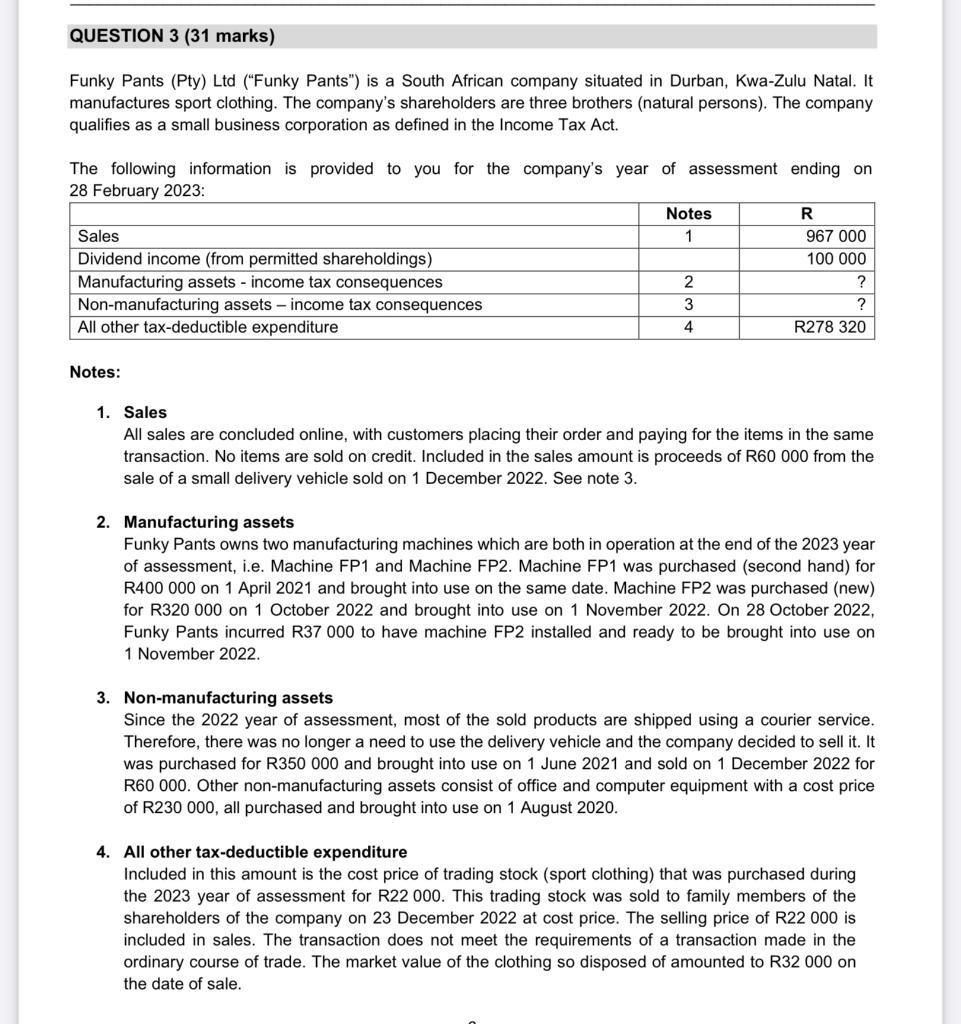

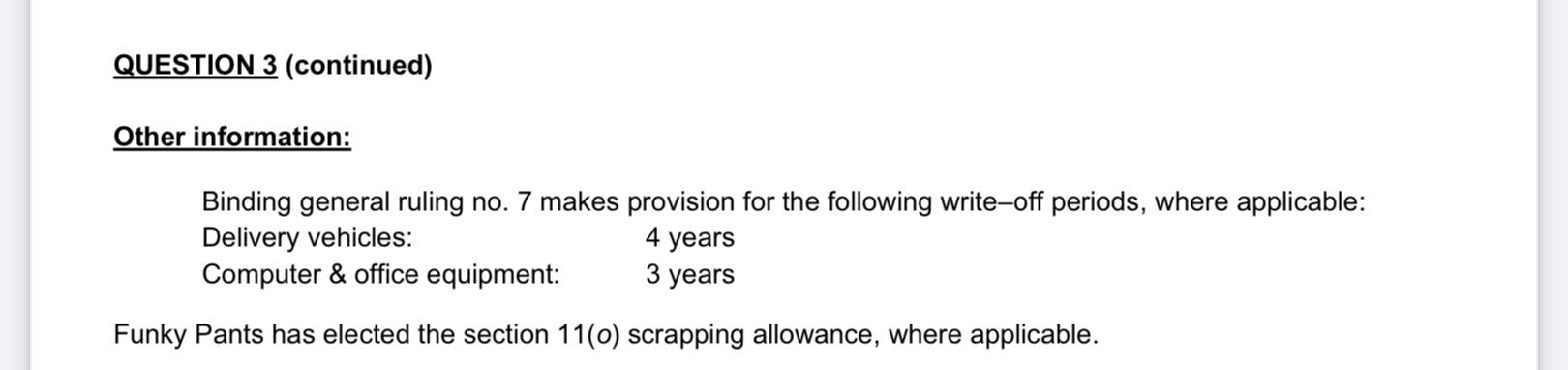

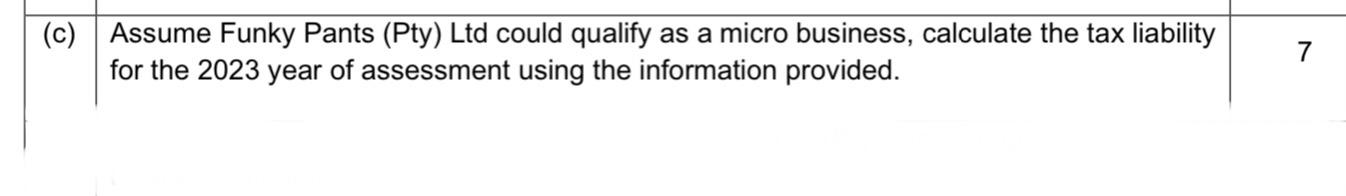

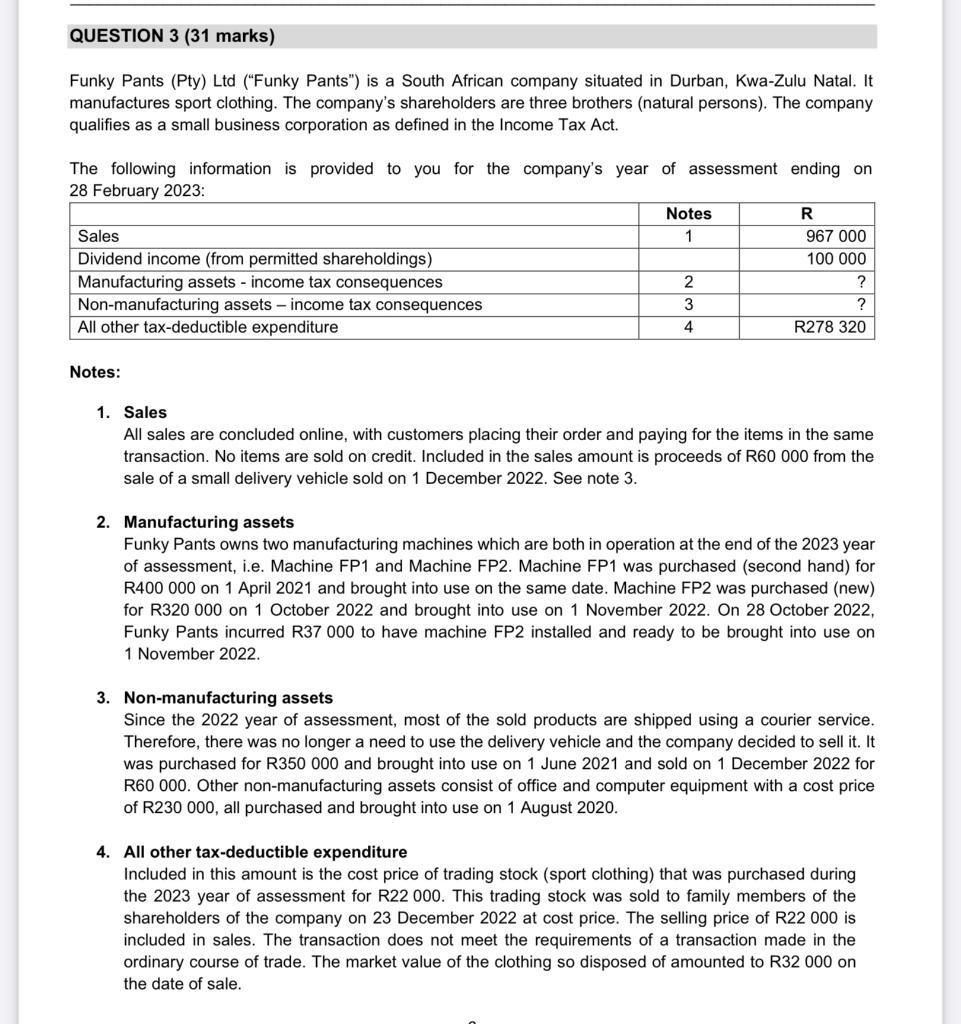

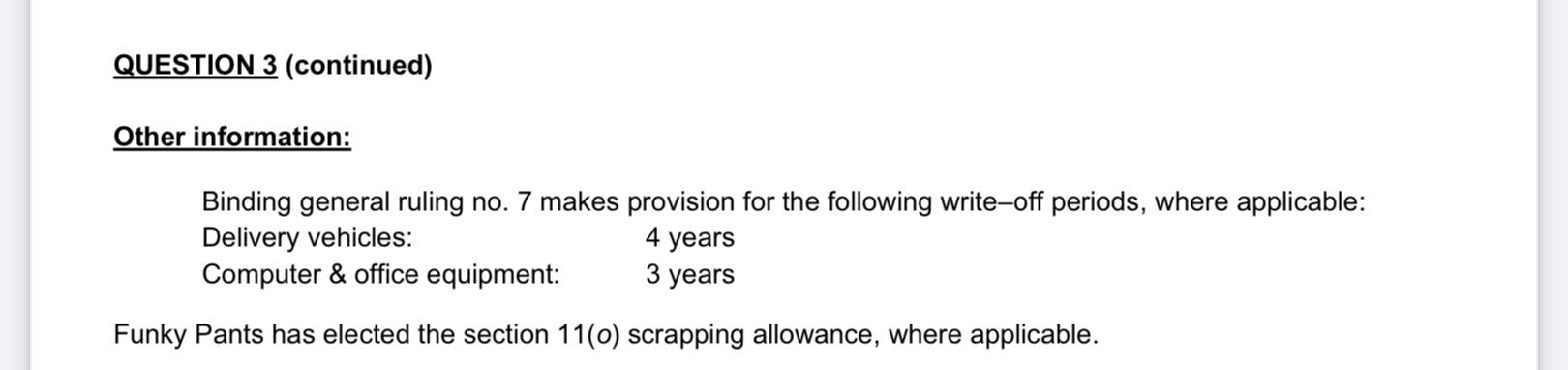

Funky Pants (Pty) Ltd ("Funky Pants") is a South African company situated in Durban, Kwa-Zulu Natal. It manufactures sport clothing. The company's shareholders are three brothers (natural persons). The company qualifies as a small business corporation as defined in the Income Tax Act. The following information is provided to you for the company's year of assessment ending on 28 February 2023: Notes: 1. Sales All sales are concluded online, with customers placing their order and paying for the items in the same transaction. No items are sold on credit. Included in the sales amount is proceeds of R60 000 from the sale of a small delivery vehicle sold on 1 December 2022. See note 3. 