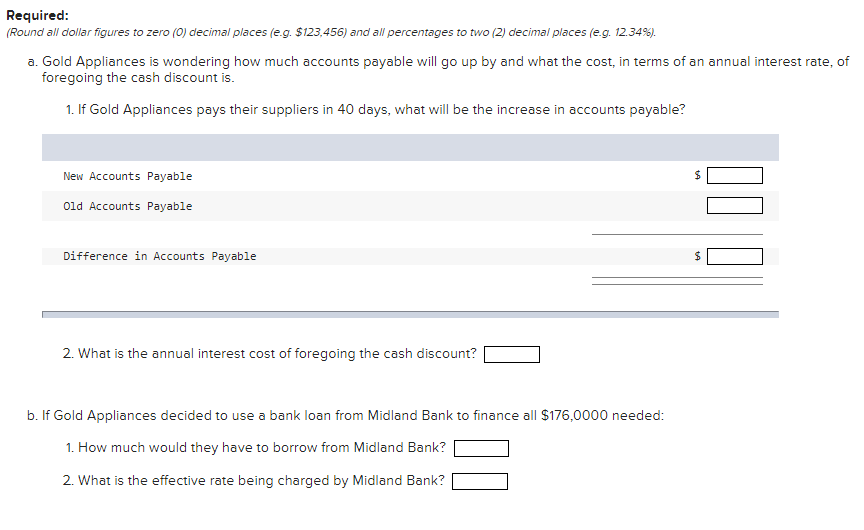

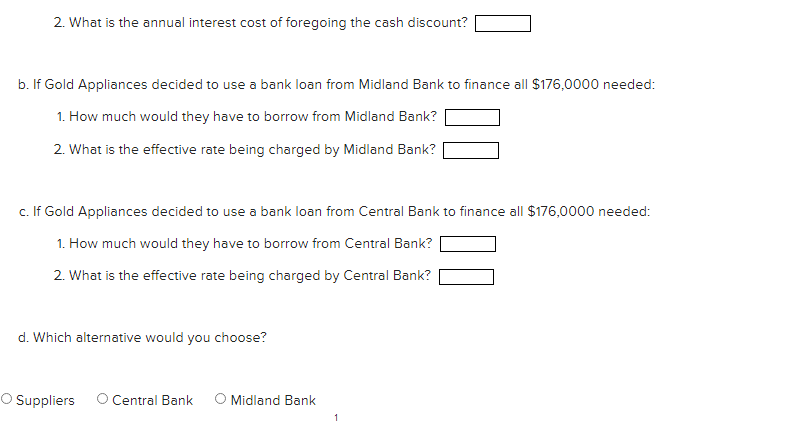

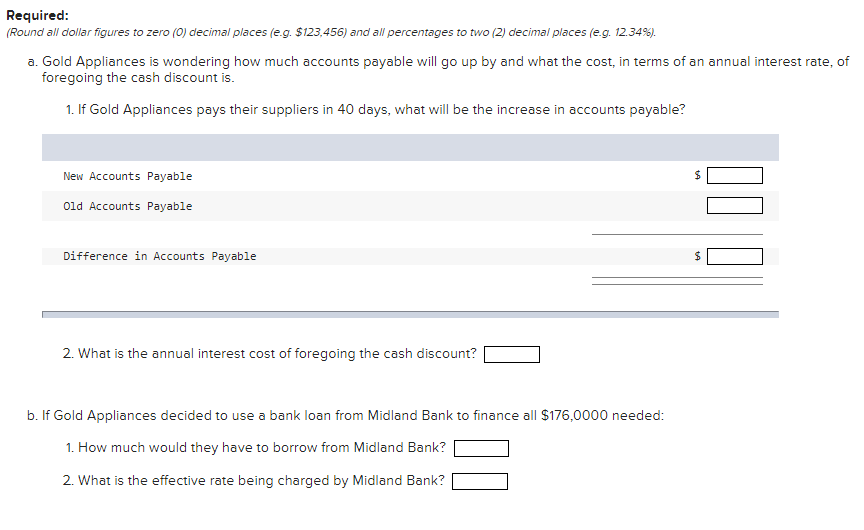

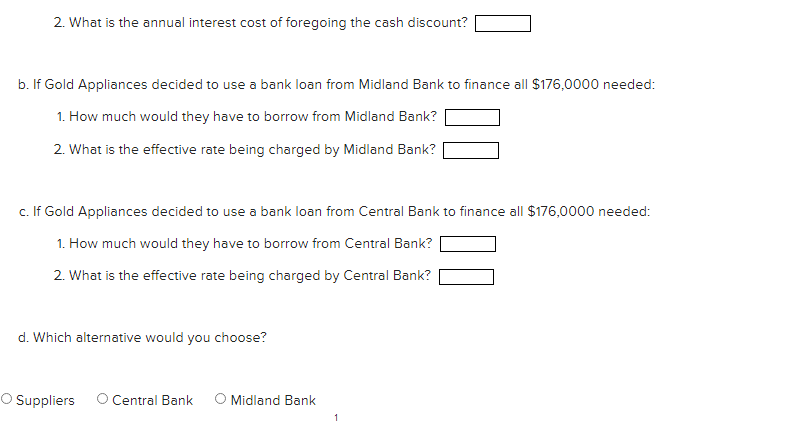

Funding Alternatives Gold Appliances purchases $20 million of inventory from its suppliers every year. They are looking to finance an increase in inventory of $1,760,000. Three alternatives are being considered: 1. Increase accounts payable: Supplier's terms are 2/10 net 40 and Gold Appliances has traditionally taken advantage of the discount, paying their suppliers in 10 days. If Gold Appliances chooses to forego the discount, they would pay their suppliers in 40 days, instead of 10. 2. Midland Bank will let Gold Appliances borrow the amount they need with the following conditions: Midland Bank requires a compensating balance of $45,000 be maintained by Gold Appliances at all times. The company currently has $20,000 on account with Midland that would count toward compensating balances. Midland Band will charge 12.00 percent interest per annum for the loan. 3. The Central Bank is offering to charge 12.00 percent interest per annum with no requirement for a compensating balance, but the loan would be discounted. Required: (Round all dollar figures to zero (O) decimal places (eg. $123,456) and all percentages to two (2) decimal places (e.g. 12.34%). a. Gold Appliances is wondering how much accounts payable will go up by and what the cost, in terms of an annual interest rate, of foregoing the cash discount is. 1. If Gold Appliances pays their suppliers in 40 days, what will be the increase in accounts payable? New Accounts Payable 64 Old Accounts Payable 000 Difference in Accounts Payable ta 2. What is the annual interest cost of foregoing the cash discount? b. If Gold Appliances decided to use a bank loan from Midland Bank to finance all $176,0000 needed: 1. How much would they have to borrow from Midland Bank? 2. What is the effective rate being charged by Midland Bank? 2. What is the annual interest cost of foregoing the cash discount? b. If Gold Appliances decided to use a bank loan from Midland Bank to finance all $176,0000 needed: 1. How much would they have to borrow from Midland Bank? 2. What is the effective rate being charged by Midland Bank? c. If Gold Appliances decided to use a bank loan from Central Bank to finance all $176,0000 needed: 1. How much would they have to borrow from Central Bank? 2. What is the effective rate being charged by Central Bank? d. Which alternative would you choose? Suppliers Central Bank O Midland Bank