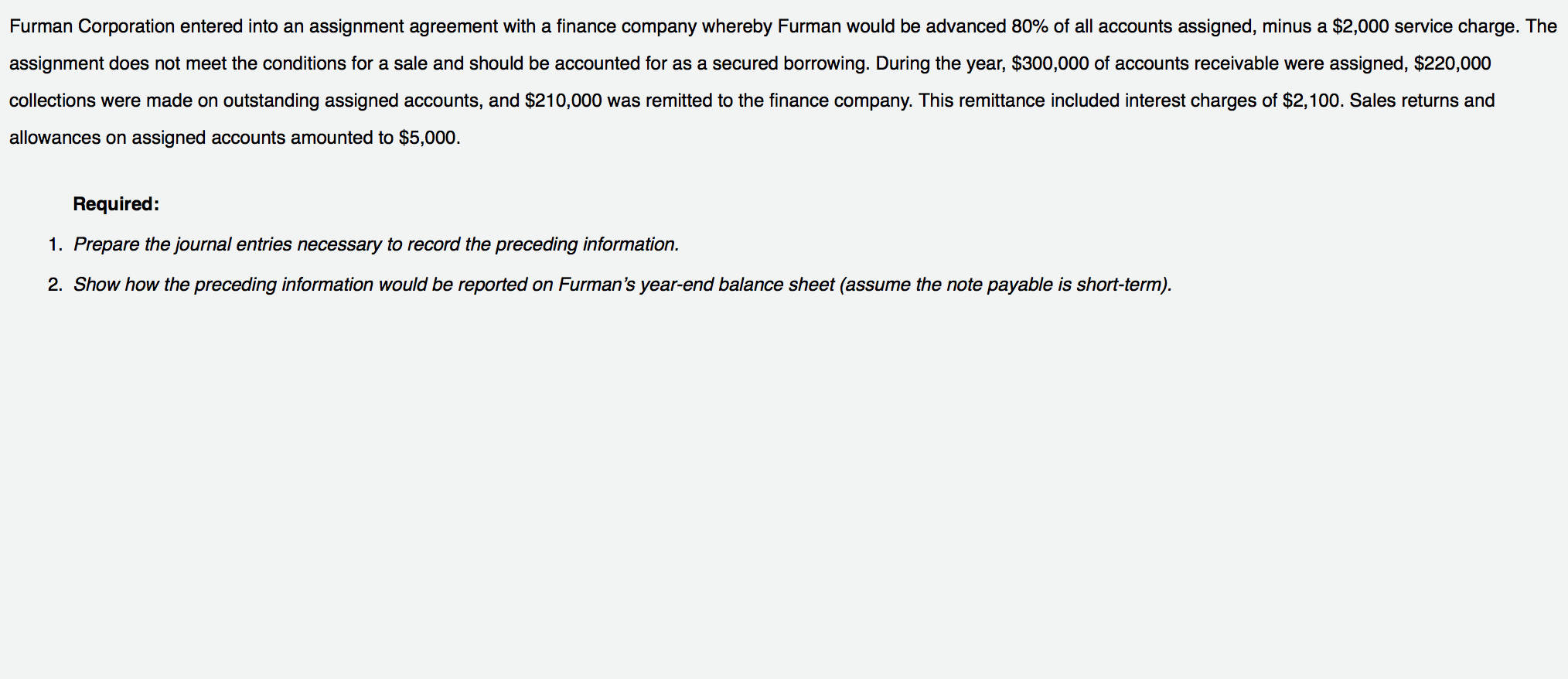

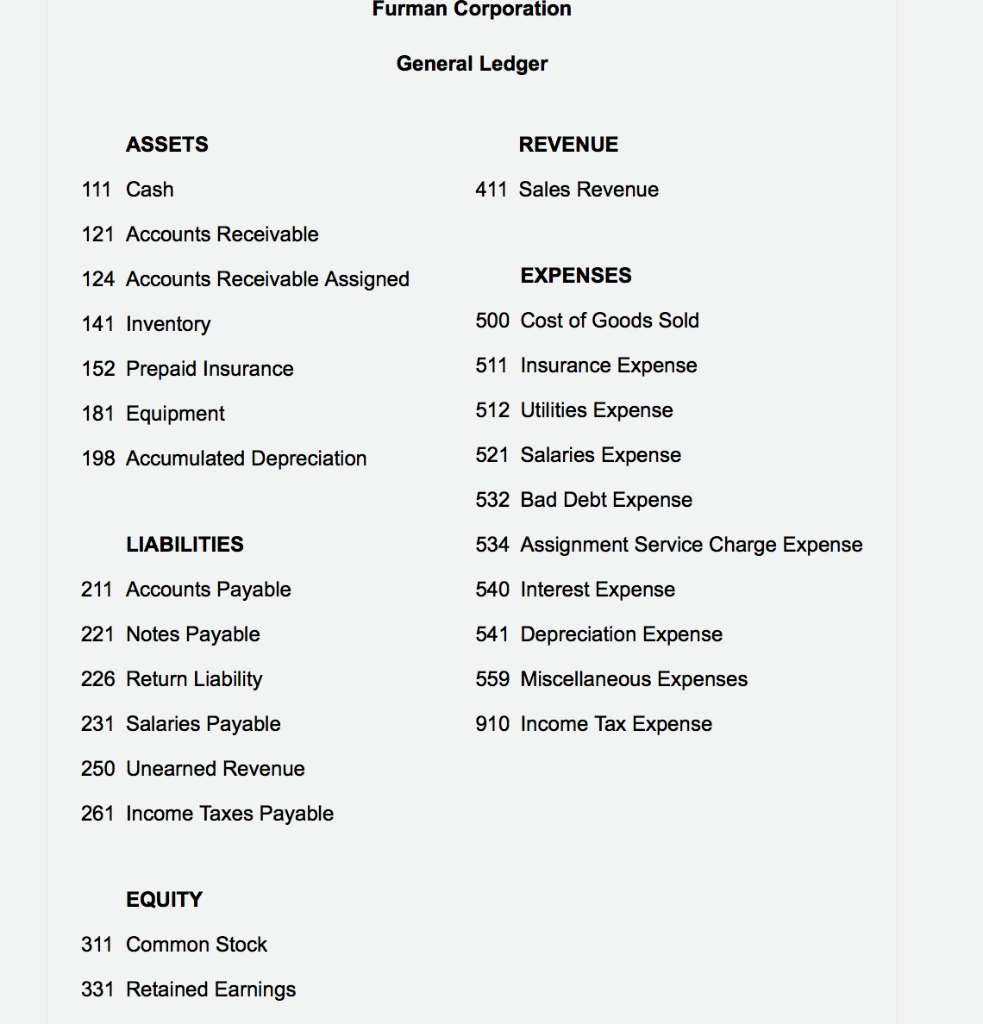

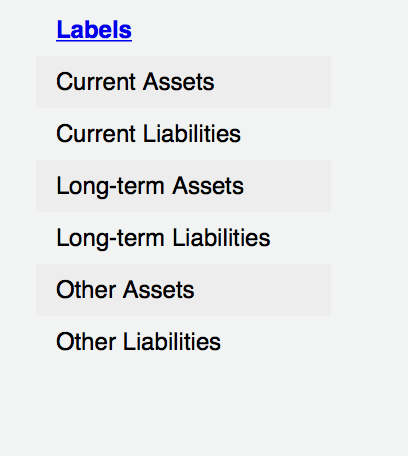

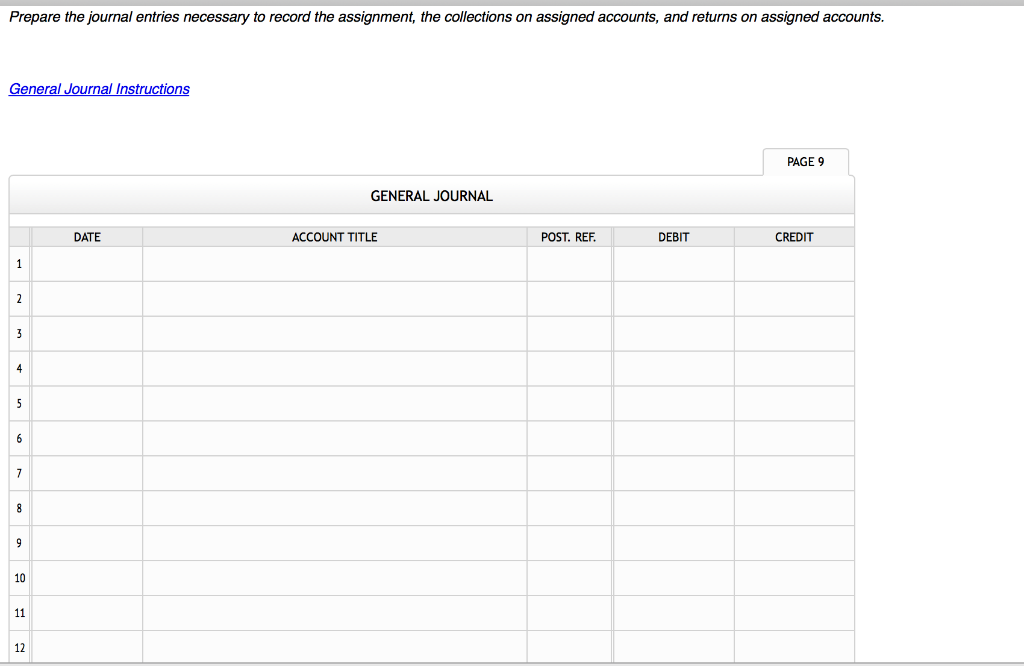

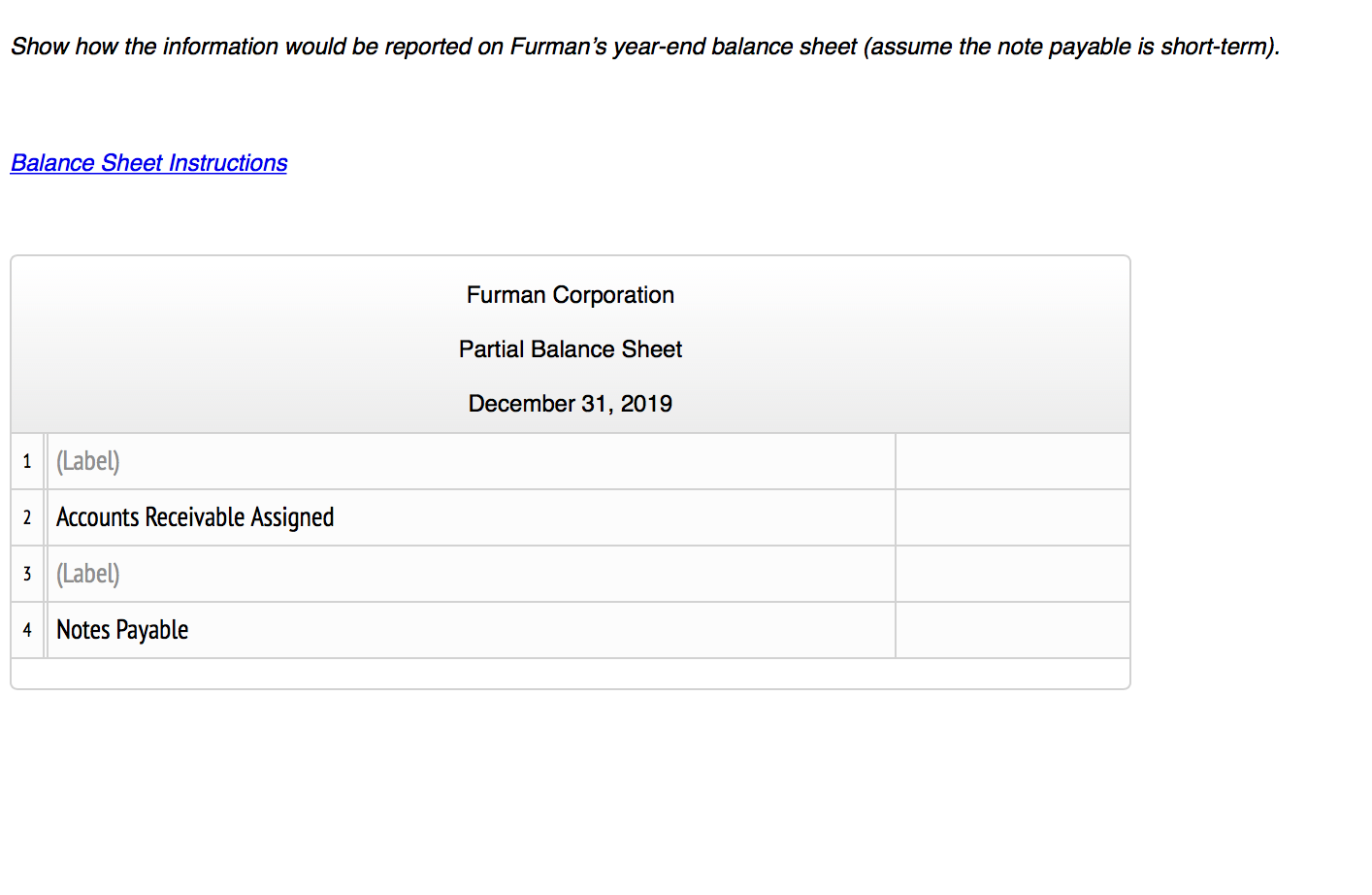

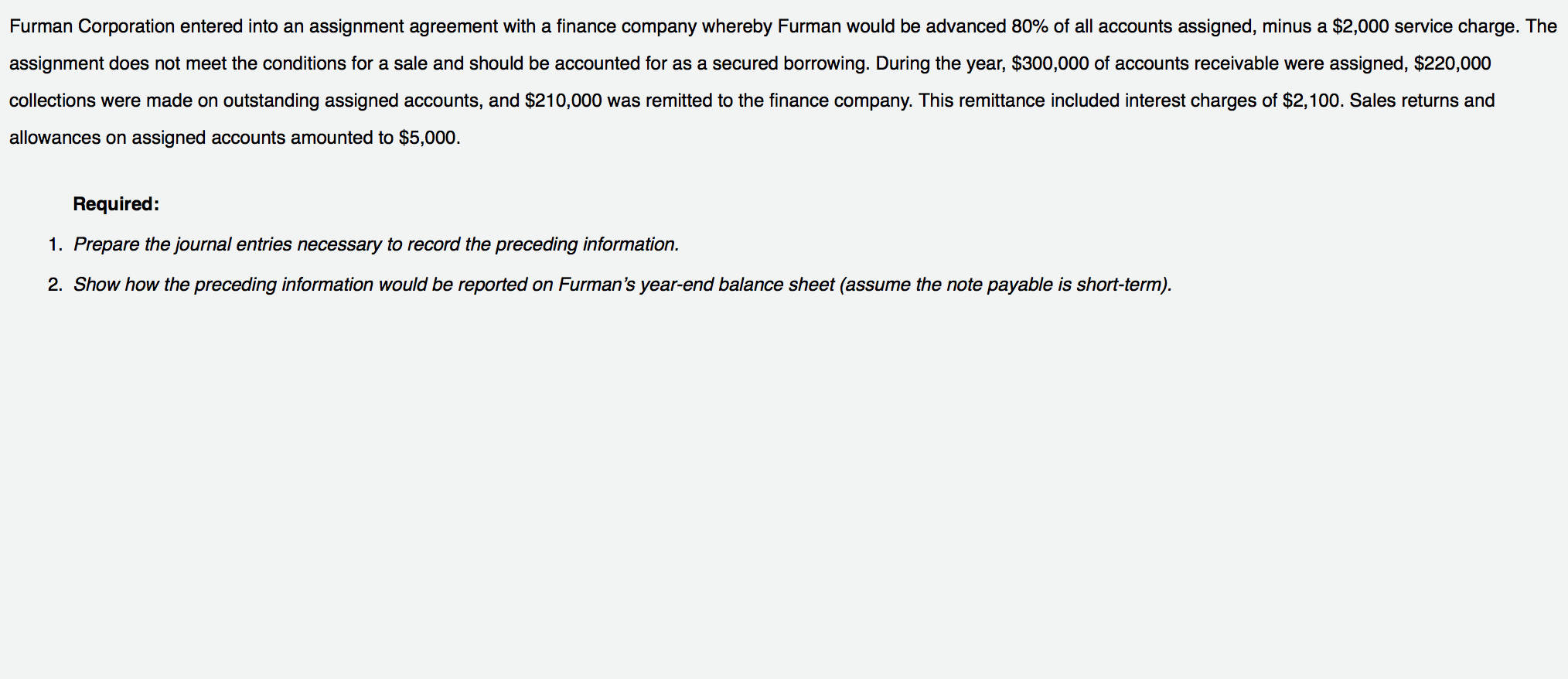

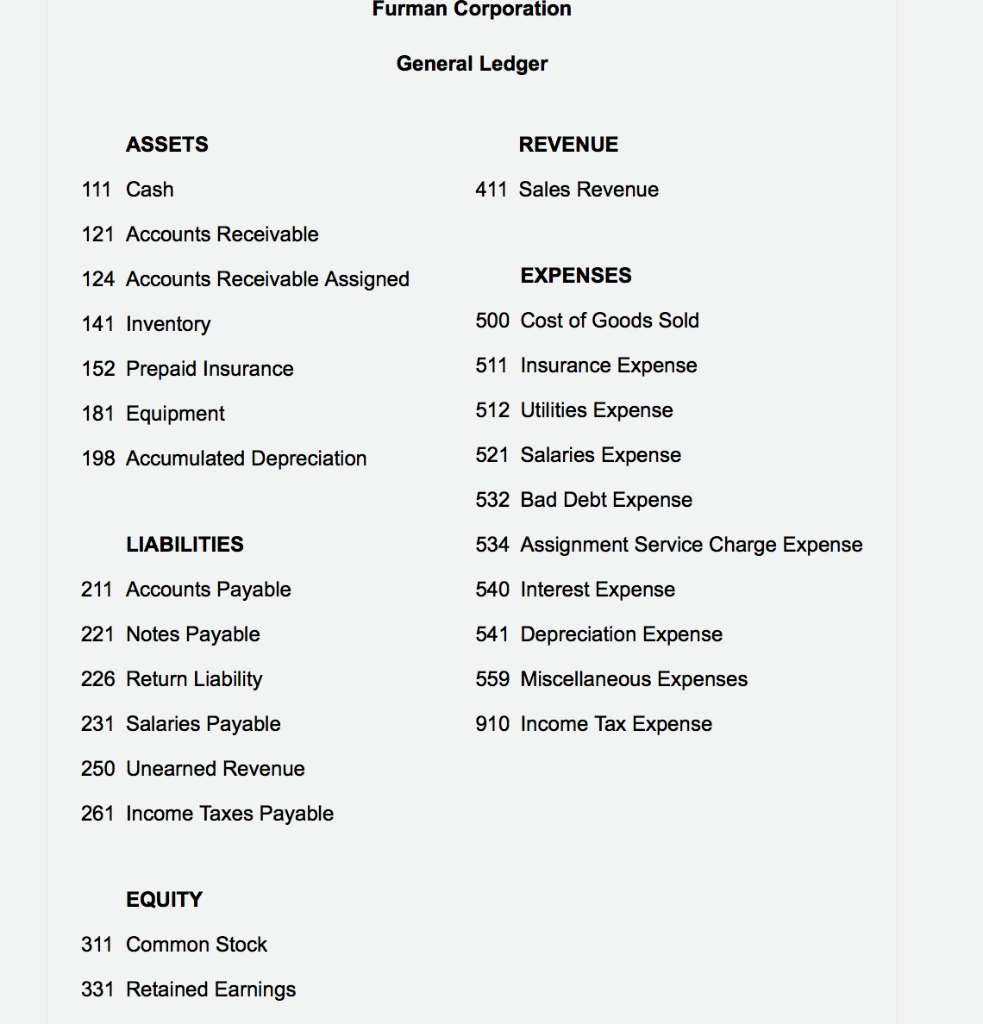

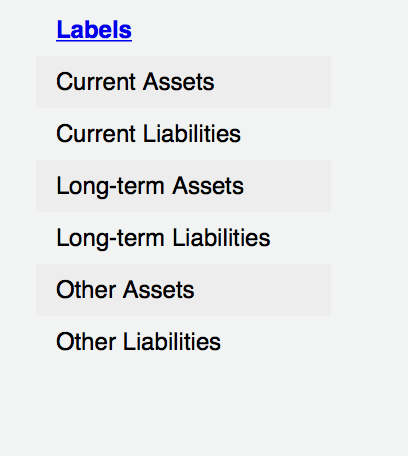

Furman Corporation entered into an assignment agreement with a finance company whereby Furman would be advanced 80% of all accounts assigned, minus a $2,000 service charge. The assignment does not meet the conditions for a sale and should be accounted for as a secured borrowing. During the year, $300,000 of accounts receivable were assigned, $220,000 collections were made on outstanding assigned accounts, and $210,000 was remitted to the finance company. This remittance included interest charges of $2,100. Sales returns and allowances on assigned accounts amounted to $5,000. Required: 1. Prepare the journal entries necessary to record the preceding information. 2. Show how the preceding information would be reported on Furman's year-end balance sheet (assume the note payable is short-term). Furman Corporation General Ledger ASSETS REVENUE 111 Cash 411 Sales Revenue 121 Accounts Receivable 124 Accounts Receivable Assigned EXPENSES 141 Inventory 500 Cost of Goods Sold 511 Insurance Expense 152 Prepaid Insurance 512 Utilities Expense 181 Equipment 198 Accumulated Depreciation 521 Salaries Expense 532 Bad Debt Expense LIABILITIES 534 Assignment Service Charge Expense 211 Accounts Payable 540 Interest Expense 221 Notes Payable 541 Depreciation Expense 559 Miscellaneous Expenses 226 Return Liability 231 Salaries Payable 910 Income Tax Expense 250 Unearned Revenue 261 Income Taxes Payable EQUITY 311 Common Stock 331 Retained Earnings Labels Current Assets Current Liabilities Long-term Assets Long-term Liabilities Other Assets Other Liabilities Prepare the journal entries necessary to record the assignment, the collections on assigned accounts, and returns on assigned accounts. General Journal Instructions PAGE 9 GENERAL JOURNAL DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT Show how the information would be reported on Furman's year-end balance sheet (assume the note