Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fund Accounting Principles and Practices Fund accounting is a specialized form of accounting used by non - profit organizations, government entities, and other entities with

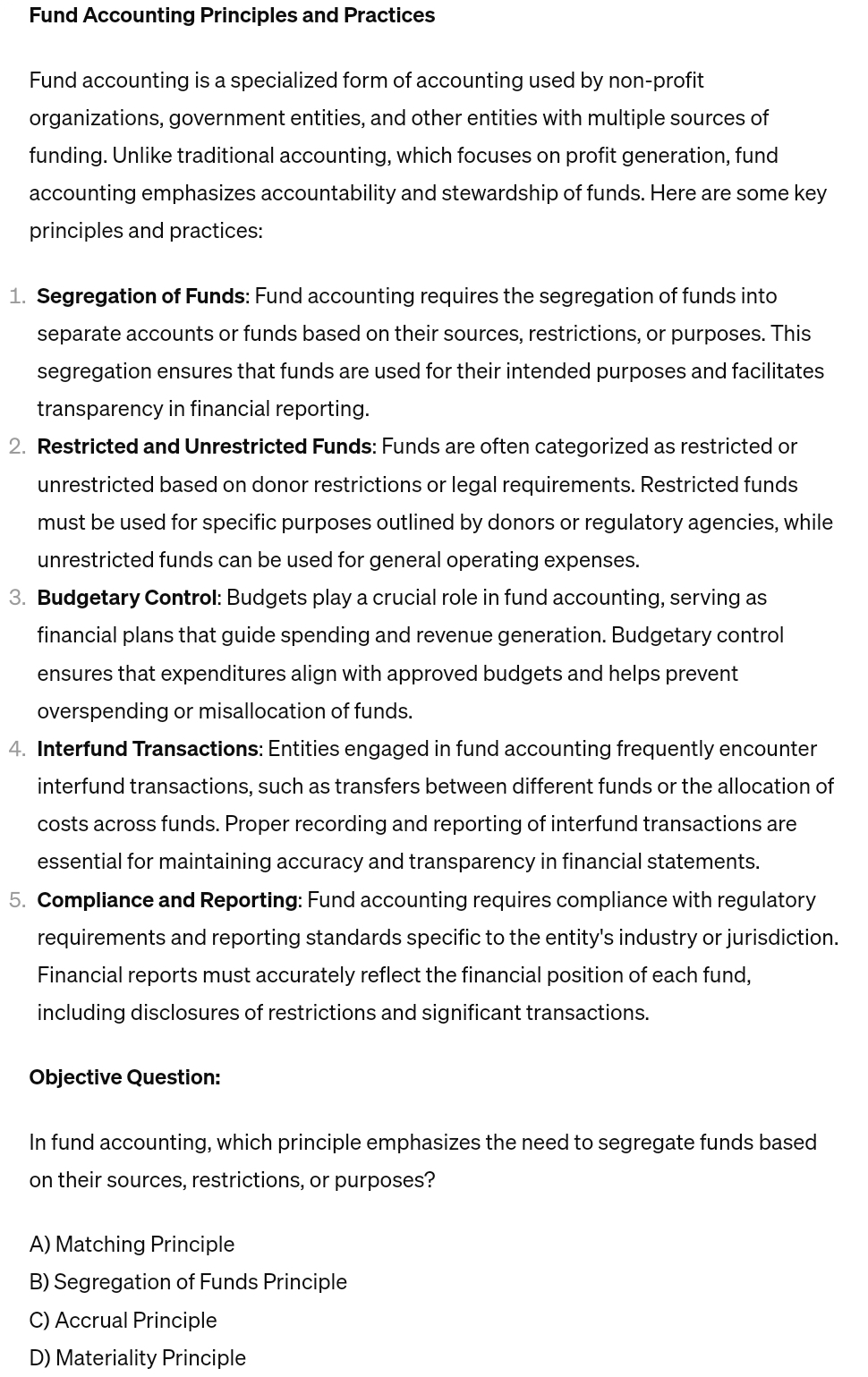

Fund Accounting Principles and Practices

Fund accounting is a specialized form of accounting used by nonprofit organizations, government entities, and other entities with multiple sources of funding. Unlike traditional accounting, which focuses on profit generation, fund accounting emphasizes accountability and stewardship of funds. Here are some key principles and practices:

Segregation of Funds: Fund accounting requires the segregation of funds into separate accounts or funds based on their sources, restrictions, or purposes. This segregation ensures that funds are used for their intended purposes and facilitates transparency in financial reporting.

Restricted and Unrestricted Funds: Funds are often categorized as restricted or unrestricted based on donor restrictions or legal requirements. Restricted funds must be used for specific purposes outlined by donors or regulatory agencies, while unrestricted funds can be used for general operating expenses.

Budgetary Control: Budgets play a crucial role in fund accounting, serving as financial plans that guide spending and revenue generation. Budgetary control ensures that expenditures align with approved budgets and helps prevent overspending or misallocation of funds.

Interfund Transactions: Entities engaged in fund accounting frequently encounter interfund transactions, such as transfers between different funds or the allocation of costs across funds. Proper recording and reporting of interfund transactions are essential for maintaining accuracy and transparency in financial statements.

Compliance and Reporting: Fund accounting requires compliance with regulatory requirements and reporting standards specific to the entity's industry or jurisdiction. Financial reports must accurately reflect the financial position of each fund, including disclosures of restrictions and significant transactions.

Objective Question:

In fund accounting, which principle emphasizes the need to segregate funds based on their sources, restrictions, or purposes?

A Matching Principle

B Segregation of Funds Principle

C Accrual Principle

D Materiality Principle

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started