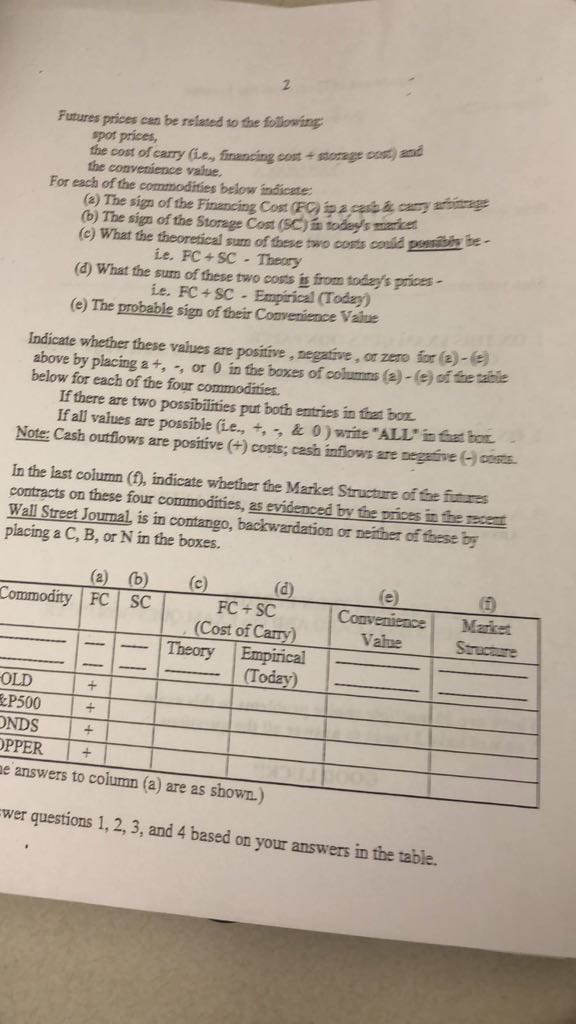

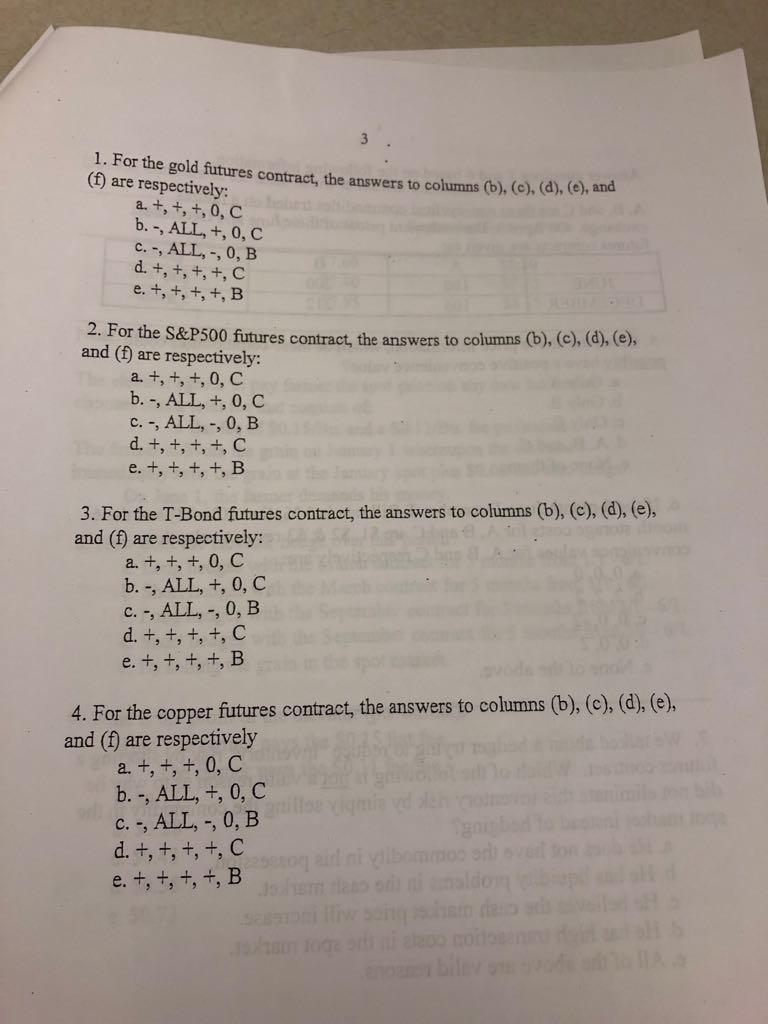

Futures prices can be related to the following spor prices, the cost of carry (ie, financing cost + storage 00500 the convenience value, For each of the commodities below indicate (2) The sign of the Financing Cost (F) in a cab o (b) The sign of the Storage Cost (SC) in today's most () What the theoretical sum of these two costs could porn ie. FC - SC - Theory (d) What the sum of these two costs is from toez's prices ie. FC - SC - Empirical (Today) (e) The probable sign of their Convenience Value Indicate whether these values are positive negative, or zero for 2- above by placing a +, -, or 0 in the boxes of columns (2) - 20 below for each of the four commodities. If there are two possibilities put both entries in that box If all values are possible (ie., +, - & 0 ) write "ALL' infaat bon Note: Cash outflows are positive (+) costs; cash inflows are negative OOSE In the last column (f), indicate whether the Market Structure of fire finnes contracts on these four commodities, as evidenced by the prices in the recent Wall Street Journal is in contango, backwardation or neither of these bo placing a C, B, or N in the boxes. (a) Commodity FC (b) SC (c) FC - SC (Cost of Carry) Theory Empirical (Today) Convenience Value Market STE OLD 11++ P500 ONDS OPPER + me answers to column (aare as shown. wer questions 1, 2, 3, and 4 based on your answers in the table. 1. For the gold futures contract, the answers to columns) old Tutures contract, the answers to columns (b), (c), (d), (), and (f) are respectively: a. +, +, +,0, C b.- ALL, +, 0, C C. -, ALL, -,0,B d. +, +, +, +, C e. +, +, +, +, B 2. For the S&P500 futures contract, the answers to columns (b), c), (), and (f) are respectively: a. +, +, +, 0, C b. , ALL, +, 0, C C., ALL, -, 0, B d. +, +, +, +, C e. +, +, +, +, B 3. For the T-Bond futures contract, the answers to columns (b), (c), (d), (e), and (f) are respectively: a. +, +, +, 0, C b. , ALL, +, 0, C c. -, ALL, -, 0,B d. +, +, +, +, C e. +, +, +, +, B 4. For the copper futures contract, the answers to columns (b), (c), (d), (e), and (f) are respectively a. +, +, +, 0, C b. -, ALL, +, 0, C C. -, ALL, -, 0, B