Answered step by step

Verified Expert Solution

Question

1 Approved Answer

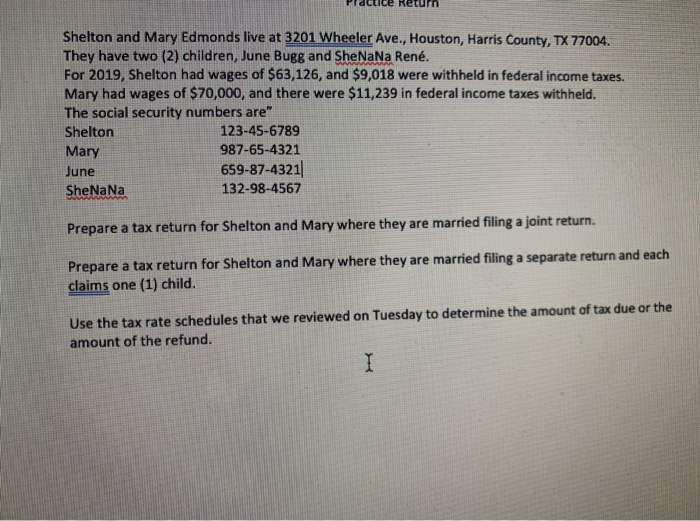

Shelton and Mary Edmonds live at 3201 Wheeler Ave., Houston, Harris County, TX 77004. They have two (2) children, June Bugg and SheNaNa Ren.

