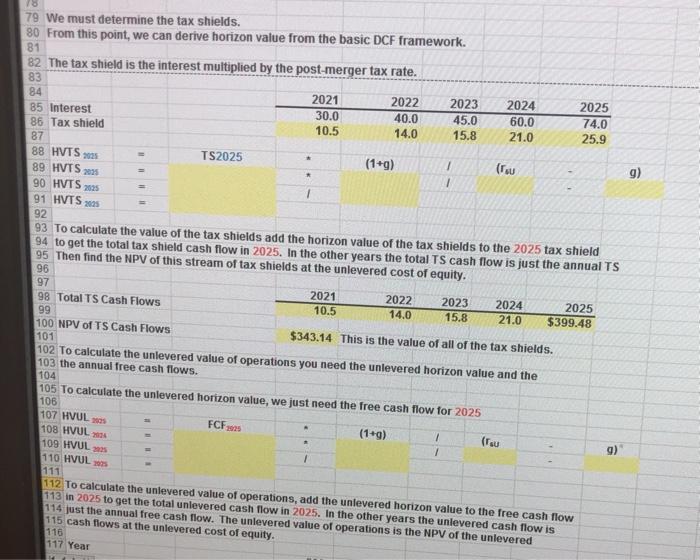

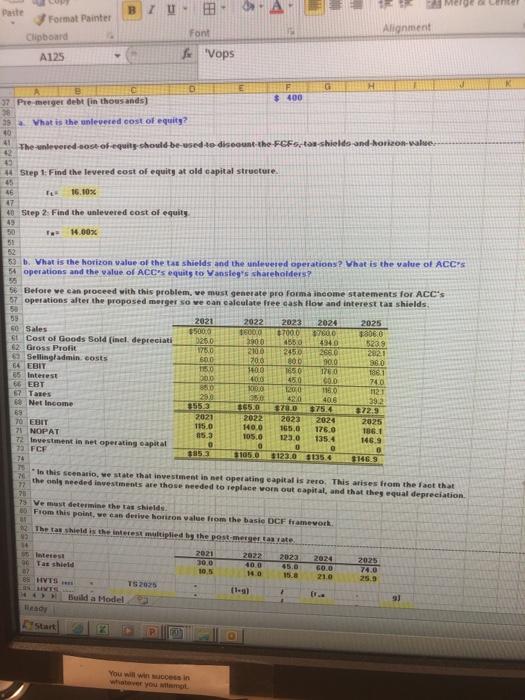

g) 18 79 We must determine the tax shields. 80 From this point, we can derive horizon value from the basic DCF framework. 81 82 The tax shield is the interest multiplied by the post-merger tax rate. 83 84 2021 2022 2023 2024 2025 85 Interest 30.0 40.0 45.0 60.0 74.0 86 Tax shield 10.5 14.0 15.8 21.0 25.9 87 88 HVTS 25 TS2025 (1+9) 1 (ru 89 HVTS 2035 1 90 HVTS 2025 1 91 HVTS 2 92 93 To calculate the value of the tax shields add the horizon value of the tax shields to the 2025 tax shield 94 to get the total tax shield cash flow in 2025. In the other years the total TS cash flow is just the annual TS 95 Then find the NPV of this stream of tax shields at the unlevered cost of equity. 96 97 2021 2022 2023 2024 98 Total TS Cash Flows 2025 10.5 14.0 15.8 21.0 $399.48 99 100 NPV of TS Cash Flows $343.14 This is the value of all of the tax shields. 101 102 To calculate the unlevered value of operations you need the unlevered horizon value and the 103 the annual free cash flows. 104 105 To calculate the unlevered horizon value, we just need the free cash flow for 2025 106 107 HVUL 108 HVUL 2 (1+9) 1 (rou 9) 109 HVUL 1 110 HVUL 111 112 To calculate the unlevered value of operations, add the unlevered horizon value to the free cash flow 113 in 2025 to get the total unlevered cash flow in 2025. In the other years the unlevered cash flow is 114 just the annual free cash flow. The unlevered value of operations is the NPV of the unlevered 115 cash flows at the unlevered cost of equity. 116 117 Year FCF B 7 Format Painter Clipboard Font Alignment A125 "Vops E H e C 37 Premerger debt fin thousands) $400 39 What is the unlevered cost of equity? 40 41 The-unlevered ost of equing should be used to discount the FCFortar-shields and horizon value 42 Step 1: Find the levered cost of equity at old capital structure. 45 46 16.10% 47 40 Step 2 Find the unlevered cost of equity 43 14.00% 51 52 52 b. Vhat is the horizon value of the ta shields and the unlevered operations? What is the value of ACC's 54 operations and the value of ACC's quits to Vansley's shareholders? 4949 360 TO 56 Before we can proceed with this problem, we must generate pro forma income statements for ACC's 57 operations after the proposed merger so we can calculate free cash flow and interest as shields 5 09 2021 2022 2023 2024 2025 50 Sales 85000 t6000 +700.0 $760.0 $8060 et Cost of Goods Sold (incl. depreciati 0250 2900 2880 5239 62 Gross Profit 1750 2100 2450 2680 2021 9 Sellingadmin costs 600 700 30.0 64 EBIT 1150 1400 1650 1760 1861 65 Interest 30.0 450 COLO 740 66 EBT 880 KO 1200 1121 87 Tanes 2020 350 4804006 392 66 Net Income 355.3 $65.0 700 $75.4 $72.9 69 2021 2022 2023 70 EBIT 2024 2025 115.0 140.0 71 NOPAT 165,0 176.0 85.3 186.1 105.0 123.0 T2 Investment in het operating capital 135.4 0 146.9 G 0 13 FCF 0853 $105.0 312300354 74 $1469 TE 20 * In this scenario, we state that investment is net operating eapital is rero. This arises from the fact that the only needed investments are those needed to replace or out capital, and that they equal depreciation 20 75. Ve must determine the ta shields SO From this point, we can desive horiron value from the basic DCF framework The tas shield is the necessiplied by the post-mergestas rate 14 2023 96 Tat shield 07 2021 300 10,5 2022 40.0 2024 60.0 21.0 2025 74.0 25.3 WTS 15.0 Build a Model 9) You will wicces in g) 18 79 We must determine the tax shields. 