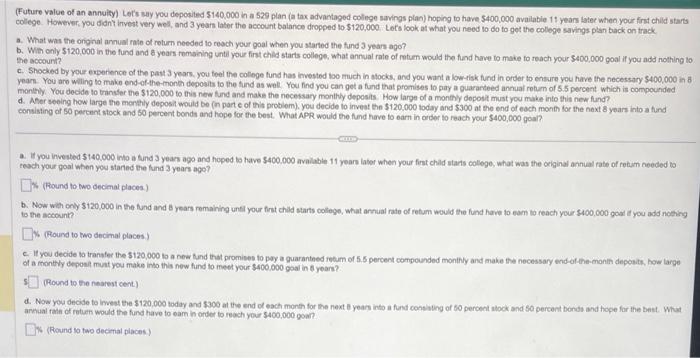

(Future value of an annuity) Lets say you deposiled 5140,000 in a 529 plan (a tax advantaged colinge savings plan) hoping to have 5400,000 availabie 11 yeans later when your frat child starts coliege. However, you didnt invest very wes, and 3 yeais lator the account batance dropped lo $120,000. Lots look at what you need to do to get the college savings plan tack on track. a. What was the onginal annual rate of return needed to ceoch your goal when you started the fund 3 years ago? b. Wih only $120,000 in the fund and 8 years momahing untli your first chlld starts colloge. what annual rate of rotuen would the fund have to make to reach your $400,000 goal if you add nothing to the account? c. Shocked by your expetence of the past 3 years. you toel the colloge fund has hvestod boo much in atocks, and you want a low-lisk fund in order to ensure you have the necessary s400, 000 in 6 yean. You are willing to make end-ofthe-moneh deposits to the find as wal. You find you can get a fund that promises to pay a puaranteed anrual rotum of 5.5 percent which is compounded manitiy. You decide to transler the $120,000 to this new fund and make the necessary monthly deposits. How large of a monthy dopost must you make into this new fund? d. Aser seeing how large the menthiy deposit would be (n part ef thit problem), you decide to inveat the $120.000 loday and $300 at the end of each month lor the next 8 years into a fund consisting of $0 percent stock and $0 percent bonds and hope for the best. What APR. would the fund have to oart in orsor to reach your $400,000 goal? a. If you inveated $140.000 into a tind 3 yeass ago and hoped to have $400.000 available 11 yean lator when your fint chald starts coliege, what was the ceiginal annual rate of retim needed to enach your poal when you started the fund 3 years age? (Fhound to two decimal places.) b. Now with ony $120,000 in the fund and B years remaining unel your fint chld starts colege, what annual rate of retum would the fund have to eam to reach your stoo, 000 goal it you add noehing to the acoount? 6 (Round to two decimal places.) It you decide to tranafer the 5120,000 to a new tund that promies to poy a guaranthed retum of 5.5 percent congounded monithly and make the necessary end-of-the-monit deponits, how large. of a monthly deposit munt you make into this new fund to meet your $400.000 goal in 8 years? (Round to the nearest cent) d. Now you decide to imeet the $120,000 today and 5300 at the end of each month for the next o yeans into a fund consiting of to percent alock and 50 percent bonde and hope far the bent. What anchal fain of rotuen would the fund have to earn in order to reach your 5400,000 goar? (Round to two decmal places)