Answered step by step

Verified Expert Solution

Question

1 Approved Answer

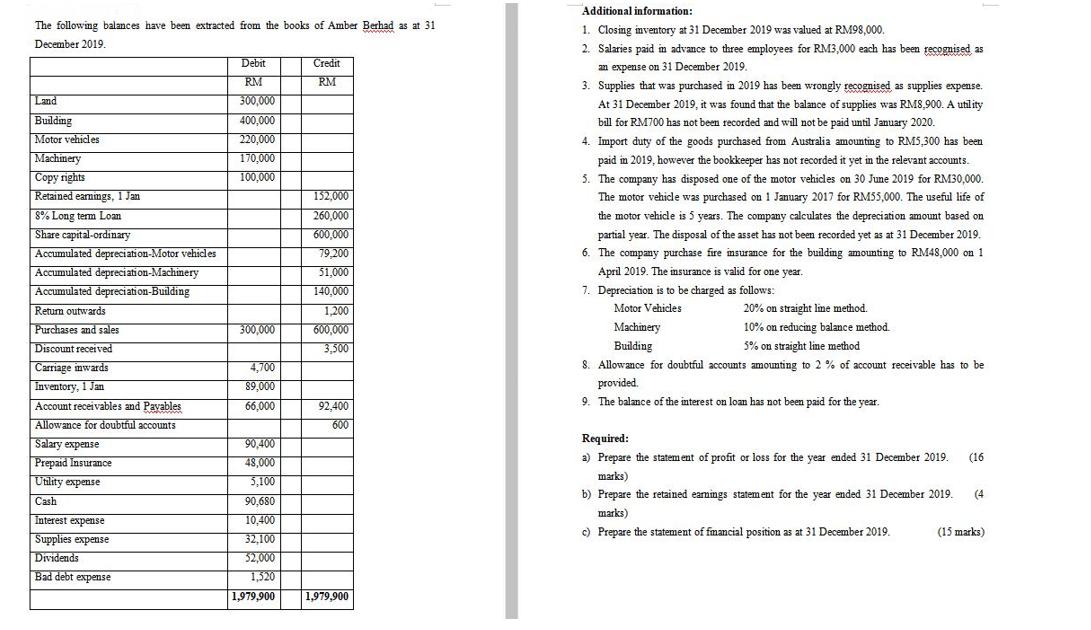

Additional information: The following balances have been extracted from the books of Amber Berhad as at 31 1. Closing inventory at 31 December 2019

Additional information: The following balances have been extracted from the books of Amber Berhad as at 31 1. Closing inventory at 31 December 2019 was valued at RM98,000. 2. Salaries paid m advance to three employees for RM3,000 each has been recognised as December 2019. Debit Credit an expense on 31 December 2019. RM RM 3. Supplies that was purchased in 2019 has been wrongly recognised as supplies expense. Land 300,000 At 31 December 2019, it was found that the balance of supplies was RMS,900. A utility Buildimg Motor vehicles Machinery 400,000 bill for RM700 has not been recorded and will not be paid until January 2020. 220,000 4. Import duty of the goods purchased from Australia amounting to RM5,300 has been 170,000 paid im 2019, however the bookkeeper has not recorded it yet in the relevant accounts. Copy rights Retained earnings, 1 Jan 5. The company has disposed one of the motor vehicles on 30 June 2019 for RM30,000. The motor vehicde was purchased on 1 January 2017 for RM55,000. The useful life of 100,000 152,000 260,000 600,000 8% Long term Loan Share capital-ordinary Accumulated depreciation-Motor vehicles Accumulated depreciation-Machinery Accumulated depreciation-Building the motor vehicde is 5 years. The company calculates the depreciation amount based on partial year. The disposal of the asset has not been recorded yet as at 31 December 2019. 79,200 6. The company purchase fire insurance for the building amounting to RM48,000 on 1 51,000 April 2019. The insurance is valid for one year. 140,000 7. Depreciation is to be charged as follows: Retum outwards 1,200 Motor Vehicles 20% on straight line method. 10% on reducing balance method. 5% on straight line method S. Allowance for doubtful accounts amounting to 2 % of account receivable has to be Machinery 600,000 3,500 Purchases and sales 300,000 Discount received Building Carriage imwards Inventory, 1 Jan Account receivables and Pavables 4,700 provided. 9. The balance of the interest on loan has not been paid for the year. 89,000 66,000 92,400 Allowance for doubtful accounts 600 Salary expense 90,400 Required: a) Prepare the statem ent of profit or loss for the year ended 31 December 2019. (16 Prepaid Insurance Unlity expense 48,000 5,100 marks) b) Prepare the retained eamings statem ent for the year ended 31 December 2019. (4 Cash 90,680 marks) Interest expense 10,400 c) Prepare the statement of fmancial position as at 31 December 2019. (15 marks) Supplies expense 32,100 Dividends Bad debt expense 32,000 1,520 1,979,900 1,979,900

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Statement of Profit or Loss for the year ended 31 December 2019 Particulars Note Amount Par...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started