of goods sold? Which method produces the lowest cost of goods sold? What causes the difference in cost of goods sold? 15 Purchase 5 units 1615 805 26 Purchase 14 units 170 - $ 2,380 Which method produces the highest cost of goods sold? LIFO Print Done Which method produces the lowest cost of goods sold? FIFO The difference in cost of goods sold under the two methods identified above was caused by the increase in inventory unit cost This question is complete Move your cursor over or tap on the red arrows to see incorrect answers All parts showing Similar Question MacBook Air 888 SO F3 DU FB F7 990 511 SY $ % A # 2 & 7 2 1 C Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started