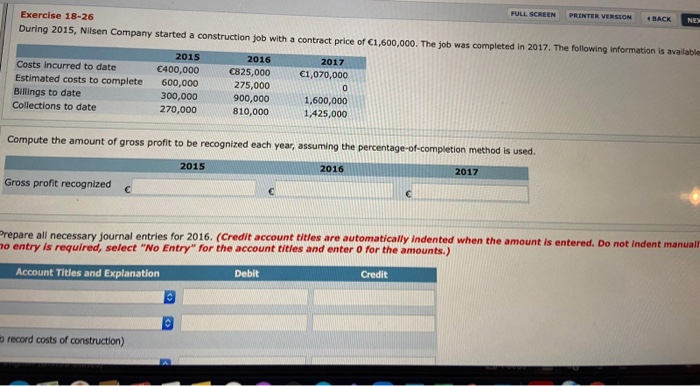

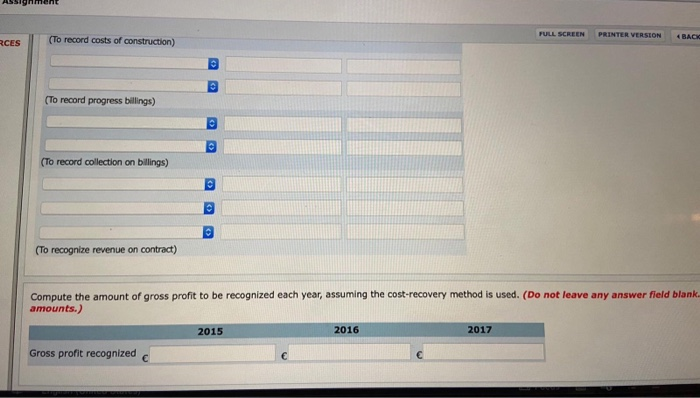

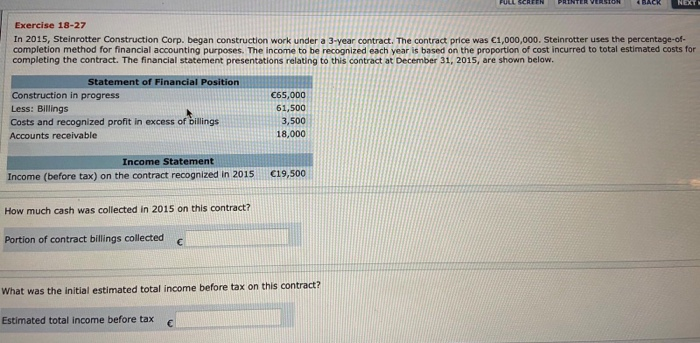

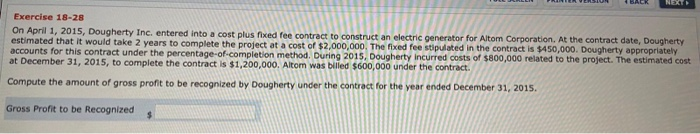

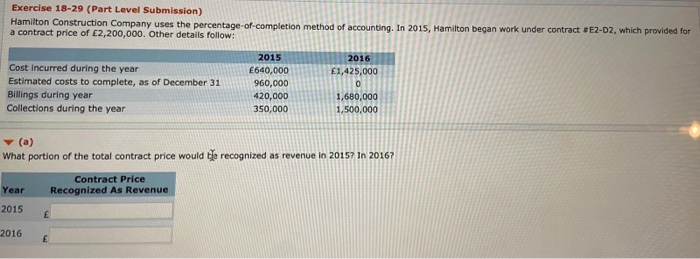

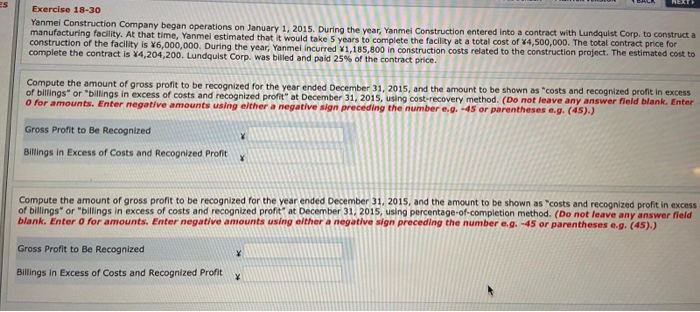

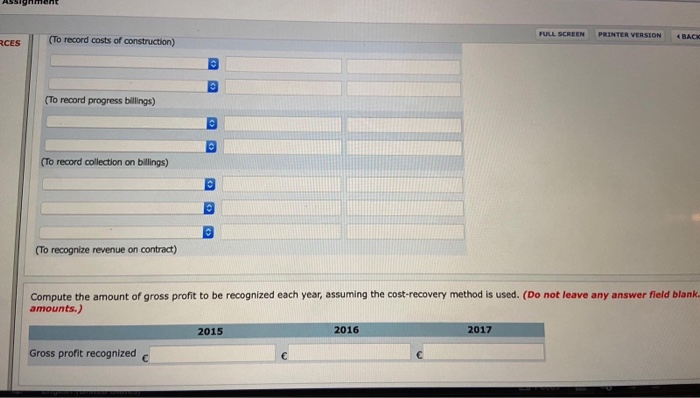

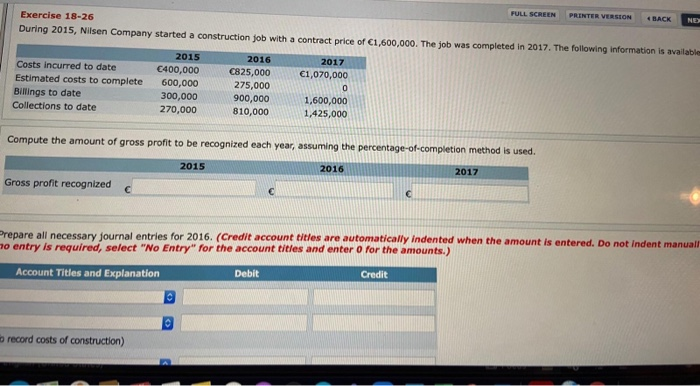

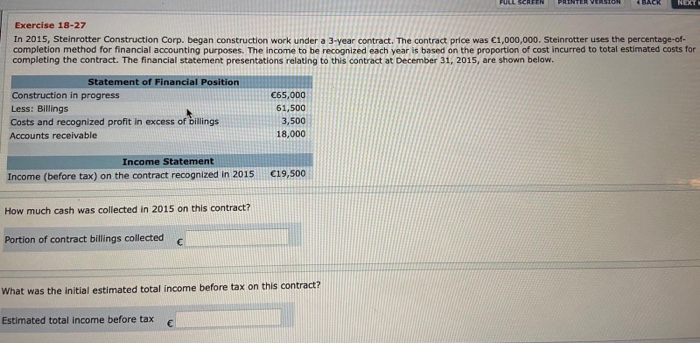

FULL SCREEN PRINTER VERSION Exercise 18-26 During 2015, Nilsen Company started a construction job with a contract price of C1,600,000. The job was completed in 2017. The following information is available BACK NE Costs incurred to date Estimated costs to complete Billings to date Collections to date 2015 400,000 600,000 300,000 270,000 2016 0825,000 275,000 900,000 810,000 2017 1,070,000 0 1,600,000 1,425,000 Compute the amount of gross profit to be recognized each year, assuming the percentage-of-completion method is used. 2015 2016 2017 Gross profit recognized Prepare all necessary journal entries for 2016. (Credit account titles are automatically indented when the amount is entered. Do not indent manuall 70 entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit record costs of construction) FULL SCREEN (To record costs of construction) PRINTER VERSION 4 4 BACK RCES (To record progress billings) (To record collection on billings) (To recognize revenue on contract) Compute the amount of gross profit to be recognized each year, assuming the cost-recovery method is used. (Do not leave any answer field blank amounts.) 2015 2016 2017 Gross profit recognized NEXT Exercise 18-27 In 2015, Steinrotter Construction Corp. began construction work under a 3-year contract. The contract price was 1,000,000. Steinrotter uses the percentage-of- completion method for financial accounting purposes. The income to be recognized each year is based on the proportion of cost incurred to total estimated costs for completing the contract. The financial statement presentations relating to this contract at December 31, 