Answered step by step

Verified Expert Solution

Question

1 Approved Answer

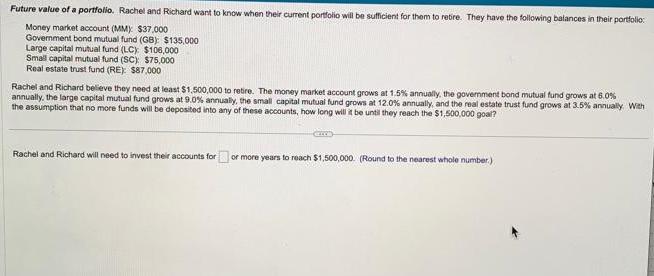

Future value of a portfolio. Rachel and Richard want to know when their current portfolio will be sufficient for them to retire. They have

Future value of a portfolio. Rachel and Richard want to know when their current portfolio will be sufficient for them to retire. They have the following balances in their portfolio: Money market account (MM): $37.000 Government bond mutual fund (GB): $135,000 Large capital mutual fund (LC): $106,000 Small capital mutual fund (SC): $75,000 Real estate trust fund (RE): $87,000 Rachel and Richard believe they need at least $1,500,000 to retire. The money market account grows at 1.5% annually, the government bond mutual fund grows at 6.0% annually, the large capital mutual fund grows at 9.0% annually, the small capital mutual fund grows at 12.0% annually, and the real estate trust fund grows at 3.5% annually. With the assumption that no more funds will be deposited into any of these accounts, how long will it be until they reach the $1,500,000 goal? Rachel and Richard will need to invest their accounts for of or more years to reach $1,500,000. (Round to the nearest whole number.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the time it will take for Rachel and Richards portfolio to reach 1500000 we can use the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started