Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FX, Inc. is a volume manufacturer of high technology automotive mirrors (including cell link and voice activation). FX is looking to expand their operations

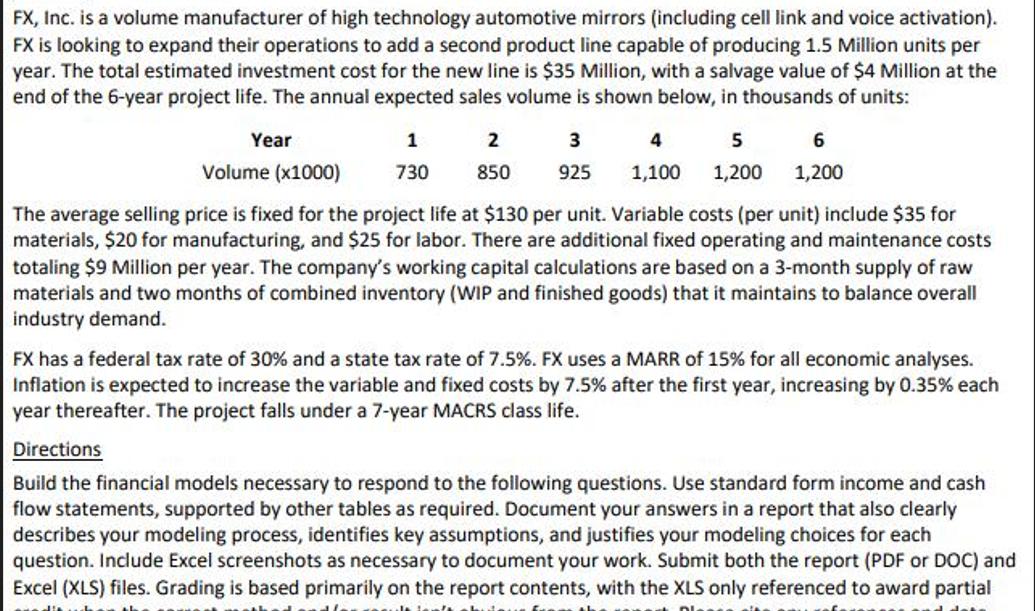

FX, Inc. is a volume manufacturer of high technology automotive mirrors (including cell link and voice activation). FX is looking to expand their operations to add a second product line capable of producing 1.5 Million units per year. The total estimated investment cost for the new line is $35 Million, with a salvage value of $4 Million at the end of the 6-year project life. The annual expected sales volume is shown below, in thousands of units: Year 1 730 2 850 3 925 4 5 1,100 1,200 6 1,200 Volume (x1000) The average selling price is fixed for the project life at $130 per unit. Variable costs (per unit) include $35 for materials, $20 for manufacturing, and $25 for labor. There are additional fixed operating and maintenance costs totaling $9 Million per year. The company's working capital calculations are based on a 3-month supply of raw materials and two months of combined inventory (WIP and finished goods) that it maintains to balance overall industry demand. FX has a federal tax rate of 30% and a state tax rate of 7.5%. FX uses a MARR of 15% for all economic analyses. Inflation is expected to increase the variable and fixed costs by 7.5% after the first year, increasing by 0.35% each year thereafter. The project falls under a 7-year MACRS class life. Directions Build the financial models necessary to respond to the following questions. Use standard form income and cash flow statements, supported by other tables as required. Document your answers in a report that also clearly describes your modeling process, identifies key assumptions, and justifies your modeling choices for each question. Include Excel screenshots as necessary to document your work. Submit both the report (PDF or DOC) and Excel (XLS) files. Grading is based primarily on the report contents, with the XLS only referenced to award partial credit when the correct method and/or result isn't obvious from the report. Please cite any references and data sources. Questions alternative. For this analysis, ignore inflation and currency fluctuations. A) Use the plant information above. Assume that a flexible line could be purchased for $70 Million (instead of the initial $35 Million investment) that would expand capacity to 3.5 Million units. The salvage value of this unit is $15 Million. The added volumes are normally distributed based on past automotive fluctuations (you define the specific distribution based on historical values). Assuming no financing is required, what is the new NPV distribution? Year Volume (x1000) Prob. of Project Management wants to explore another 1 0 0 2 4 5 3 500 1000 1,200 1,400 0.5 0.5 0.75 0.75 6 1,600 0.75 (Use can assume each year's probably is independent or dependent increase - your choice) B) Assume that FX, Inc. decided finance $50 Million of the $70 Million purchase price with $35 million in a new stock offering, $3 Million from the short-term loan at 12% and another $12 Million with a bond offering. The firm's current stock price is $27.50 per share. The investment bankers can offer the new offering at $23 per share. There is a 7% float cost for the stock issue. The bonds would be raised at $1,150 par value for 10 years with a market price of $1,120, and 12% annual interest payable at the end of each year. Using the weighted average cost of capital as the MARR, what is the NPV for the flexible project? Make and list any necessary assumptions (B value, etc.).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started