Answered step by step

Verified Expert Solution

Question

1 Approved Answer

fully analysis each question. 2-3 paragraphs each question. Case 6 Bluffton Pharmacy-Part 1 What Can Two New Pharmacy Owners Learn about Their Business from its

fully analysis each question. 2-3 paragraphs each question.

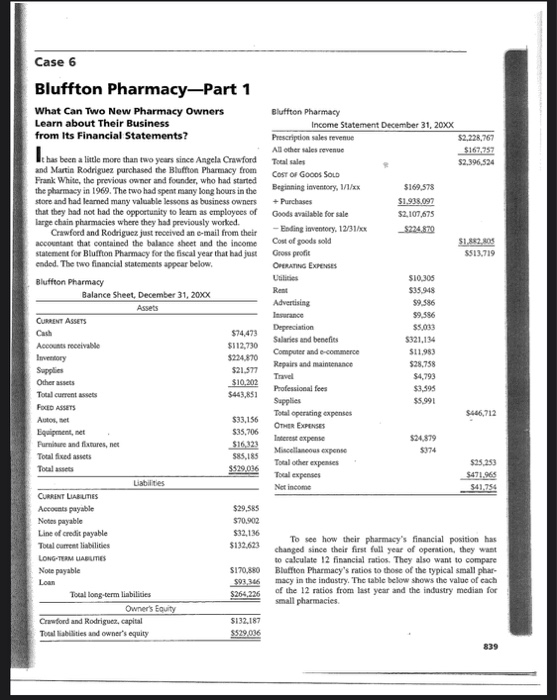

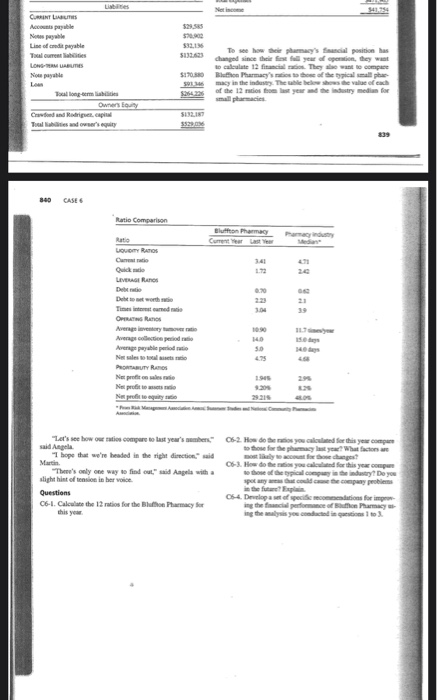

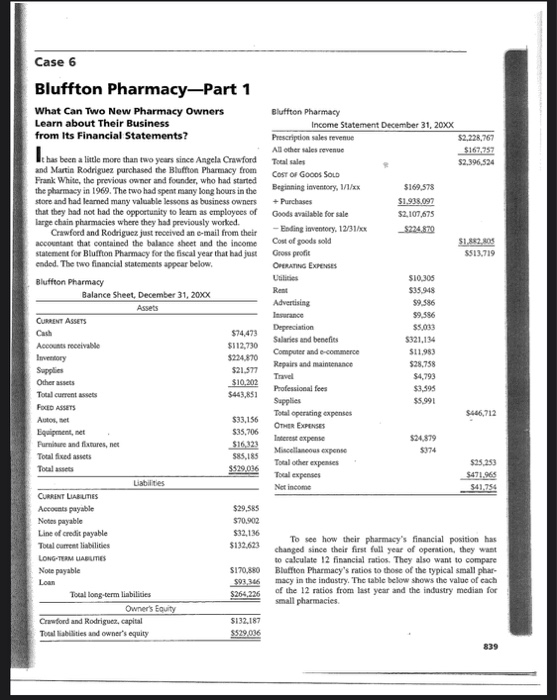

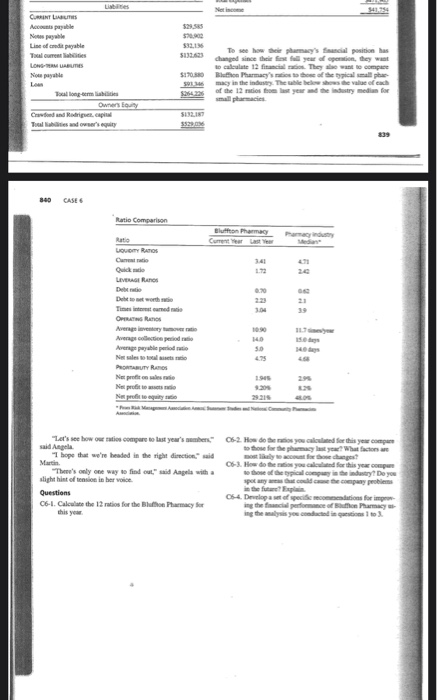

Case 6 Bluffton Pharmacy-Part 1 What Can Two New Pharmacy Owners Learn about Their Business from its Financial Statements? 52.228,767 $167/252 $2.396.524 It has been a little more than two years since Angela Crawford and Martin Rodriguez purchased the Bluffon Pharmacy from Frank White, the previous owner and founder, who had started the pharmacy in 1969. The two had spent many long hours in the store and had learned many valuable lessons as business owners that they had not had the opportunity to leam as employees of large chain pharmacies where they had previously worked Crawford and Rodriguez just received an e-mail from their accountant that contained the balance sheet and the income statement for Bluffon Pharmacy for the fiscal year that had just ended. The two financial statements appear below. $1.882.803 $513.719 Bluffton Pharmacy Balance Sheet, December 31, 20xx Assets CURRENT ASSETS Bluffton Pharmacy Income Statement December 31, 20XX Prescription sales revenue All other sales revenue Tocal sales Cost Of Gocos SOLD Beginning inventory, 1/1/xx $169,578 $1.938.097 Goods available for sale $2,107,675 -Ending inventory. 12/31/xx _5224.870 Cost of goods sold Gross profit OPERATING EXPENSES Lalities| SI0.305 S15948 Advertising $9.986 Jeance 39,586 Depreciation $5.033 Salaries and benefits 5321,134 Computer and e-commerce $11.983 Repairs and maintenance $28,758 Trad $4.793 Professional fees $3.395 Supplies $5.991 Total operating expenses OTHER EXPENSES Interest expense $24,879 Miscellaneous expens Total other expenses Toul expenses Net income $74,473 $112,730 $224,870 $21.577 $10.202 $463,851 $646,712 $33.156 $35,706 516,123 585,185 $529,036 5074 $25.253 $471.965 Accounts receivable levey Supplies Other assets Total current assets FOCED ASSETS Autos, bet Equipment, et Furniture and fixtures, net Totalfixed assets Total assets Liabilities CURRENT LIABUTIES Accounts payable Notas payable Line of credit payable Total current liabilities LONG-TERM LABUMES Notepayable Loan Tocal long-term liabilities Owner's Equity Crawford and Rodrigues, capital Tocal liabilities and owner's equity $41.754 $70.902 $12.196 $132.623 $170,880 $93.346 $264.226 To see how their pharmacy's financial position has changed since their first full year of operation, they want to calculate 12 financial ratios. They also want to compare Blafton Pharmacy's ratios to those of the typical small phar macy in the industry. The table below shows the value of cach of the 12 ratios from last year and the industry median for small pharmacies $132.187 $529,036 CURRENT LA Our LOOR LEGER Ons Average Avenge News PONTANUTY RAMOS Nespre Na pat Ne quity wa Angela hope that w e headed in the right direction. id The's only way wide with a sight into her Questions C6-L. Call the 13 to furthe Blue Pharmacy Case 6 Bluffton Pharmacy-Part 1 What Can Two New Pharmacy Owners Learn about Their Business from its Financial Statements? 