payable is short-term). Balance Sheet Instructions Furman Corporation Partial Balance Sheet December 31, 2019 (Label) Accounts Receivable Assigned (Label) Notes Payable Furman Corporation entered into an assignment agreement with a finance company whereby Furman would be advanced 80% of all accounts assigned, minus a $2,000 service charge. The assignment does not meet the conditions for a sale and should be accounted for as a secured borrowing. During the year, $300,000 of accounts receivable were assigned, $220,000 collections were made on outstanding assigned accounts, and $210,000 was remitted to the finance company. This remittance included interest charges of $2,100. Sales returns and allowances on assigned accounts amounted to $5,000. Required: 1. Prepare the journal entries necessary to record the preceding information. 2. Show how the preceding information would be reported on Furman's year-end balance sheet (assume the note payable is short-term). Furman Corporation General Ledger ASSETS REVENUE 111 Cash 411 Sales Revenue 121 Accounts Receivable 124 Accounts Receivable Assigned EXPENSES 141 Inventory 500 Cost of Goods Sold 511 Insurance Expense 152 Prepaid Insurance 512 Utilities Expense 181 Equipment 198 Accumulated Depreciation 521 Salaries Expense 532 Bad Debt Expense LIABILITIES 534 Assignment Service Charge Expense 211 Accounts Payable 540 Interest Expense 221 Notes Payable 541 Depreciation Expense 559 Miscellaneous Expenses 226 Return Liability 231 Salaries Payable 910 Income Tax Expense 250 Unearned Revenue 261 Income Taxes Payable EQUITY 311 Common Stock 331 Retained Earnings Labels Current Assets Current Liabilities Long-term Assets Long-term Liabilities Other Assets Other Liabilities Prepare the journal entries necessary to record the assignment, the collections on assigned accounts, and returns on assigned accounts. General Journal Instructions PAGE 9 GENERAL JOURNAL DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT Show how the information would be reported on Furman's year-end balance sheet (assume the note payable is short-term). Balance Sheet Instructions Furman Corporation Partial Balance Sheet December 31, 2019 (Label) Accounts Receivable Assigned (Label) Notes Payable