2015, are shown below. Statement of Financial Position Construction in progress Less: Billings Costs and recognized profit in excess of billings Accounts receivable 65,000 61,500 3,500 18,000 Income Statement Income (before tax) on the contract recognized in 2015 C19,500 How much cash was collected in 2015 on this contract? Portion of contract billings collected What was the initial estimated total income before tax on this contract? Estimated total income before tax NEXT Exercise 18-28 On April 1, 2015, Dougherty Inc, entered into a cost plus fixed fee contract to construct an electric generator for Altom Corporation. At the contract date, Dougherty estimated that it would take 2 years to complete the project at a cost of $2,000,000. The fixed fee stipulated in the contract is $450,000. Dougherty appropriately accounts for this contract under the percentage-of-completion method. During 2015, Dougherty incurred costs of $800,000 related to the project. The estimated cost at December 31, 2015, to complete the contract is $1,200,000. Altom was billed $600,000 under the contract. Compute the amount of gross profit to be recognized by Dougherty under the contract for the year ended December 31, 2015. Gross Profit to be recognized Exercise 18-29 (Part Level Submission) Hamilton Construction Company uses the percentage-of-completion method of accounting. In 2015, Hamilton began work under contract #E2-D2, which provided for a contract price of 2,200,000. Other details follow: Cost incurred during the year Estimated costs to complete, as of December 31 Billings during year Collections during the year 2015 640,000 960,000 420,000 350,000 2016 1,425,000 0 1,680,000 1,500,000 What portion of the total contract price would be recognized as revenue in 2015? In 2016? Year Contract Price Recognized As Revenue 2015 E 2016 E ES NEXT Exercise 18-30 Yanmel Construction Company began operations on January 1, 2015. During the year, Yanmel Construction entered into a contract with Lundquist Corp. to