Answered step by step

Verified Expert Solution

Question

1 Approved Answer

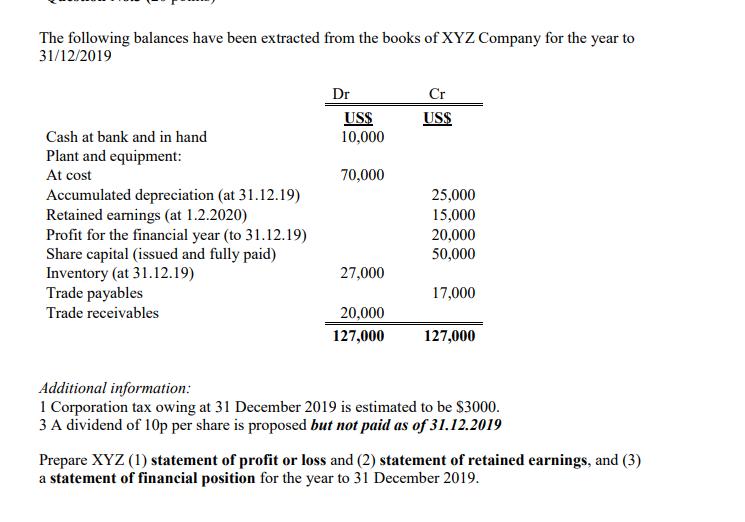

The following balances have been extracted from the books of XYZ Company for the year to 31/12/2019 Dr Cr USS 10,000 USS Cash at

The following balances have been extracted from the books of XYZ Company for the year to 31/12/2019 Dr Cr USS 10,000 USS Cash at bank and in hand Plant and equipment: At cost 70,000 Accumulated depreciation (at 31.12.19) Retained earnings (at 1.2.2020) Profit for the financial year (to 31.12.19) Share capital (issued and fully paid) Inventory (at 31.12.19) Trade payables 25,000 15,000 20,000 50,000 27,000 17,000 Trade receivables 20,000 127,000 127,000 Additional information: 1 Corporation tax owing at 31 December 2019 is estimated to be $3000. 3 A dividend of 10p per share is proposed but not paid as of 31.12.2019 Prepare XYZ (1) statement of profit or loss and (2) statement of retained earnings, and (3) a statement of financial position for the year to 31 December 2019.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Books of XYZ Statement of Profit or loss For the period ended 31122019 Particulars Profit before Tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started