Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q2-1 Governmental accounting systems are different from business accounting systems. Why? Q2-2 Funds used in state and local government accounting and financial reporting are

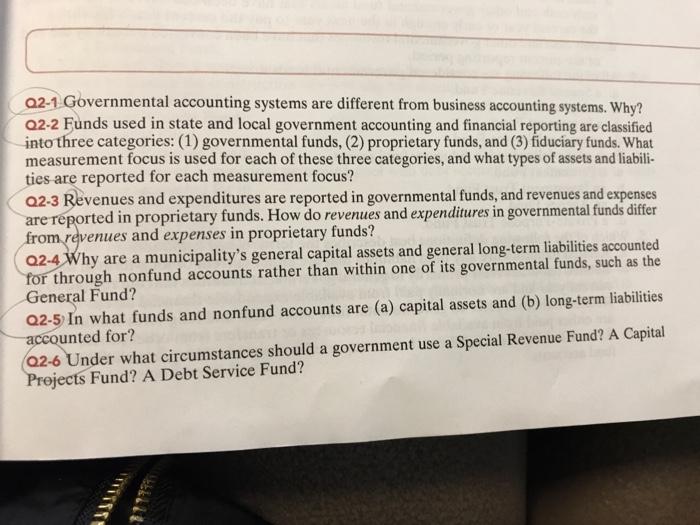

Q2-1 Governmental accounting systems are different from business accounting systems. Why? Q2-2 Funds used in state and local government accounting and financial reporting are classified into three categories: (1) governmental funds, (2) proprietary funds, and (3) fiduciary funds. What measurement focus is used for each of these three categories, and what types of assets and liabili- ties are reported for each measurement focus? Q2-3 Revenues and expenditures are reported in governmental funds, and revenues and expenses are reported in proprietary funds. How do revenues and expenditures in governmental funds differ from revenues and expenses in proprietary funds? Q2-4 Why are a municipality's general capital assets and general long-term liabilities accounted for through nonfund accounts rather than within one of its governmental funds, such as the General Fund? Q2-5 In what funds and nonfund accounts are (a) capital assets and (b) long-term liabilities accounted for? (Q2-6 Under what circumstances should a government use a Special Revenue Fund? A Capital Projects Fund? A Debt Service Fund?

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 The main difference between governmental accounting and business accounting is that businesses are run to make a profit while government entities exist to provide services to the public This means t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started