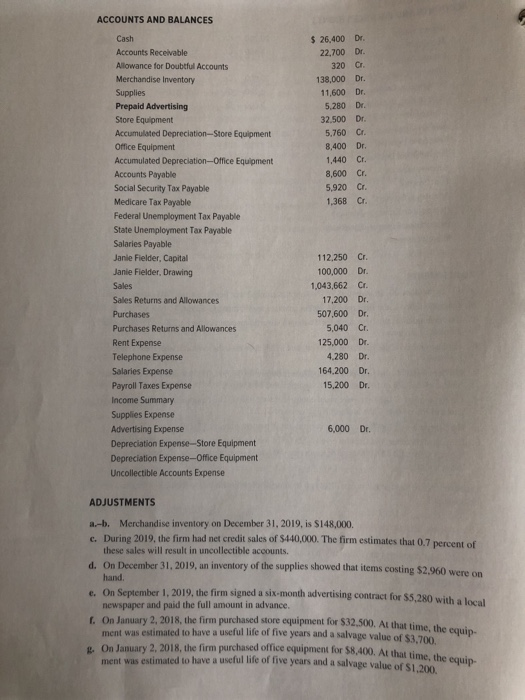

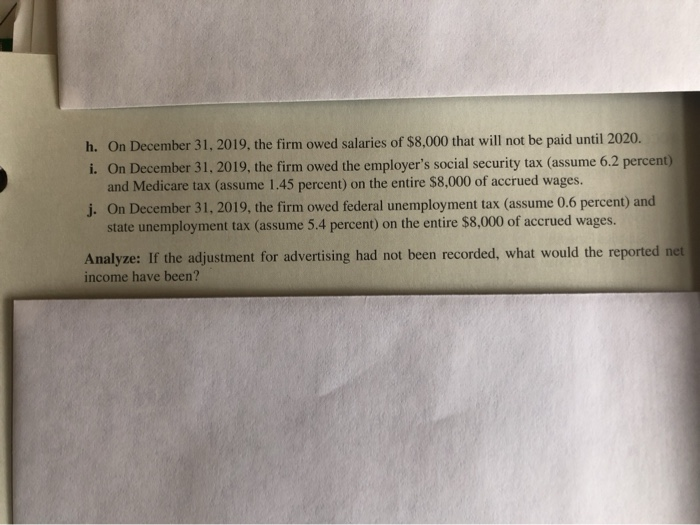

Fun Depot is a retail store that sells toys, games, and bicycles. On December 31, 2019, the firm's general ledger contained the following accounts and balances. INSTRUCTIONS 1. Prepare the Trial Balance section of a 10-column worksheet. The worksheet covers the year ended December 31, 2019. 2. Enter the adjustments below in the Adjustments section of the worksheet. Identify each adjust- ment with the appropriate letter. 3. Complete the worksheet. ACCOUNTS AND BALANCES $ 26,400 Dr. 22,700 Dr. 320 Cr. 138,000 Dr. 11,600 Dr. 5.280 Dr. 32.500 Dr. 5.760 Cr. 8,400 Dr. 1.440 Cr. 8,600 Cr. 5.920 Cr. 1,368 Cr. Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Supplies Prepaid Advertising Store Equipment Accumulated Depreciation-Store Equipment Office Equipment Accumulated Depreciation-Office Equipment Accounts Payable Social Security Tax Payable Medicare Tax Payable Federal Unemployment Tax Payable State Unemployment Tax Payable Salaries Payable Janie Fielder, Capital Janie Fielder, Drawing Sales Sales Returns and Allowances Purchases Purchases Returns and Allowances Rent Expense Telephone Expense Salaries Expense Payroll Taxes Expense Income Summary Supplies Expense Advertising Expense Depreciation Expense-Store Equipment Depreciation Expense-Office Equipment Uncollectible Accounts Expense 112.250 CM 100,000 Dr. 1,043,662 Cr. 17.200 Dr. 507,600 Dr. 5,040 Cr. 125,000 Dr. 4.280 Dr. 164.200 Dr. 15.200 Dr. 6,000 Dr. ADJUSTMENTS a-b. Merchandise inventory on December 31, 2019, is $148,000. c. During 2019, the firm had net credit sales of $440,000. The firm estimates that 0.7 percent of these sales will result in uncollectible accounts. d. On December 31, 2019, an inventory of the supplies showed that items costing $2.960 were on hand. On September 1, 2019, the firm signed a six-month advertising contract for $5,280 with a local newspaper and paid the full amount in advance. 1. On January 2, 2018, the firm purchased store equipment for $32,500. At that time, the ment was estimated to have a useful life of five years and a salvage value of $3.700 . On January 2, 2018, the firm purchased office equipment for $8,400. At that time ment was estimated to have a useful life of five years and a salvage value of S1200 58.400. At that time, the equip- h. On December 31, 2019, the firm owed salaries of $8,000 that will not be paid until 2020. i. On December 31, 2019, the firm owed the employer's social security tax (assume 6.2 percent) and Medicare tax (assume 1.45 percent) on the entire $8,000 of accrued wages. j. On December 31, 2019, the firm owed federal unemployment tax (assume 0.6 percent) and state unemployment tax (assume 5.4 percent) on the entire $8,000 of accrued wages. Analyze: If the adjustment for advertising had not been recorded, what would the reported net income have been