Answered step by step

Verified Expert Solution

Question

1 Approved Answer

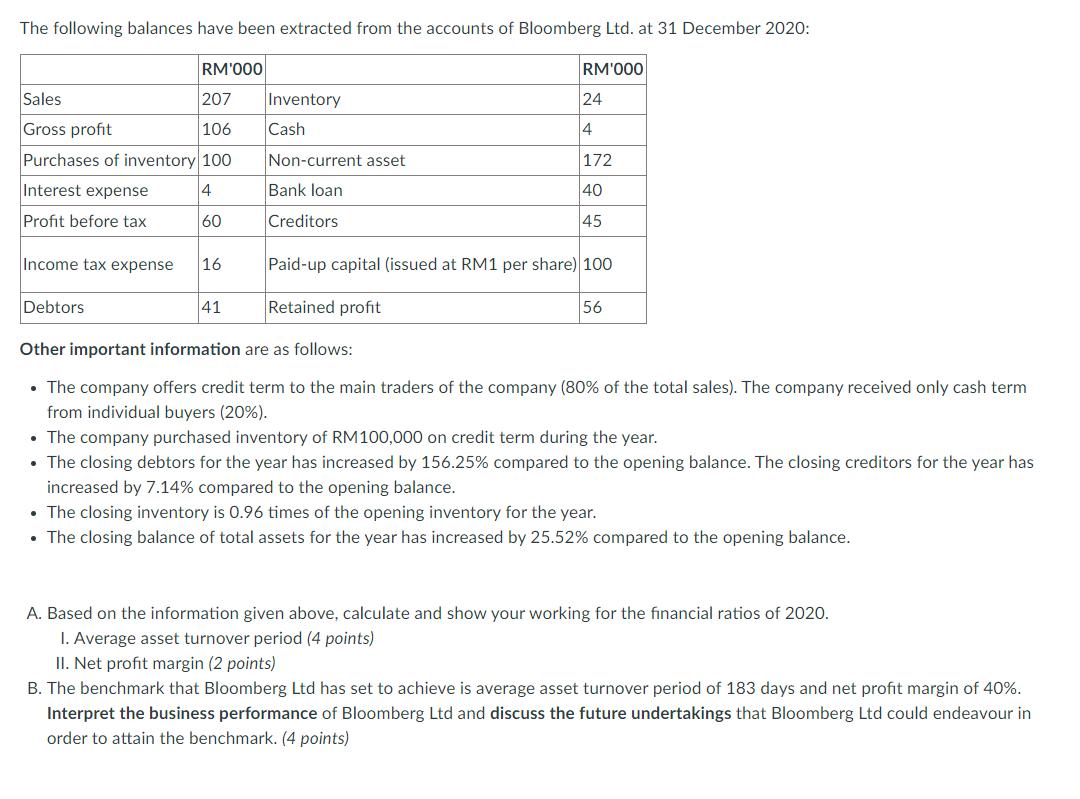

The following balances have been extracted from the accounts of Bloomberg Ltd. at 31 December 2020: RM'000 207 106 Purchases of inventory 100 Interest

The following balances have been extracted from the accounts of Bloomberg Ltd. at 31 December 2020: RM'000 207 106 Purchases of inventory 100 Interest expense 4 Profit before tax 60 Sales Gross profit Income tax expense 16 Debtors 41 . Inventory Cash Non-current asset Bank loan Creditors RM'000 24 4 172 40 45 Paid-up capital (issued at RM1 per share) 100 Retained profit 56 Other important information are as follows: The company offers credit term to the main traders of the company (80% of the total sales). The company received only cash term from individual buyers (20%). The company purchased inventory of RM100,000 on credit term during the year. closing del ors for year has increased by 156.25% compared the opening baland The closing creditors for the year has increased by 7.14% compared to the opening balance. The closing inventory is 0.96 times of the opening inventory for the year. The closing balance of total assets for the year has increased by 25.52% compared to the opening balance. A. Based on the information given above, calculate and show your working for the financial ratios of 2020. I. Average asset turnover period (4 points) II. Net profit margin (2 points) B. The benchmark that Bloomberg Ltd has set to achieve is average asset turnover period of 183 days and net profit margin of 40%. Interpret the business performance of Bloomberg Ltd and discuss the future undertakings that Bloomberg Ltd could endeavour in order to attain the benchmark. (4 points)

Step by Step Solution

★★★★★

3.57 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

A Average asset turnover period Sales Average total assets Average total assets ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started