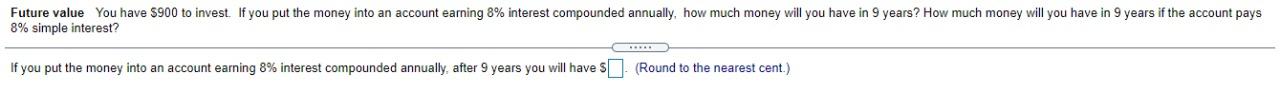

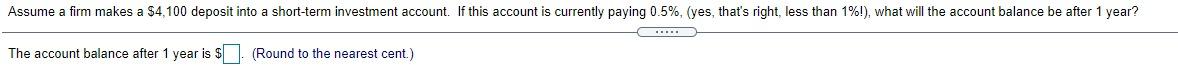

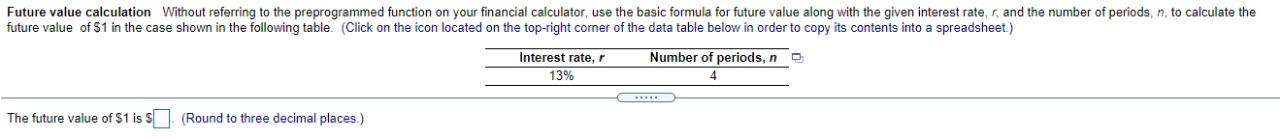

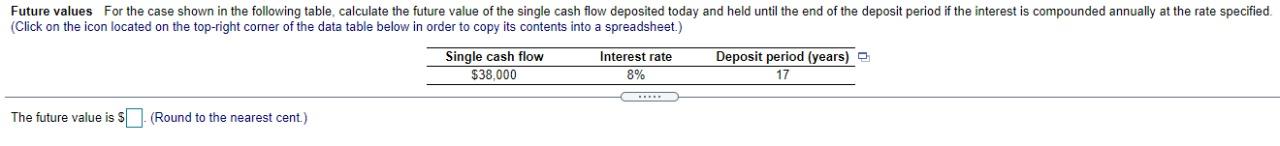

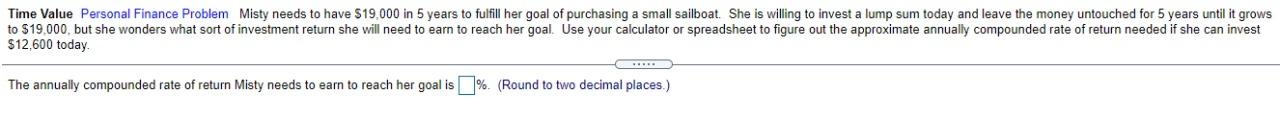

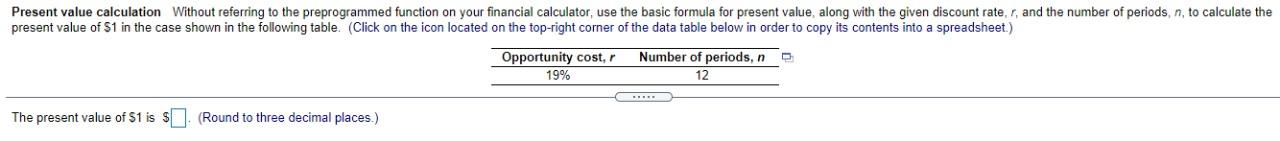

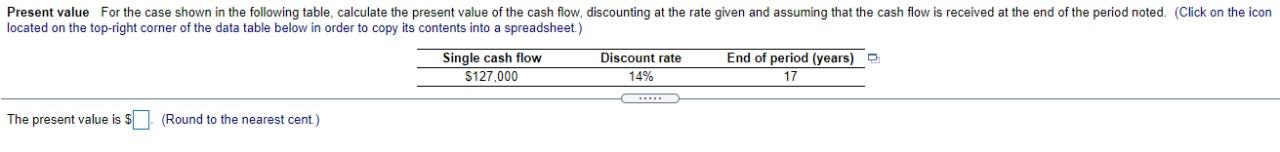

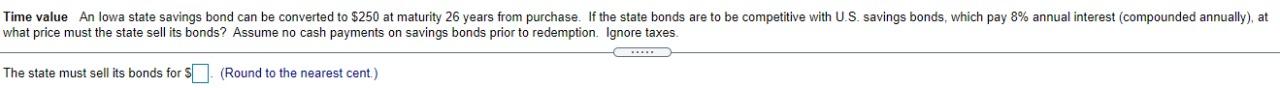

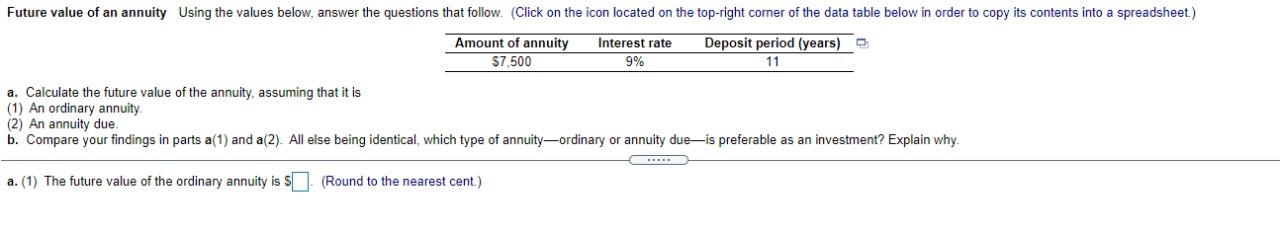

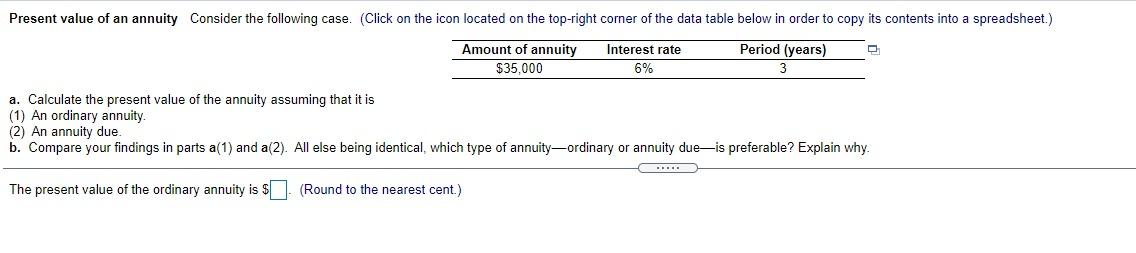

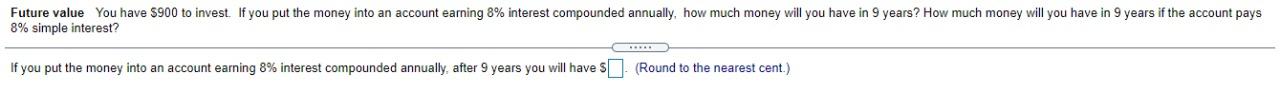

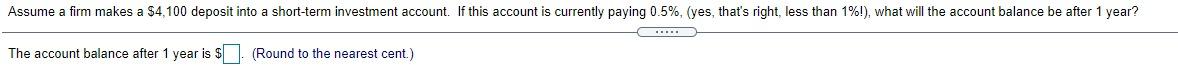

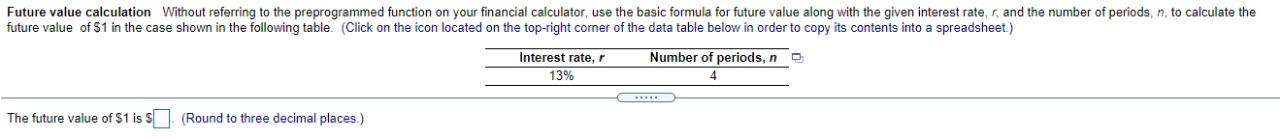

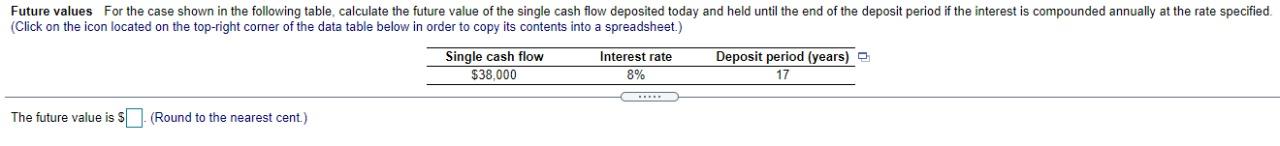

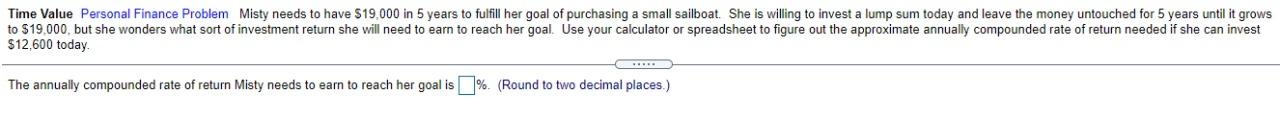

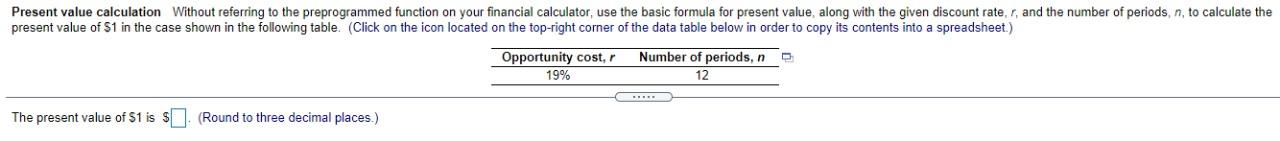

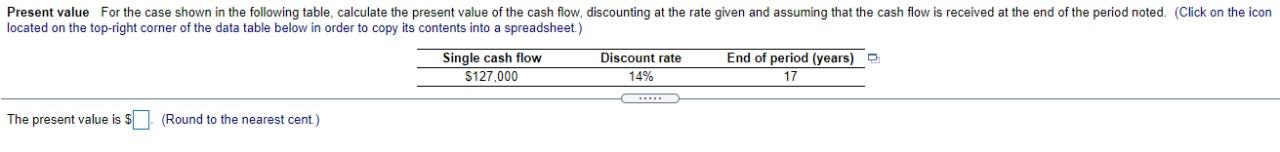

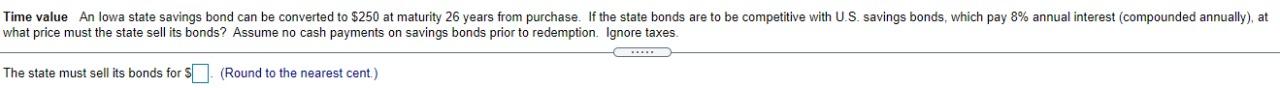

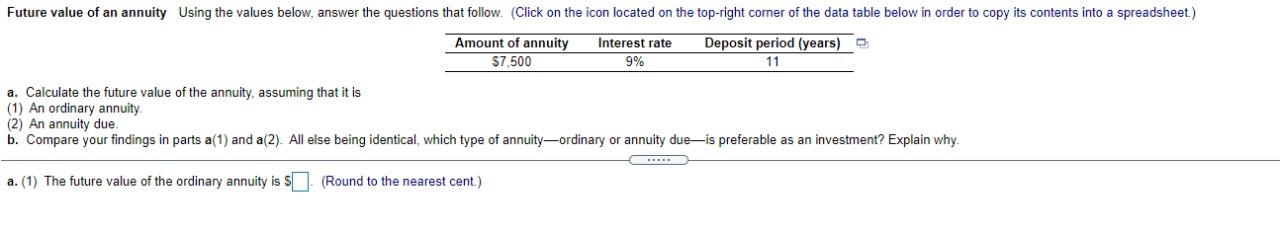

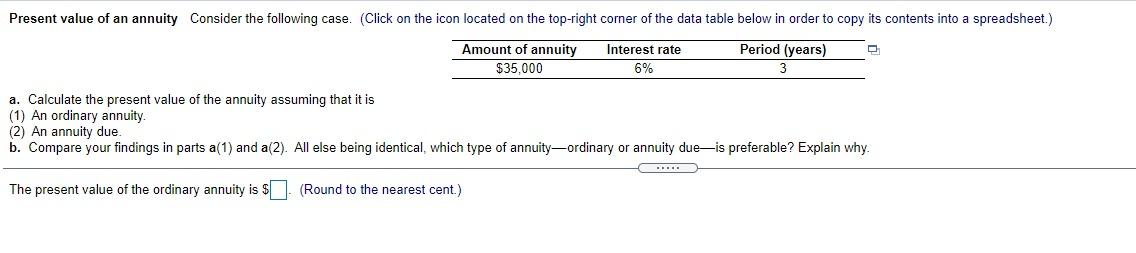

Future value You have $900 to invest. If you put the money into an account earning 8% interest compounded annually, how much money will you have in 9 years? How much money will you have in 9 years if the account pays 8% simple interest? If you put the money into an account earning 8% interest compounded annually, after 9 years you will have $(Round to the nearest cent.) Assume a firm makes a $4,100 deposit into a short-term investment account. If this account is currently paying 