Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Future value of an annuity) In 14 years you are planning on retiring and buying a house in Oviedo, Florida. The house you are looking

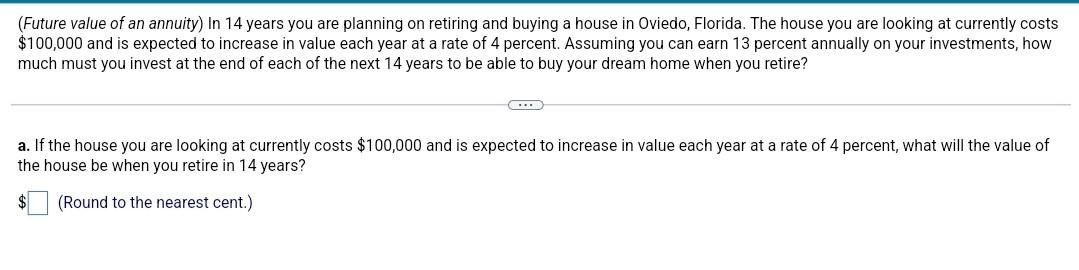

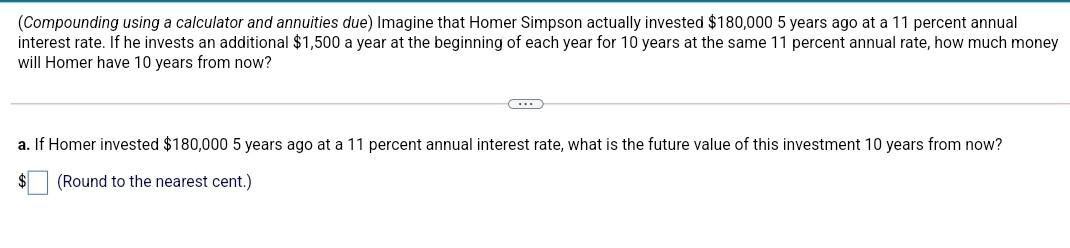

(Future value of an annuity) In 14 years you are planning on retiring and buying a house in Oviedo, Florida. The house you are looking at currently costs $100,000 and is expected to increase in value each year at a rate of 4 percent. Assuming you can earn 13 percent annually on your investments, how much must you invest at the end of each of the next 14 years to be able to buy your dream home when you retire? .. a. If the house you are looking at currently costs $100,000 and is expected to increase in value each year at a rate of 4 percent, what will the value of the house be when you retire in 14 years? $ (Round to the nearest cent.) (Compounding using a calculator and annuities due) Imagine that Homer Simpson actually invested $180,000 5 years ago at a 11 percent annual interest rate. If he invests an additional $1,500 a year at the beginning of each year for 10 years at the same 11 percent annual rate, how much money will Homer have 10 years from now? C. a. If Homer invested $180,000 5 years ago at a 11 percent annual interest rate, what is the future value of this investment 10 years from now? (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started