Question

Fun Bulb, Co. has been expanding quite rapidly and ventured into a newly developed materials for their products at the end of 2018. At that

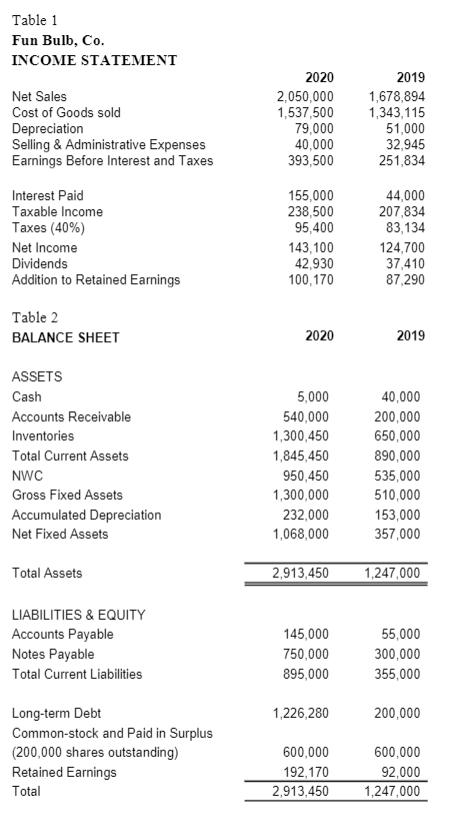

Fun Bulb, Co. has been expanding quite rapidly and ventured into a newly developed materials for their products at the end of 2018. At that time, the future outlook seemed very promising and the economy was stable. Stock price per share was $7. The overall competitive pressure was not too severe. Due to this expectation, the firm built two new manufacturing plants and significantlyincreased its inventory.Now it is the end of 2020. Fun Bulb had a quite a jump in profits over the past few years.However, when Mary Stuart, the Assistant to the CFO at Fun Bulb, looked at the accounting statements for 2020, she was not happy to see the lower profitability shown in the statements. There was also a big concern on the significant drop in the cash balance of the firm. Mary knew that the stockholders would be very concerned when these statementsare released. She also knew that her boss, the CFO, would need to come up with some reasonable answers for the cash issue. The cash balance issue isof particular importance because the firm is planning on raising some short-term capital in the recent future. The current stock price per share at the end of 2020is $5.50. Given Table 1 and 2 below (Income Statement and Balance Sheet for the recent two years), Mary needs to do some basic cash flow and financial ratio analysis and provide suggestions to her boss. Please help her by answering the following 6 questions.

1.Why has the stock price fallen despite the fact that the net income has increased?

2.How liquid would you say that this company is? Calculate the absolute liquidity of the firm. How does it compare with the previous year's liquidity position?

3.How does the market value of the stock compare with its book value? Is the book value accurately reflecting the true condition of the company?

4.The board of directors is not clear as to why the cash balancehas dropped so much despite the increase in sales and the reduction in cost of goods sold. What should Mary tell them?

5.Measure the free cash flow of the firm. What does it indicate?

6.Calculate the net working capital of the company for each of the two years.What can you conclude about the firm's net working capital?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started