Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Future value of a portfolio. Rachel and Richard want to know when their current portfolio will be sufficient for them to retire. They have the

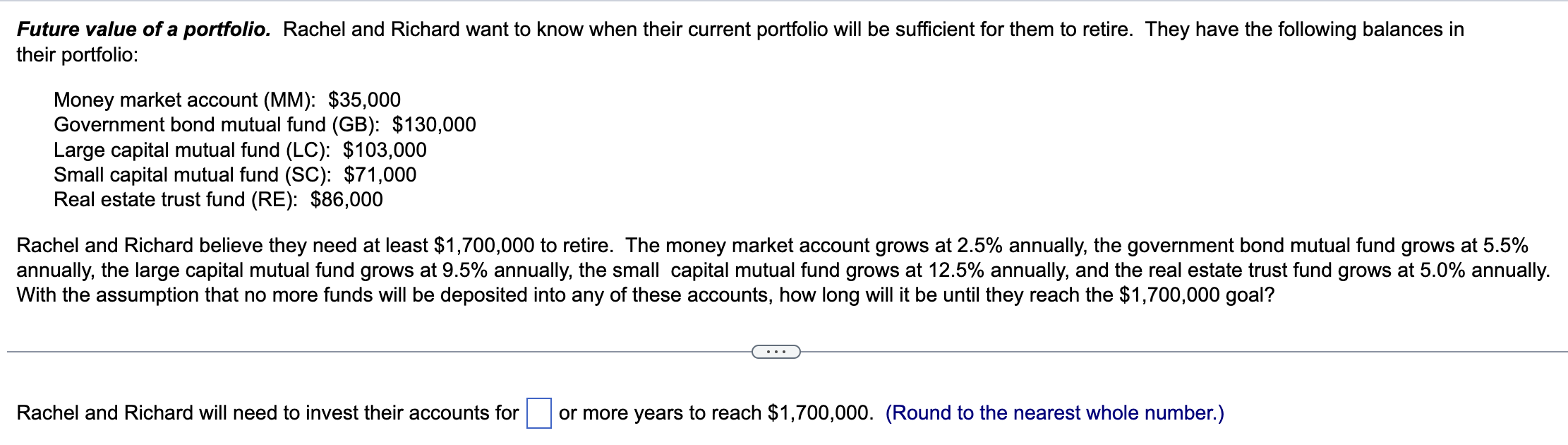

Future value of a portfolio. Rachel and Richard want to know when their current portfolio will be sufficient for them to retire. They have the following balances in

their portfolio:

Money market account MM: $

Government bond mutual fund GB: $

Large capital mutual fund LC: $

Small capital mutual fund SC: $

Real estate trust fund RE: $

Rachel and Richard believe they need at least $ to retire. The money market account grows at annually, the government bond mutual fund grows at

annually, the large capital mutual fund grows at annually, the small capital mutual fund grows at annually, and the real estate trust fund grows at annually.

With the assumption that no more funds will be deposited into any of these accounts, how long will it be until they reach the $ goal?

Rachel and Richard will need to invest their accounts for

or more years to reach $Round to the nearest whole number.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started