Answered step by step

Verified Expert Solution

Question

1 Approved Answer

let's suppose you know you will sell 30,000 barrels of oil next June. You again want to hedge any price risk using the CL

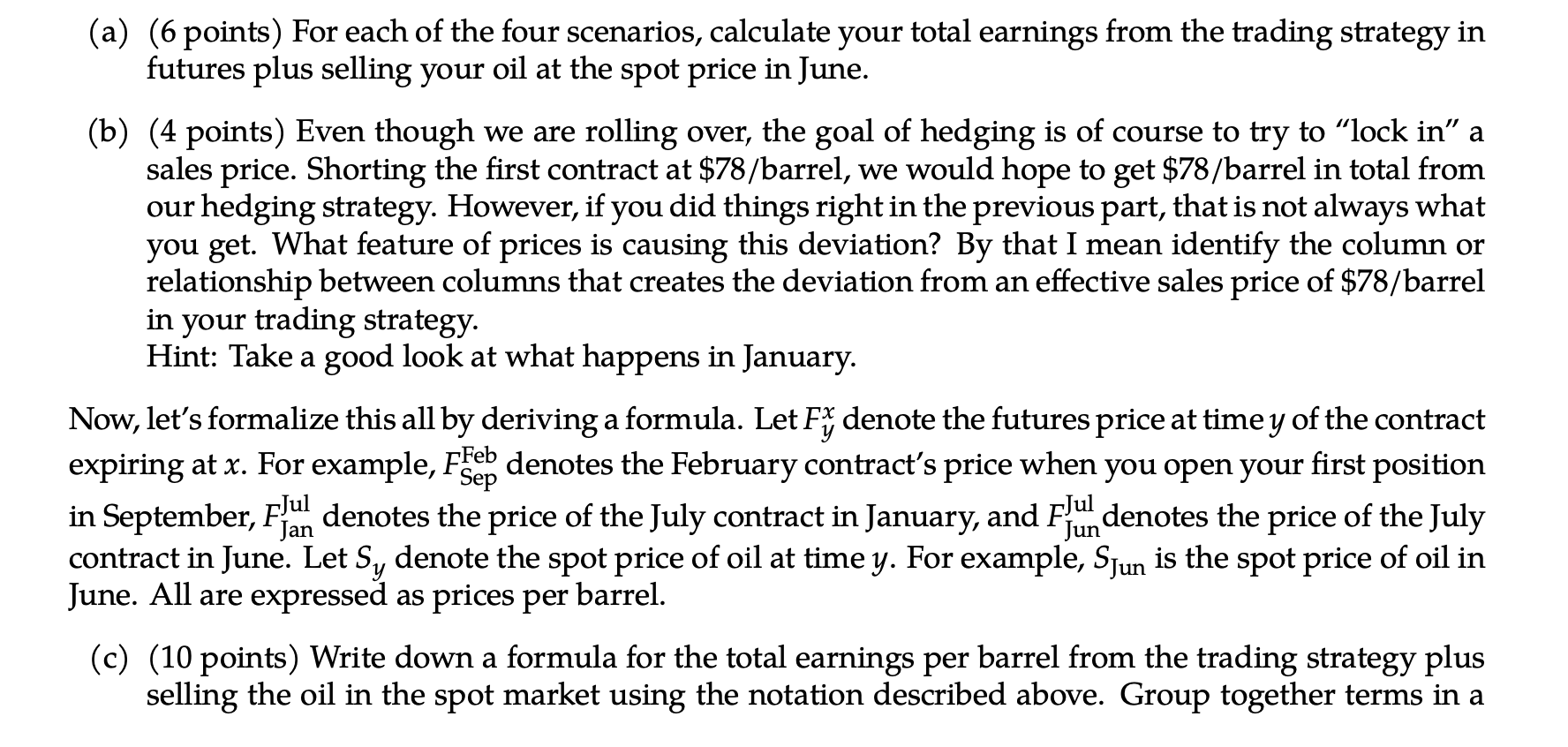

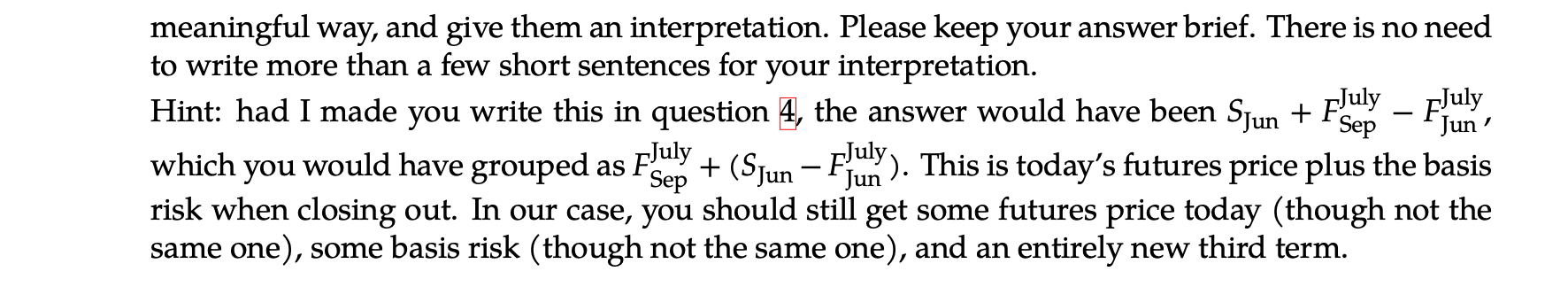

let's suppose you know you will sell 30,000 barrels of oil next June. You again want to hedge any price risk using the CL (NYMEX WTI light sweet crude) contracts. However, unlike the previous problem, suppose you are unable to invest in July futures contracts, and are instead only able to hedge using shorter-dated contracts. You therefore decide to use the following hedging strategy: Today, you short 30 contracts of February futures, at a price of $78/barrel. In January, you close out your position in 30 contracts of February futures, and open a short posi- tion of 30 contracts in July futures. In June, you close out your July futures position, and sell 30,000 barrels of oil in the spot market for oil. Closing out your current futures position and opening the same position in longer-dated futures is known as rolling over. Let's first use some concrete numbers to analyze what happens before making you do it with formu- las. As before, suppose there are four possible scenarios. Scenario February Futures in January July Futures in January July Futures in June Spot Price in June 1 23 2 4 60.00 70.00 80.00 90.00 70.00 70.00 80.00 80.00 62.00 68.00 82.00 88.00 62.00 68.00 82.00 88.00 Note that different columns are at different times. All prices are expressed as dollars per barrel. The "February Futures in January" column is the price of the February contract in January (when you close out). The "July Futures in January" column is the price of the July contract in January (when you open that position). The "July Futures in June" column is the price of the July contract in June (when you close out that position). The "Spot Price in June" is the spot price for the oil you sell in June. (a) (6 points) For each of