construct a manufacturing facility. At that time, Yanmel estimated that it would take 5 years to complete the facility at a total cost of $4,500,000. The total contract price for construction of the facility is 76,000,000. During the year, Yanmel incurred 41,185,800 in construction costs related to the construction project. The estimated cost to complete the contract is 84,204,200. Lundquist Corp. was billed and paid 25% of the contract price. Compute the amount of gross profit to be recognized for the year ended December 31, 2015, and the amount to be shown as "costs and recognized profit in excess of billings" or "billings in excess of costs and recognized profit" at December 31, 2015, using cost-recovery method. (Do not leave any answer field blank. Enter O for amounts. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Gross Profit to Be Recognized Billings in Excess of costs and Recognized Profit Compute the amount of gross profit to be recognized for the year ended December 31, 2015, and the amount to be shown as "costs and recognized profit in excess of billings" or "billings in excess of costs and recognized profit' at December 31, 2015, using percentage-of-completion method. (Do not leave any answer field blank. Enter o for amounts. Enter negative amounts using e/ther a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Gross Profit to Be Recognized X Billings in Excess of Costs and Recognized Profit FULL SCREEN PRINTER VERSION (To record costs of construction) 4 4 BACK RCES (To record progress billings) (To record collection on billings) (To recognize revenue on contract) Compute the amount of gross profit to be recognized each year, assuming the cost-recovery method is used. (Do not leave any answer field blank amounts.) 2015 2016 2017 Gross profit recognized FULL SCREEN PRINTER VERSION Exercise 18-26 During 2015, Nilsen Company started a construction job with a contract price of C1,600,000. The job was completed in 2017. The following information is available