Answered step by step

Verified Expert Solution

Question

1 Approved Answer

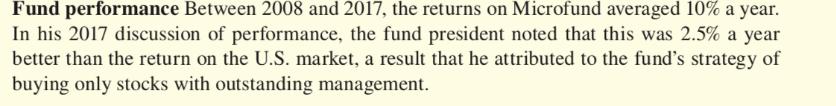

Fund performance Between 2008 and 2017, the returns on Microfund averaged 10% a year. In his 2017 discussion of performance, the fund president noted

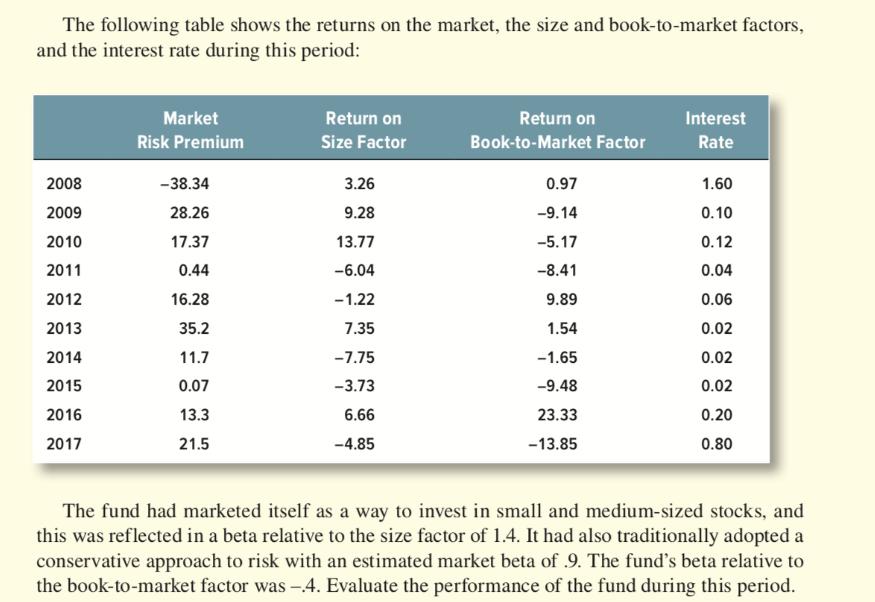

Fund performance Between 2008 and 2017, the returns on Microfund averaged 10% a year. In his 2017 discussion of performance, the fund president noted that this was 2.5% a year better than the return on the U.S. market, a result that he attributed to the fund's strategy of buying only stocks with outstanding management. The following table shows the returns on the market, the size and book-to-market factors, and the interest rate during this period: 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Market Risk Premium -38.34 28.26 17.37 0.44 16.28 35.2 11.7 0.07 13.3 21.5 Return on Size Factor 3.26 9.28 13.77 -6.04 -1.22 7.35 -7.75 -3.73 6.66 -4.85 Return on Book-to-Market Factor 0.97 -9.14 -5.17 -8.41 9.89 1.54 -1.65 -9.48 23.33 -13.85 Interest Rate 1.60 0.10 0.12 0.04 0.06 0.02 0.02 0.02 0.20 0.80 The fund had marketed itself as a way to invest in small and medium-sized stocks, and this was reflected in a beta relative to the size factor of 1.4. It had also traditionally adopted a conservative approach to risk with an estimated market beta of .9. The fund's beta relative to the book-to-market factor was -.4. Evaluate the performance of the fund during this period.

Step by Step Solution

★★★★★

3.60 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Fund Performance Comment Comment Step 1 of 4 It is the performance which gives a return on the inves...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started