0.5%, (yes, that's right, less than 1%!), what will the account balance be after 1 year? .... The account balance after 1 year is $. (Round to the nearest cent.) Future value calculation Without referring to the preprogrammed function on your financial calculator, use the basic formula for future value along with the given interest rate, r, and the number of periods, n, to calculate the future value of $1 in the case shown in the following table. (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet.) Number of periods, n Interest rate, r 13% The future value of $1 is $(Round to three decimal places) Future values For the case shown in the following table, calculate the future value of the single cash flow deposited today and held until the end of the deposit period if the interest is compounded annually at the rate specified (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Single cash flow Interest rate Deposit period (years) $38,000 8% 17 The future value is 5 (Round to the nearest cent) Time Value Personal Finance Problem Misty needs to have $19,000 in 5 years to fulfill her goal of purchasing a small sailboat. She is willing to invest a lump sum today and leave the money untouched for 5 years until it grows to $19.000, but she wonders what sort of investment return she will need to earn to reach her goal. Use your calculator or spreadsheet to figure out the approximate annually compounded rate of return needed if she can invest $12,600 today. The annually compounded rate of return Misty needs to earn to reach her goal is %. (Round to two decimal places.) Present value calculation Without referring to the preprogrammed function on your financial calculator, use the basic formula for present value, along with the given discount rate, r, and the number of periods, n, to calculate the present value of S1 in the case shown in the following table. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Opportunity cost, Number of periods, n 19% 12 The present value of $1 is $. (Round to three decimal places.) Present value for the case shown in the following table, calculate the present value of the cash flow, discounting at the rate given and assuming that the cash flow is received at the end of the period noted. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Single cash flow S127,000 Discount rate 14% End of period (years) 17 The present value is $ (Round to the nearest cent.) Time value An lowa state savings bond can be converted to $250 at maturity 26 years from purchase. If the state bonds are to be competitive with U.S. savings bonds, which pay 8% annual interest (compounded annually), at what price must the state sell its bonds? Assume no cash payments on savings bonds prior to redemption. Ignore taxes. The state must sell its bonds for $(Round to the nearest cent.) Future value of an annuity Using the values below, answer the questions that follow. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Amount of annuity $7,500 Interest rate 9% Deposit period (years) 11 a. Calculate the future value of the annuity, assuming that it is (1) An ordinary annuity. (2) An annuity due b. Compare your findings in parts a(1) and (2). All else being identical, which type of annuity-ordinary or annuity dueis preferable as an investment? Explain why. a. (1) The future value of the ordinary annuity is 5 (Round to the nearest cent.) Present value of an annuity Consider the following case. (Click on the icon located on the top-right corner of the data table below in order to copy contents into a spreadsheet.) Period (years) Amount of annuity $35,000 Interest rate 6% a. Calculate the present value of the annuity assuming that it is (1) An ordinary annuity. (2) An annuity due b. Compare your findings in parts a (1) and a(2). All else being identical, which type of annuityordinary or annuity dueis preferable? Explain why. D. The present value of the ordinary annuity is $. (Round to the nearest cent.)