d. +, +, +, +, C e. +, +, +, +, B s e oli loo mo Futures prices can be related to the following spor prices, the cost of carry (ie, financing cost + storage 00500 the convenience value, For each of the commodities below indicate (2) The sign of the Financing Cost (F) in a cab o (b) The sign of the Storage Cost (SC) in today's most () What the theoretical sum of these two costs could porn ie. FC - SC - Theory (d) What the sum of these two costs is from toez's prices ie. FC - SC - Empirical (Today) (e) The probable sign of their Convenience Value Indicate whether these values are positive negative, or zero for 2- above by placing a +, -, or 0 in the boxes of columns (2) - 20 below for each of the four commodities. If there are two possibilities put both entries in that box If all values are possible (ie., +, - & 0 ) write "ALL' infaat bon Note: Cash outflows are positive (+) costs; cash inflows are negative OOSE In the last column (f), indicate whether the Market Structure of fire finnes contracts on these four commodities, as evidenced by the prices in the recent Wall Street Journal is in contango, backwardation or neither of these bo placing a C, B, or N in the boxes. (a) Commodity FC (b) SC (c) FC - SC (Cost of Carry) Theory Empirical (Today) Convenience Value Market STE OLD 11++ P500 ONDS OPPER + me answers to column (aare as shown. wer questions 1, 2, 3, and 4 based on your answers in the table. 1. For the gold futures contract, the answers to columns) old Tutures contract, the answers to columns (b), (c), (d), (), and (f) are respectively: a. +, +, +,0, C b.- ALL, +, 0, C C. -, ALL, -,0,B d. +, +, +, +, C e. +, +, +, +, B 2. For the S&P500 futures contract, the answers to columns (b), c), (), and (f) are respectively: a. +, +, +, 0, C b. , ALL, +, 0, C C., ALL, -, 0, B d. +, +, +, +, C e. +, +, +, +, B 3. For the T-Bond futures contract, the answers to columns (b), (c), (d), (e), and (f) are respectively: a. +, +, +, 0, C b. , ALL, +, 0, C c. -, ALL, -, 0,B d. +, +, +, +, C e. +, +, +, +, B 4. For the copper futures contract, the answers to columns (b), (c), (d), (e), and (f) are respectively a. +, +, +, 0, C b. -, ALL, +, 0, C C. -, ALL, -, 0, B d. +, +, +, +, C e. +, +, +, +, B s e oli loo mo