the four scenarios, calculate your total earnings from the trading strategy in futures plus selling your oil at the spot price in June. (b) (4 points) Even though we are rolling over, the goal of hedging is of course to try to "lock in" a sales price. Shorting the first contract at $78/barrel, we would hope to get $78/barrel in total from our hedging strategy. However, if you did things right in the previous part, that is not always what you get. What feature of prices is causing this deviation? By that I mean identify the column or relationship between columns that creates the deviation from an effective sales price of $78/barrel in your trading strategy. Hint: Take a good look at what happens in January. Sep Now, let's formalize this all by deriving a formula. Let F denote the futures price at time y of the contract expiring at x. For example, Free denotes the February contract's price when you open your first position in September, Flul denotes the price of the July contract in January, and Flu denotes the price of the July contract in June. Let Sy denote the spot price of oil at time y. For example, SJun is the spot price of oil in June. All are expressed as prices per barrel. Jan Jun (c) (10 points) Write down a formula for the total earnings per barrel from the trading strategy plus selling the oil in the spot market using the notation described above. Group together terms in a meaningful way, and give them an interpretation. Please keep your answer brief. There is no need to write more than a few short sentences for your interpretation. Hint: had I made you write this in question 4, the answer would have been Sjun + FJuly - Fluly, Sep Sep Jun' which you would have grouped as F July + (SJun - July). This is today's futures price plus the basis risk when closing out. In our case, you should still get some futures price today (though not the same one), some basis risk (though not the same one), and an entirely new third term.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started