Answered step by step

Verified Expert Solution

Question

1 Approved Answer

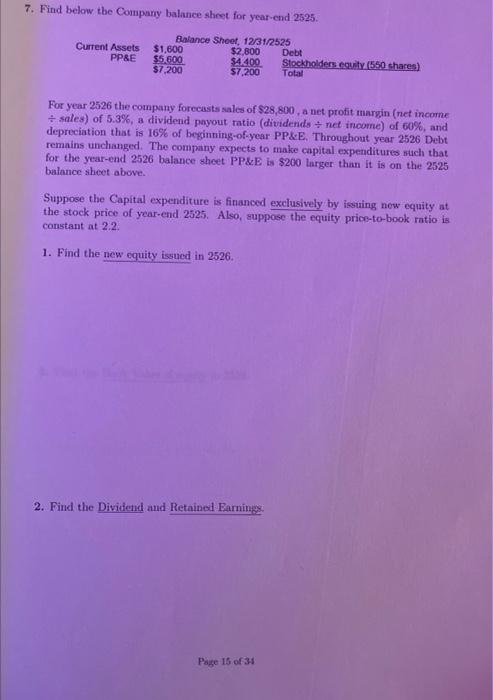

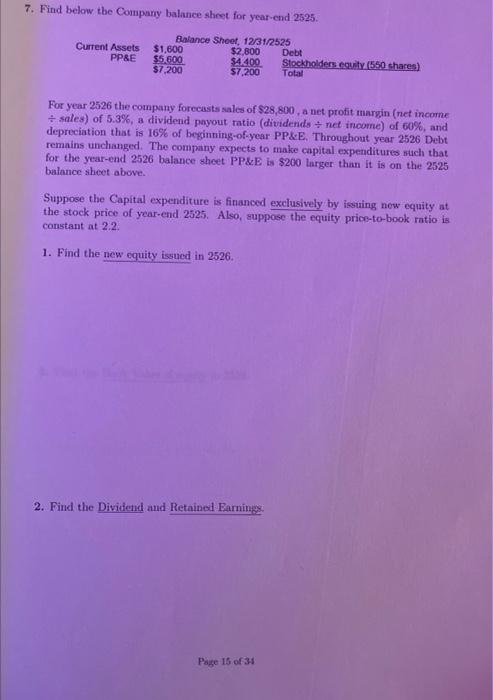

Full workout-- add labels 7. Find below the Company balance sheet for year-end 2525 Balance Sheet, 12/31/2525 Current Assets $1.600 $2,800 Debt PPSE $5.600 $4.400

Full workout-- add labels

7. Find below the Company balance sheet for year-end 2525 Balance Sheet, 12/31/2525 Current Assets $1.600 $2,800 Debt PPSE $5.600 $4.400 Stockholders equity (550 shares) $7,200 57,200 Total For year 2526 the company forecasts sales of $28,800.a net profit margin (net income sales) of 5.3%, a dividend payout ratio (dividends + net income) of 60%, and depreciation that is 16% of beginning-of-year PP&E. Throughout year 2526 Debt remains unchanged. The company expects to make capital expenditures such that for the year-end 2526 balance sheet PP&E is $200 larger than it is on the 2525 balance sheet above. Suppose the Capital expenditure is financed exclusively by issuing new equity at the stock price of year-end 2525. Also, suppose the equity price-to-book ratio is constant at 2.2 1. Find the new equity issued in 2526 2. Find the Dividend and Retained Earnings Page 15 of 31 3. Find the Book Value of equity in 2526. 4. Find the stock price per share in 2525. 5. Find the number of share outstanding in 2526. 6. Find the stock price per share in 2526. 7. Find the dividend per share. 8. Find the stockholder's annual rate of return for year 2526

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started