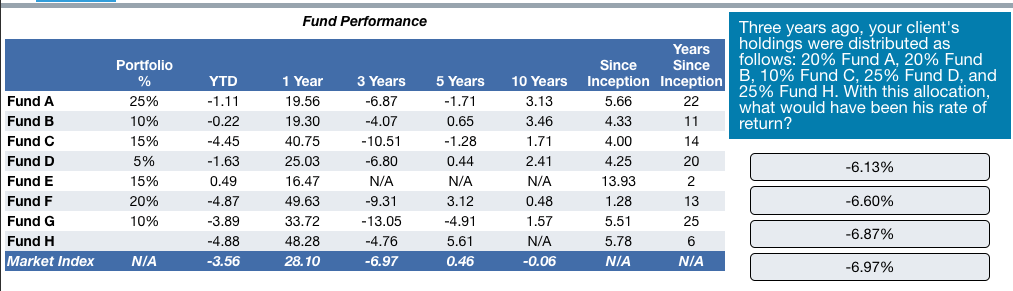

Question: Fund Performance Three years ago, your client's holdings were distributed as follows: 20% Fund A, 20% Fund B. 10% Fund C, 25% Fund D, and

Fund Performance Three years ago, your client's holdings were distributed as follows: 20% Fund A, 20% Fund B. 10% Fund C, 25% Fund D, and 25% Fund H. With this allocation what would have been his rate of return? Years Since Portfolio Since YTD 1 Year 3 Years 5 Years 10 Years Inception Inception Fund A Fund B Fund C Fund D Fund E Fund F Fund G Fund H Market Index 25% 1.11 19.56 6.87 1.71 5.66 10% -0.22 19.30-4.07 0.65 3.46 4.33 11 15% -4.45 1.63 0.49 40.75 25.03 16.47 -10.51 -6.80 N/A 1.28 0.44 N/A 1.71 14 20 2 13 25 6 NIA 4.25 -6.13% -6.60% -6.87% -6.97% 15% N/A 20% -4.87 49.63-9.31 3.12 0.48 1.57 N/A 0.06 1.28 5.51 5.78 NIA 10% 3.89 4.88 3.56 33.72 48.28 28.10 5.61 0.46 NIA -6.97

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts