Fundametal of financial management

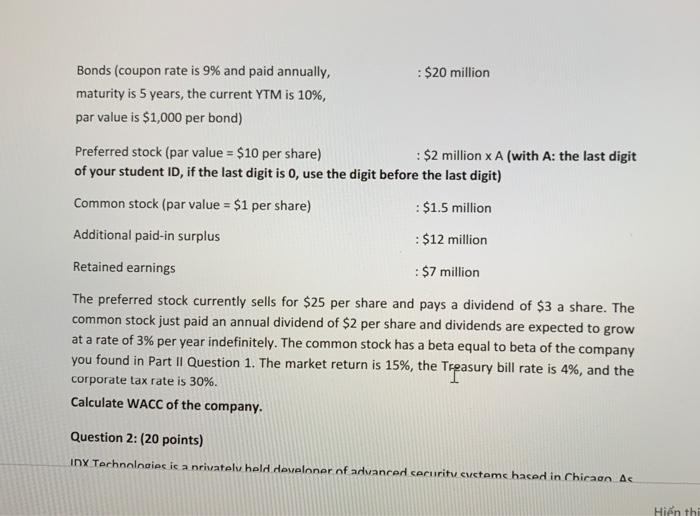

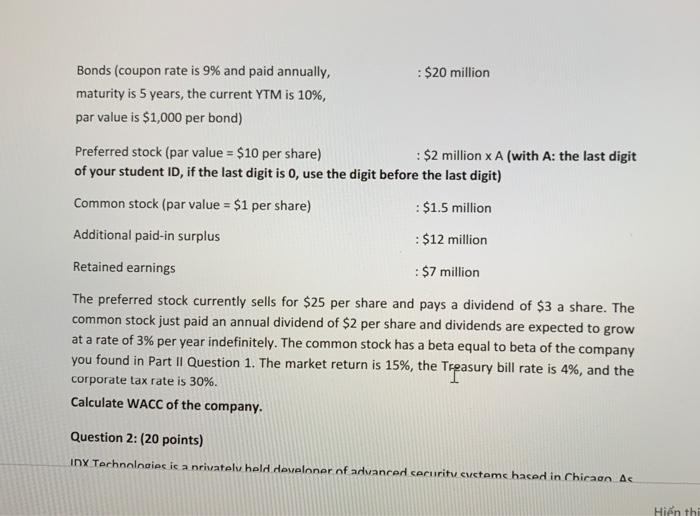

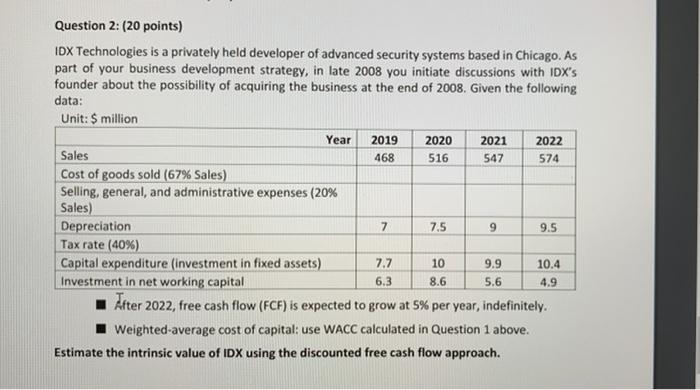

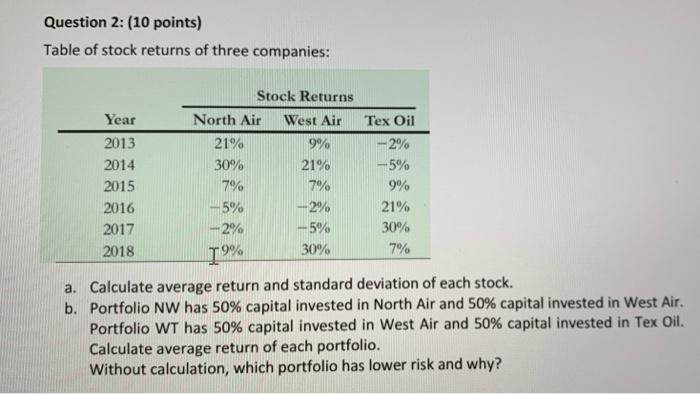

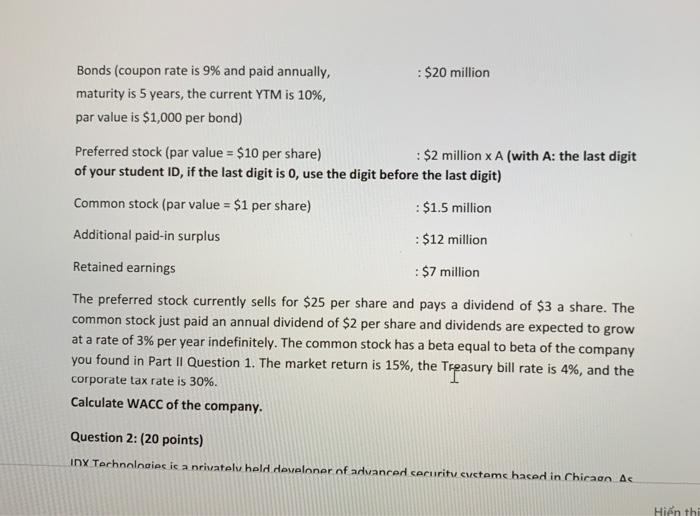

: $20 million Bonds (coupon rate is 9% and paid annually, maturity is 5 years, the current YTM is 10%, par value is $1,000 per bond) Preferred stock (par value = $10 per share) : $2 million x A (with A: the last digit of your student ID, if the last digit is 0, use the digit before the last digit) Common stock (par value = $1 per share) : $1.5 million Additional paid-in surplus : $12 million Retained earnings : $7 million The preferred stock currently sells for $25 per share and pays a dividend of $3 a share. The common stock just paid an annual dividend of $2 per share and dividends are expected to grow at a rate of 3% per year indefinitely. The common stock has a beta equal to beta of the company you found in Part II Question 1. The market return is 15%, the Treasury bill rate is 4%, and the corporate tax rate is 30%. Calculate WACC of the company. Question 2: (20 points) IDX Technologies is a privately held develoner of advanced cerurity cystems hased in Chicago Ac Hin th Question 2: (20 points) IDX Technologies is a privately held developer of advanced security systems based in Chicago. As part of your business development strategy, in late 2008 you initiate discussions with IDX's founder about the possibility of acquiring the business at the end of 2008. Given the following data: Unit: $ million Year 2019 2020 2021 2022 Sales 468 516 547 574 Cost of goods sold (67% Sales) Selling, general, and administrative expenses (20% Sales) Depreciation 7 7.5 9 9.5 Tax rate (40%) Capital expenditure (investment in fixed assets) 7.7 10 9.9 10.4 Investment in net working capital 6.3 8.6 5.6 4.9 After 2022, free cash flow (FCF) is expected to grow at 5% per year, indefinitely Weighted average cost of capital: use WACC calculated in Question 1 above. Estimate the intrinsic value of IDX using the discounted free cash flow approach. Question 2: (10 points) Table of stock returns of three companies: Stock Returns Year North Air West Air Tex Oil 2013 21% 9% -2% 2014 30% 21% -5% 2015 7% 7% 9% 2016 5% --2% 21% 2017 - 2% -5% 30% 2018 30% 7% I 9% a. Calculate average return and standard deviation of each stock. b. Portfolio NW has 50% capital invested in North Air and 50% capital invested in West Air. Portfolio WT has 50% capital invested in West Air and 50% capital