Question

Fundamental analysis is a school of thought in market analysis that assumes each stock has a beta, an intrinsic, an estimated, a relative (or true

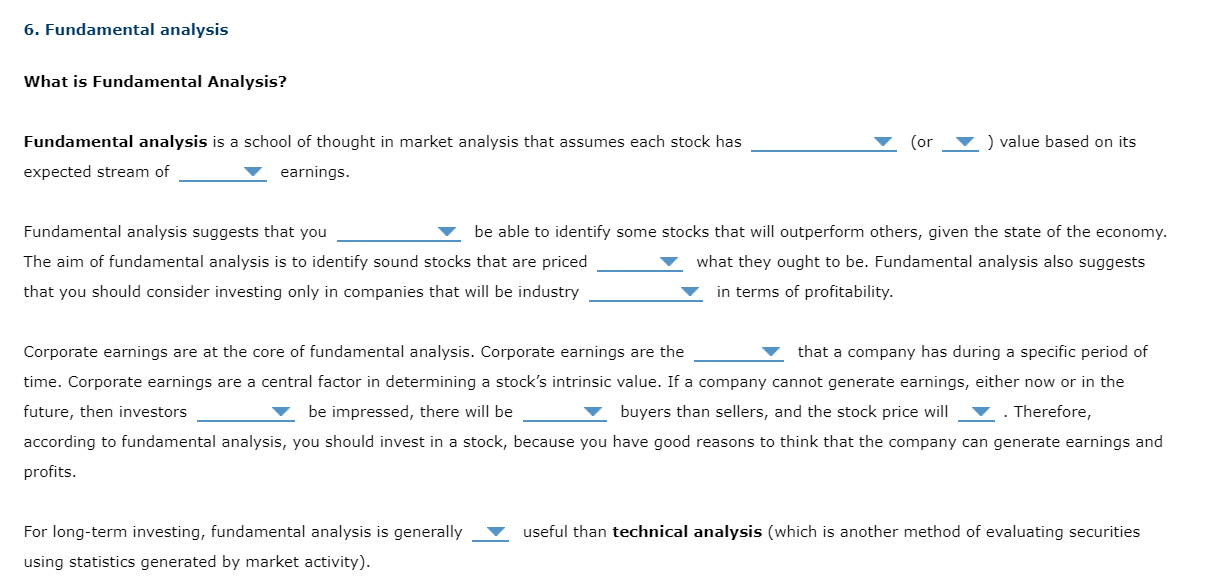

Fundamental analysis is a school of thought in market analysis that assumes each stock has a beta, an intrinsic, an estimated, a relative (or true or false ) value based on its expected stream of past or future earnings.

Fundamental analysis suggests that you should or should not be able to identify some stocks that will outperform others, given the state of the economy. The aim of fundamental analysis is to identify sound stocks that are priced below or above what they ought to be. Fundamental analysis also suggests that you should consider investing only in companies that will be industry leaders or followers in terms of profitability.

Corporate earnings are at the core of fundamental analysis. Corporate earnings are the losses or profits that a company has during a specific period of time. Corporate earnings are a central factor in determining a stocks intrinsic value. If a company cannot generate earnings, either now or in the future, then investors will or will not be impressed, there will be more or fewer buyers than sellers, and the stock price will rise or fall Therefore, according to fundamental analysis, you should invest in a stock, because you have good reasons to think that the company can generate earnings and profits.

For long-term investing, fundamental analysis is generally more or less useful than technical analysis (which is another method of evaluating securities using statistics generated by market activity).

What is Fundamental Analysis? Fundamental analysis is a school of thought in market analysis that assumes each stock has (or value based on its expected stream of earnings. Fundamental analysis suggests that you be able to identify some stocks that will outperform others, given the state of the economy. The aim of fundamental analysis is to identify sound stocks that are priced what they ought to be. Fundamental analysis also suggests that you should consider investing only in companies that will be industry in terms of profitability. Corporate earnings are at the core of fundamental analysis. Corporate earnings are the that a company has during a specific period of time. Corporate earnings are a central factor in determining a stock's intrinsic value. If a company cannot generate earnings, either now or in the future, then investors be impressed, there will be buyers than sellers, and the stock price will . Therefore, according to fundamental analysis, you should invest in a stock, because you have good reasons to think that the company can generate earnings and profits. For long-term investing, fundamental analysis is generally useful than technical analysis (which is another method of evaluating securities using statistics generated by market activity)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started