full working please

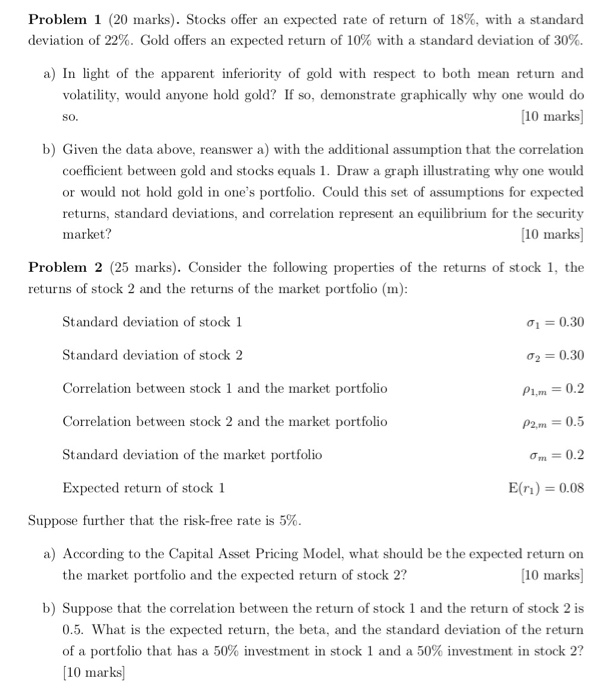

Problem 1 (20 marks). Stocks offer an expected rate of return of 18%, with a standard deviation of 22%. Gold offers an expected return of 10% with a standard deviation of 30%. a) In light of the apparent inferiority of gold with respect to both mean return and volatility, would anyone hold gold? If so, demonstrate graphically why one would do So. [10 marks) b) Given the data above, reanswer a) with the additional assumption that the correlation coefficient between gold and stocks equals 1. Draw a graph illustrating why one would or would not hold gold in one's portfolio. Could this set of assumptions for expected returns, standard deviations, and correlation represent an equilibrium for the security market? [10 marks) Problem 2 25 marks). Consider the following properties of the returns of stock 1, the returns of stock 2 and the returns of the market portfolio (m): Standard deviation of stock 1 0 = 0.30 Standard deviation of stock 2 = 0.30 Correlation between stock 1 and the market portfolio Correlation between stock 2 and the market portfolio P1m = 0.2 P2,m=0.5 Om = 0.2 Standard deviation of the market portfolio Expected return of stock 1 E(ru) = 0.08 Suppose further that the risk-free rate is 5%. a) According to the Capital Asset Pricing Model, what should be the expected return on the market portfolio and the expected return of stock 2? (10 marks) b) Suppose that the correlation between the return of stock 1 and the return of stock 2 is 0.5. What is the expected return, the beta, and the standard deviation of the return of a portfolio that has a 50% investment in stock 1 and a 50% investment in stock 2? (10 marks) c) Is the portfolio you constructed in part b) an efficient portfolio? Assuming the CAPM is true, could you build a combination of the market portfolio and the portfolio of part b) to increase the expected return of the market portfolio without changing the variance of the combined portfolio. 15 marks) Problem 3 (20 marks). A stock has a beta of 1.2 and an expected return of 16%. The risk-free asset currently earns 5%. a) What is the expected return on a portfolio that is equally invested in the two assets? 15 marks b) If a portfolio of the two assets has a beta of 0.75, what are the portfolio weights? 15 marks] c) If a portfolio of the two assets has an expected return of 8%, what is its beta? 15 marks) d) If a portfolio of the two assets has a beta of 2.3, what are the portfolio weights? How do you interpret the weights for the two assets in this case? Explain. (5 marks Problem 4 (25 marks). Consider the following table, which gives a security analysts ex- pected return on two stocks for two particular market returns: Aggressive Stock Defensive Stock States Market Return Bad 5% Good 25% -2% 6% 38% 12% a) What are the betas of the two stocks? 15 marks) b) What is the expected rate of return on each stock if the market return is equally likely to be 5% or 25%? (5 marks] c) If the T-bill rate is 6% and the market return is equally likely to be 5% or 25%, draw the SML for this economy. (5 marks) d) Plot the two securities on the SML graph. What are the alphas of each? [10 marks) Problem 5 (10 marks). Assume that the risk-free rate of interest is 6% and the expected rate of return on the market is 16%. a) A share of stock sells for $50 today. It will pay a dividend of $6 per share at the end of the year. Its beta is 1.2. What do investors expect the stock to sell for at the end of the year? (5 marks) b) A stock has an expected rate of return of 4%. What is its beta? (5 marks) Problem 1 (20 marks). Stocks offer an expected rate of return of 18%, with a standard deviation of 22%. Gold offers an expected return of 10% with a standard deviation of 30%. a) In light of the apparent inferiority of gold with respect to both mean return and volatility, would anyone hold gold? If so, demonstrate graphically why one would do So. [10 marks) b) Given the data above, reanswer a) with the additional assumption that the correlation coefficient between gold and stocks equals 1. Draw a graph illustrating why one would or would not hold gold in one's portfolio. Could this set of assumptions for expected returns, standard deviations, and correlation represent an equilibrium for the security market? [10 marks) Problem 2 25 marks). Consider the following properties of the returns of stock 1, the returns of stock 2 and the returns of the market portfolio (m): Standard deviation of stock 1 0 = 0.30 Standard deviation of stock 2 = 0.30 Correlation between stock 1 and the market portfolio Correlation between stock 2 and the market portfolio P1m = 0.2 P2,m=0.5 Om = 0.2 Standard deviation of the market portfolio Expected return of stock 1 E(ru) = 0.08 Suppose further that the risk-free rate is 5%. a) According to the Capital Asset Pricing Model, what should be the expected return on the market portfolio and the expected return of stock 2? (10 marks) b) Suppose that the correlation between the return of stock 1 and the return of stock 2 is 0.5. What is the expected return, the beta, and the standard deviation of the return of a portfolio that has a 50% investment in stock 1 and a 50% investment in stock 2? (10 marks) c) Is the portfolio you constructed in part b) an efficient portfolio? Assuming the CAPM is true, could you build a combination of the market portfolio and the portfolio of part b) to increase the expected return of the market portfolio without changing the variance of the combined portfolio. 15 marks) Problem 3 (20 marks). A stock has a beta of 1.2 and an expected return of 16%. The risk-free asset currently earns 5%. a) What is the expected return on a portfolio that is equally invested in the two assets? 15 marks b) If a portfolio of the two assets has a beta of 0.75, what are the portfolio weights? 15 marks] c) If a portfolio of the two assets has an expected return of 8%, what is its beta? 15 marks) d) If a portfolio of the two assets has a beta of 2.3, what are the portfolio weights? How do you interpret the weights for the two assets in this case? Explain. (5 marks Problem 4 (25 marks). Consider the following table, which gives a security analysts ex- pected return on two stocks for two particular market returns: Aggressive Stock Defensive Stock States Market Return Bad 5% Good 25% -2% 6% 38% 12% a) What are the betas of the two stocks? 15 marks) b) What is the expected rate of return on each stock if the market return is equally likely to be 5% or 25%? (5 marks] c) If the T-bill rate is 6% and the market return is equally likely to be 5% or 25%, draw the SML for this economy. (5 marks) d) Plot the two securities on the SML graph. What are the alphas of each? [10 marks) Problem 5 (10 marks). Assume that the risk-free rate of interest is 6% and the expected rate of return on the market is 16%. a) A share of stock sells for $50 today. It will pay a dividend of $6 per share at the end of the year. Its beta is 1.2. What do investors expect the stock to sell for at the end of the year? (5 marks) b) A stock has an expected rate of return of 4%. What is its beta