Question

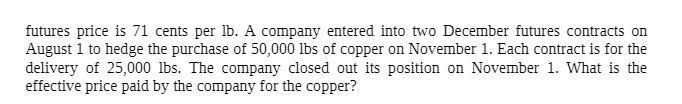

futures price is 71 cents per lb. A company entered into two December futures contracts on August 1 to hedge the purchase of 50,000

futures price is 71 cents per lb. A company entered into two December futures contracts on August 1 to hedge the purchase of 50,000 lbs of copper on November 1. Each contract is for the delivery of 25,000 lbs. The company closed out its position on November 1. What is the effective price paid by the company for the copper?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The company effectively used a futures contract to lock in a price for the copper Lets brea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting and Analysis

Authors: Flawrence Revsine, Daniel Collins, Bruce, Mittelstaedt, Leon

6th edition

9780077632182, 78025672, 77632184, 978-0078025679

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App