invested in Tex Oil. Calculate average return of each portfolio. Without calculation, which portfolio has lower risk and why? : $20 million Bonds (coupon rate is 9% and paid annually, maturity is 5 years, the current YTM is 10%, par value is $1,000 per bond) Preferred stock (par value = $10 per share) : $2 million x A (with A: the last digit of your student ID, if the last digit is 0, use the digit before the last digit) Common stock (par value = $1 per share) : $1.5 million Additional paid-in surplus : $12 million Retained earnings : $7 million The preferred stock currently sells for $25 per share and pays a dividend of $3 a share. The common stock just paid an annual dividend of $2 per share and dividends are expected to grow at a rate of 3% per year indefinitely. The common stock has a beta equal to beta of the company you found in Part II Question 1. The market return is 15%, the Treasury bill rate is 4%, and the corporate tax rate is 30%. Calculate WACC of the company. Question 2: (20 points) IDX Technologies is a privately held develoner of advanced cerurity cystems hased in Chicago Ac Hin th Question 2: (20 points) IDX Technologies is a privately held developer of advanced security systems based in Chicago. As part of your business development strategy, in late 2008 you initiate discussions with IDX's founder about the possibility of acquiring the business at the end of 2008. Given the following data: Unit: $ million Year 2019 2020 2021 2022 Sales 468 516 547 574 Cost of goods sold (67% Sales) Selling, general, and administrative expenses (20% Sales) Depreciation 7 7.5 9 9.5 Tax rate (40%) Capital expenditure (investment in fixed assets) 7.7 10 9.9 10.4 Investment in net working capital 6.3 8.6 5.6 4.9 After 2022, free cash flow (FCF) is expected to grow at 5% per year, indefinitely Weighted average cost of capital: use WACC calculated in Question 1 above. Estimate the intrinsic value of IDX using the discounted free cash flow approach. Question 2: (10 points) Table of stock returns of three companies: Stock Returns Year North Air West Air Tex Oil 2013 21% 9% -2% 2014 30% 21% -5% 2015 7% 7% 9% 2016 5% --2% 21% 2017 - 2% -5% 30% 2018 30% 7% I 9% a. Calculate average return and standard deviation of each stock. b. Portfolio NW has 50% capital invested in North Air and 50% capital invested in West Air. Portfolio WT has 50% capital invested in West Air and 50% capital invested in Tex Oil. Calculate average return of each portfolio. Without calculation, which portfolio has lower risk and why