52.228,767 $167/252 $2.396.524 It has been a little more than two years since Angela Crawford and Martin Rodriguez purchased the Bluffon Pharmacy from Frank White, the previous owner and founder, who had started the pharmacy in 1969. The two had spent many long hours in the store and had learned many valuable lessons as business owners that they had not had the opportunity to leam as employees of large chain pharmacies where they had previously worked Crawford and Rodriguez just received an e-mail from their accountant that contained the balance sheet and the income statement for Bluffon Pharmacy for the fiscal year that had just ended. The two financial statements appear below. $1.882.803 $513.719 Bluffton Pharmacy Balance Sheet, December 31, 20xx Assets CURRENT ASSETS Bluffton Pharmacy Income Statement December 31, 20XX Prescription sales revenue All other sales revenue Tocal sales Cost Of Gocos SOLD Beginning inventory, 1/1/xx $169,578 $1.938.097 Goods available for sale $2,107,675 -Ending inventory. 12/31/xx _5224.870 Cost of goods sold Gross profit OPERATING EXPENSES Lalities| SI0.305 S15948 Advertising $9.986 Jeance 39,586 Depreciation $5.033 Salaries and benefits 5321,134 Computer and e-commerce $11.983 Repairs and maintenance $28,758 Trad $4.793 Professional fees $3.395 Supplies $5.991 Total operating expenses OTHER EXPENSES Interest expense $24,879 Miscellaneous expens Total other expenses Toul expenses Net income $74,473 $112,730 $224,870 $21.577 $10.202 $463,851 $646,712 $33.156 $35,706 516,123 585,185 $529,036 5074 $25.253 $471.965 Accounts receivable levey Supplies Other assets Total current assets FOCED ASSETS Autos, bet Equipment, et Furniture and fixtures, net Totalfixed assets Total assets Liabilities CURRENT LIABUTIES Accounts payable Notas payable Line of credit payable Total current liabilities LONG-TERM LABUMES Notepayable Loan Tocal long-term liabilities Owner's Equity Crawford and Rodrigues, capital Tocal liabilities and owner's equity $41.754 $70.902 $12.196 $132.623 $170,880 $93.346 $264.226 To see how their pharmacy's financial position has changed since their first full year of operation, they want to calculate 12 financial ratios. They also want to compare Blafton Pharmacy's ratios to those of the typical small phar macy in the industry. The table below shows the value of cach of the 12 ratios from last year and the industry median for small pharmacies $132.187 $529,036 CURRENT LA Our LOOR LEGER Ons Average Avenge News PONTANUTY RAMOS Nespre Na pat Ne quity wa Angela hope that w e headed in the right direction. id The's only way wide with a sight into her Questions C6-L. Call the 13 to furthe Blue Pharmacy

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started