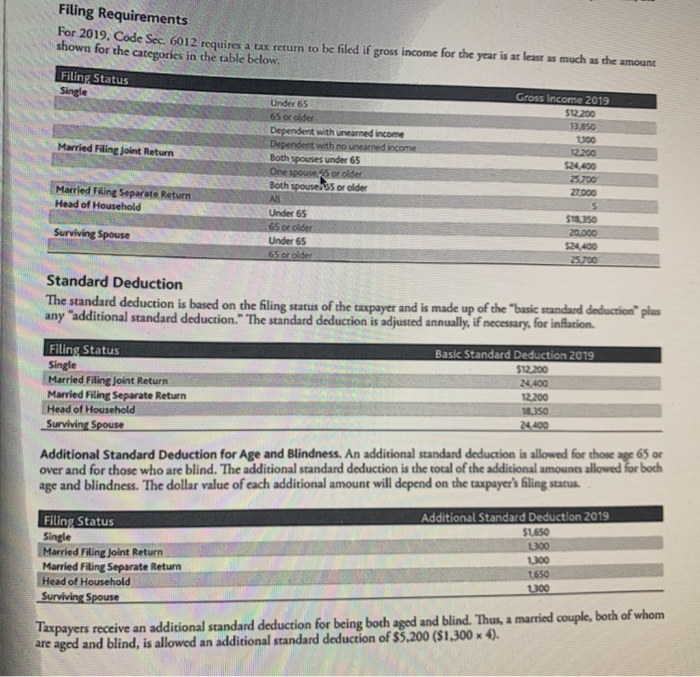

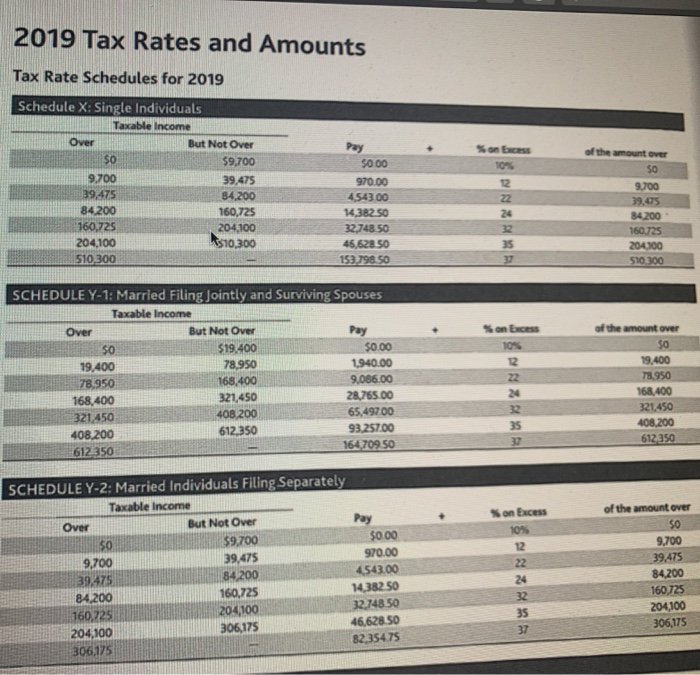

Shelton and Mary Edmonds live at 3201 Wheeler Ave., Houston, Harris County, TX 77004. They have two (2) children, June Bugg and SheNaNa Ren. For 2019, Shelton had wages of $63,126, and $9,018 were withheld in federal income taxes. Mary had wages of $70,000, and there were $11,239 in federal income taxes withheld. The social security numbers are" 123-45-6789 987-65-4321 Shelton Mary June SheNaNa 659-87-4321 132-98-4567 Prepare a tax return for Shelton and Mary where they are married filing a joint return. Prepare a tax return for Shelton and Mary where they are married filing a separate return and each claims one (1) child. Use the tax rate schedules that we reviewed on Tuesday to determine the amount of tax due or the amount of the refund. I Filing Requirements For 2019, Code Sec. 6012 requires a tax return to be filed if gross income for the year is at least as much as the amount shown for the categories in the table below. Filing Status Single Married Filing Joint Return Married Filing Separate Return Head of Household Surviving Spouse Filing Status Single Married Filing Joint Return Married Filing Separate Return Head of Household Surviving Spouse Under 65 65 or older Dependent with unearned income Dependent with no unearned income Standard Deduction The standard deduction is based on the filing status of the taxpayer and is made up of the "basic standard deduction plus any "additional standard deduction. The standard deduction is adjusted annually, if necessary, for inflation. Both spouses under 65 One spouse 55 or older Both spouse 35 or older All Under 65 65 or older Under 65 65 or older Filing Status Single Married Filing Joint Return Married Filing Separate Return Head of Household Surviving Spouse Gross Income 2019 $12.200 13,850 1300 12.200 $24,400 25,700 27,000 5 $18.350 20,000 $24,400 25,700 Basic Standard Deduction 2019 $12,200 24,400 12,200 18,350 24.400 Additional Standard Deduction for Age and Blindness. An additional standard deduction is allowed for those age 65 or over and for those who are blind. The additional standard deduction is the total of the additional amounts allowed for both age and blindness. The dollar value of each additional amount will depend on the taxpayer's filing status. Additional Standard Deduction 2019 $1,650 1,300 1,300 1,650 1,300 Taxpayers receive an additional standard deduction for being both aged and blind. Thus, a married couple, both of whom are aged and blind, is allowed an additional standard deduction of $5,200 ($1,300 x 4). 2019 Tax Rates and Amounts Tax Rate Schedules for 2019 Schedule X: Single Individuals Taxable Income Over $0 9,700 39,475 84,200 160,725 204,100 510,300 Over 50 19,400 78,950 168,400 321,450 408,200 612.350 But Not Over $9,700 SCHEDULE Y-1: Married Filing Jointly and Surviving Spouses Taxable Income Over 39,475 84,200 160,725 50 9,700 39,475 84,200 160,725 204,100 306,175 204,100 10,300 But Not Over $19,400 78,950 168,400 321,450 408,200 612,350 Pay $0.00 970.00 4,543.00 14,382.50 32,748.50 46,628.50 153,798.50 SCHEDULE Y-2: Married Individuals Filing Separately Taxable income But Not Over $9,700 39,475 84,200 160,725 204,100 306,175 Pay $0.00 1,940.00 9,086.00 28,765.00 65,497.00 93,257.00 164,709.50 Pay $0.00 970.00 4,543.00 14,382.50 32,748.50 46,628.50 82,354.75 %on Excess 10% 12 22 24 32 35 37 % on Excess 10% 12 22 24 32 35 37 % on Excess 10% 12 22 24 32 35 37 of the amount over 50 9,700 39,475 84,200 160,725 204,300 $10,300 of the amount over $0 19,400 78,950 168,400 321,450 408,200 612,350 of the amount over 50 9,700 39,475 84,200 160,725 204,100 306,175

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Tax return for Shelton Mary where they are married and filing a Joint Return Particulars Amount Tota...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started