2. Manufacturing assets Funky Pants owns two manufacturing machines which are both in operation at the end of the 2023 year of assessment, i.e. Machine FP1 and Machine FP2. Machine FP1 was purchased (second hand) for R400 000 on 1 April 2021 and brought into use on the same date. Machine FP2 was purchased (new) for R320 000 on 1 October 2022 and brought into use on 1 November 2022. On 28 October 2022, Funky Pants incurred R37 000 to have machine FP2 installed and ready to be brought into use on 1 November 2022. 3. Non-manufacturing assets Since the 2022 year of assessment, most of the sold products are shipped using a courier service. Therefore, there was no longer a need to use the delivery vehicle and the company decided to sell it. It was purchased for R350 000 and brought into use on 1 June 2021 and sold on 1 December 2022 for R60 000. Other non-manufacturing assets consist of office and computer equipment with a cost price of R230 000, all purchased and brought into use on 1 August 2020. 4. All other tax-deductible expenditure Included in this amount is the cost price of trading stock (sport clothing) that was purchased during the 2023 year of assessment for R22 000. This trading stock was sold to family members of the shareholders of the company on 23 December 2022 at cost price. The selling price of R22 000 is included in sales. The transaction does not meet the requirements of a transaction made in the ordinary course of trade. The market value of the clothing so disposed of amounted to R32 000 on the date of sale. QUESTION 3 (continued) Other information: Binding general ruling no. 7 makes provision for the following write-off periods, where applicable: Delivery vehicles: 4 years Computer \& office equipment: 3 years Funky Pants has elected the section 11(o) scrapping allowance, where applicable