Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Futures Suppose you are an oil firm, and you know you will sell 30,000 barrels of oil next June. You do not want to

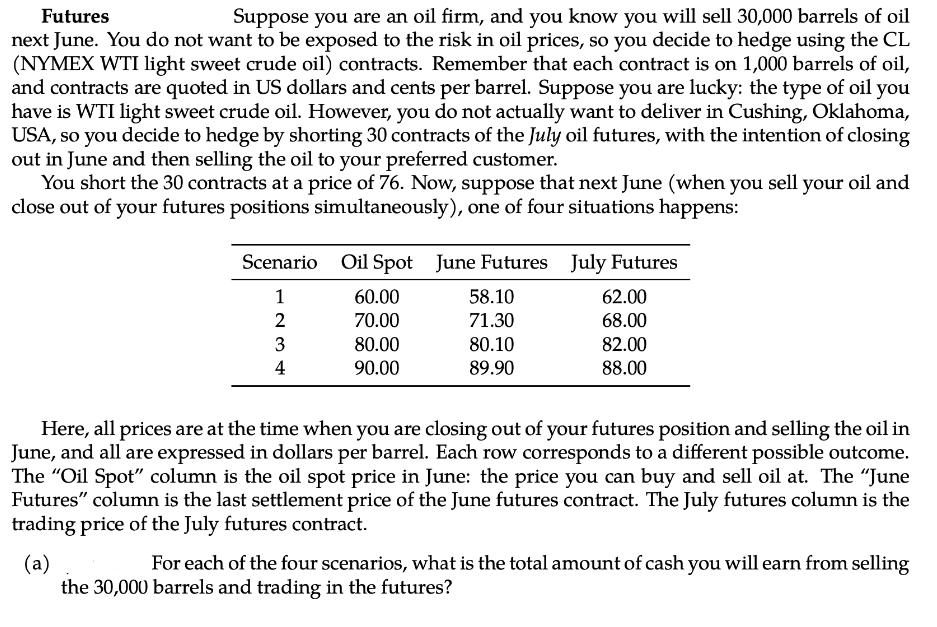

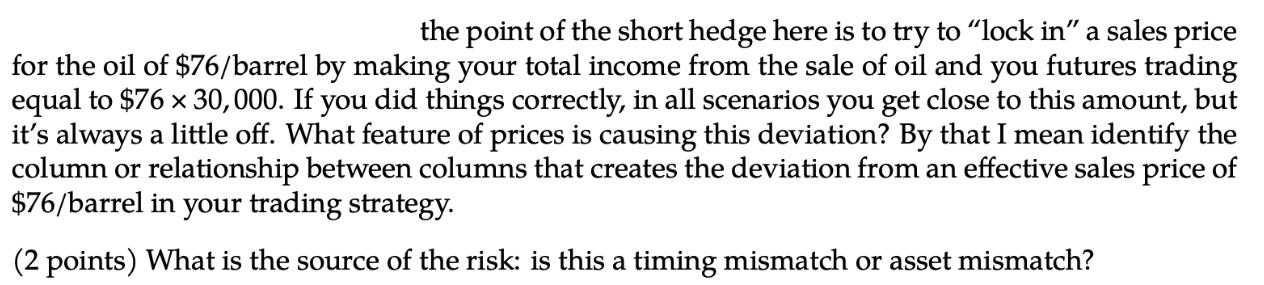

Futures Suppose you are an oil firm, and you know you will sell 30,000 barrels of oil next June. You do not want to be exposed to the risk in oil prices, so you decide to hedge using the CL (NYMEX WTI light sweet crude oil) contracts. Remember that each contract is on 1,000 barrels of oil, and contracts are quoted in US dollars and cents per barrel. Suppose you are lucky: the type of oil you have is WTI light sweet crude oil. However, you do not actually want to deliver in Cushing, Oklahoma, USA, so you decide to hedge by shorting 30 contracts of the July oil futures, with the intention of closing out in June and then selling the oil to your preferred customer. You short the 30 contracts at a price of 76. Now, suppose that next June (when you sell your oil and close out of your futures positions simultaneously), one of four situations happens: Scenario Oil Spot June Futures July Futures 1 60.00 58.10 62.00 2 70.00 71.30 68.00 3 80.00 80.10 82.00 4 90.00 89.90 88.00 Here, all prices are at the time when you are closing out of your futures position and selling the oil in June, and all are expressed in dollars per barrel. Each row corresponds to a different possible outcome. The "Oil Spot" column is the oil spot price in June: the price you can buy and sell oil at. The "June Futures" column is the last settlement price of the June futures contract. The July futures column is the trading price of the July futures contract. (a) For each of the four scenarios, what is the total amount of cash you will earn from selling the 30,000 barrels and trading in the futures? the point of the short hedge here is to try to "lock in" a sales price for the oil of $76/barrel by making your total income from the sale of oil and you futures trading equal to $76 30,000. If you did things correctly, in all scenarios you get close to this amount, but it's always a little off. What feature of prices is causing this deviation? By that I mean identify the column or relationship between columns that creates the deviation from an effective sales price of $76/barrel in your trading strategy. (2 points) What is the source of the risk: is this a timing mismatch or asset mismatch?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started