Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Furniture Limited (FL) has land and a building with a 20-year estimated useful life from the date of acquisition. The company uses the straight-line

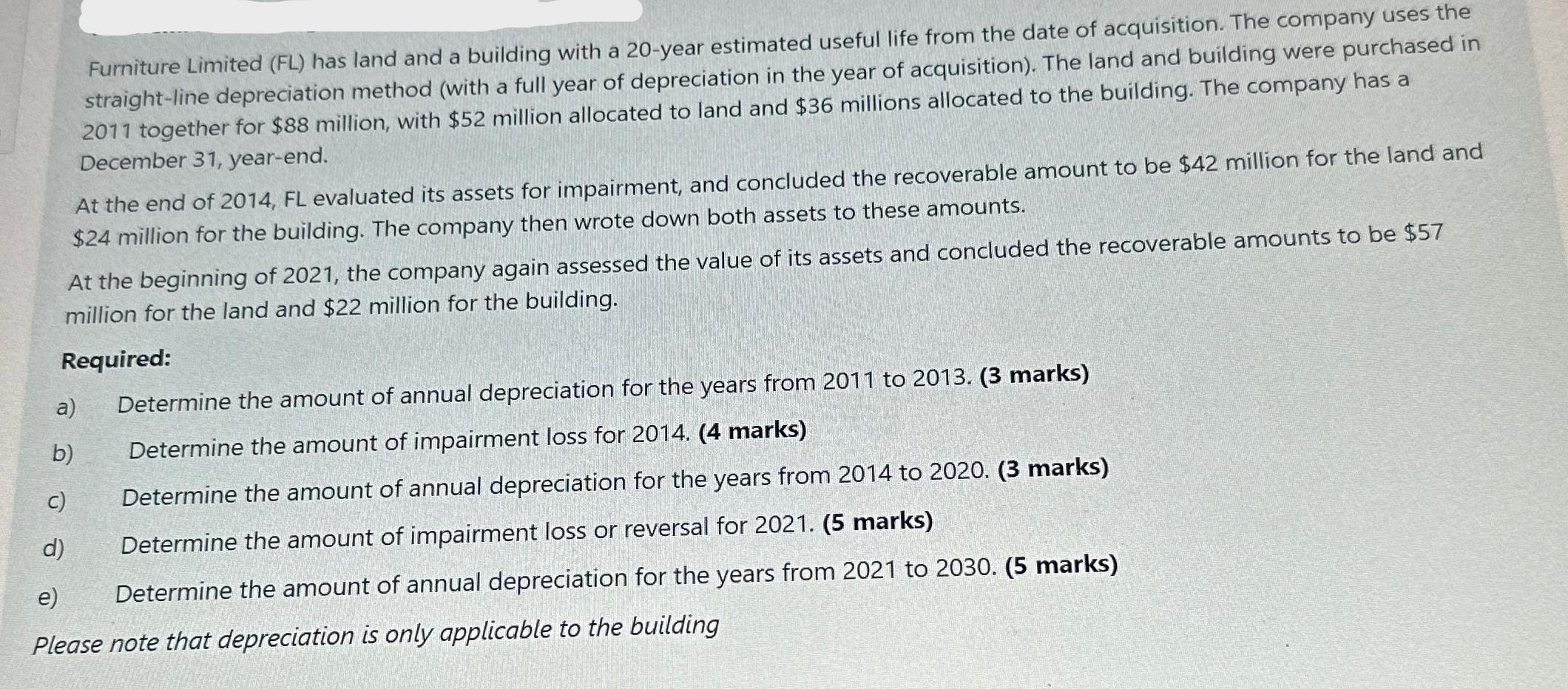

Furniture Limited (FL) has land and a building with a 20-year estimated useful life from the date of acquisition. The company uses the straight-line depreciation method (with a full year of depreciation in the year of acquisition). The land and building were purchased in 2011 together for $88 million, with $52 million allocated to land and $36 millions allocated to the building. The company has a December 31, year-end. At the end of 2014, FL evaluated its assets for impairment, and concluded the recoverable amount to be $42 million for the land and $24 million for the building. The company then wrote down both assets to these amounts. At the beginning of 2021, the company again assessed the value of its assets and concluded the recoverable amounts to be $57 million for the land and $22 million for the building. Required: a) Determine the amount of annual depreciation for the years from 2011 to 2013. (3 marks) b) Determine the amount of impairment loss for 2014. (4 marks) c) Determine the amount of annual depreciation for the years from 2014 to 2020. (3 marks) d) e) Please note that depreciation is only applicable to the building Determine the amount of impairment loss or reversal for 2021. (5 marks) Determine the amount of annual depreciation for the years from 2021 to 2030. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started