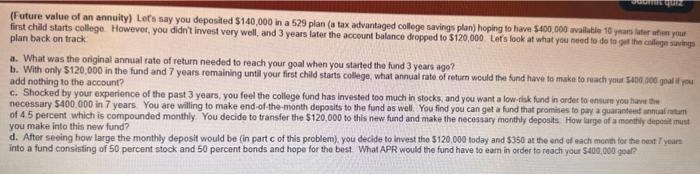

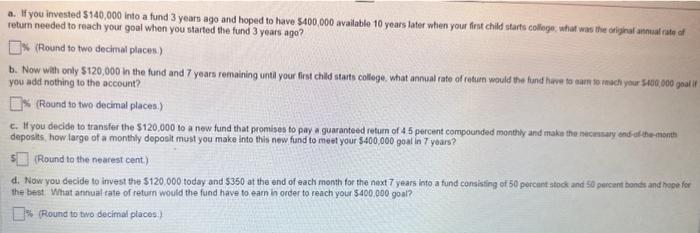

(Future value of an annuity) Lers say you deposited $140,000 in a 529 plan (a tax advantaged college savings plan) hoping to have $400.000 avallatie 10 ysars later afien your first chd starts college. Howevor, you didn' invest very well, and 3 years tater the account balance dropped to $120,000 Ler's look at what you neod to do to par ine callegn yuat plan back on track a. What was the original annual rate of return needed to reach your goal when you started the fund 3 years ago? add nothing to the account? c. Shocked by your experience of the past 3 years, you feel the college fund has invested too much in slocks, and you want a low-risk fund in order to ensure you haru the necessary 5400.000 in 7 years. You are willing to make end-of-the-month deposits to the fund as well. You find you can get a fund that promices to pay a guaranteet anntial iatum of 4.5 percent which is compounded monthly. You decide to transfer the $120,000 to this new fund and make the necessary menthly deposits How large af a menithly depoit must you make into this new fund? d. After seeing how large the monthly deposit would be (in part c of this problem), you decide lo invest the $120,000 today and $350 at the end ef each mone for the bext 7 year into a fund consisting of 50 percent stock and 50 percent bonds and hope for the best. What APR would the fund have to earm in order to reach your 5400 . 000 goal? a. If you invested $140,000 into a fund 3 years ago and hoped to have $400,000 available 10 years later when your first child starts colloge, atiat was ine crighal annual rate of return needed to reach your goal whon you started the fund 3 years ago? 15 (Round to two decimal placess) you add nothing to the account? (Round to two decimal places.) c. If you decide to transfer the $120,000 to a new fund that promises to pay a guaranteed return of 4.5 percent compounded monthly and make the mecrasary end af ihe-montb deposits, how large of a monthly deposit must you make into this new fund to meet your $400,000 goal in 7 years? (Round to the nearest cent.) d. Now you decide to invest the $120,000 today and $350 at the end of each month for the next 7 years into a fund consisting of 50 percant atock and 50 percent banis and hepe for the best. What annual rate of retum would the fund have to earn in order to reach your 5400,000 goal? (1) (Round to two decimal places:)