80 From this point, we can derive horizon value from the basic DCF framework. 81 82 The tax shield is the interest multiplied by the post-merger tax rate. 83 84 2021 2022 2023 2024 2025 85 Interest 30.0 40.0 45.0 60.0 74.0 86 Tax shield 10.5 14.0 15.8 21.0 25.9 87 88 HVTS 25 TS2025 (1+9) 1 (ru 89 HVTS 2035 1 90 HVTS 2025 1 91 HVTS 2 92 93 To calculate the value of the tax shields add the horizon value of the tax shields to the 2025 tax shield 94 to get the total tax shield cash flow in 2025. In the other years the total TS cash flow is just the annual TS 95 Then find the NPV of this stream of tax shields at the unlevered cost of equity. 96 97 2021 2022 2023 2024 98 Total TS Cash Flows 2025 10.5 14.0 15.8 21.0 $399.48 99 100 NPV of TS Cash Flows $343.14 This is the value of all of the tax shields. 101 102 To calculate the unlevered value of operations you need the unlevered horizon value and the 103 the annual free cash flows. 104 105 To calculate the unlevered horizon value, we just need the free cash flow for 2025 106 107 HVUL 108 HVUL 2 (1+9) 1 (rou 9) 109 HVUL 1 110 HVUL 111 112 To calculate the unlevered value of operations, add the unlevered horizon value to the free cash flow 113 in 2025 to get the total unlevered cash flow in 2025. In the other years the unlevered cash flow is 114 just the annual free cash flow. The unlevered value of operations is the NPV of the unlevered 115 cash flows at the unlevered cost of equity. 116 117 Year FCF B 7 Format Painter Clipboard Font Alignment A125 "Vops E H e C 37 Premerger debt fin thousands) $400 39 What is the unlevered cost of equity? 40 41 The-unlevered ost of equing should be used to discount the FCFortar-shields and horizon value 42 Step 1: Find the levered cost of equity at old capital structure. 45 46 16.10% 47 40 Step 2 Find the unlevered cost of equity 43 14.00% 51 52 52 b. Vhat is the horizon value of the ta shields and the unlevered operations? What is the value of ACC's 54 operations and the value of ACC's quits to Vansley's shareholders? 4949 360 TO 56 Before we can proceed with this problem, we must generate pro forma income statements for ACC's 57 operations after the proposed merger so we can calculate free cash flow and interest as shields 5 09 2021 2022 2023 2024 2025 50 Sales 85000 t6000 +700.0 $760.0 $8060 et Cost of Goods Sold (incl. depreciati 0250 2900 2880 5239 62 Gross Profit 1750 2100 2450 2680 2021 9 Sellingadmin costs 600 700 30.0 64 EBIT 1150 1400 1650 1760 1861 65 Interest 30.0 450 COLO 740 66 EBT 880 KO 1200 1121 87 Tanes 2020 350 4804006 392 66 Net Income 355.3 $65.0 700 $75.4 $72.9 69 2021 2022 2023 70 EBIT 2024 2025 115.0 140.0 71 NOPAT 165,0 176.0 85.3 186.1 105.0 123.0 T2 Investment in het operating capital 135.4 0 146.9 G 0 13 FCF 0853 $105.0 312300354 74 $1469 TE 20 * In this scenario, we state that investment is net operating eapital is rero. This arises from the fact that the only needed investments are those needed to replace or out capital, and that they equal depreciation 20 75. Ve must determine the ta shields SO From this point, we can desive horiron value from the basic DCF framework The tas shield is the necessiplied by the post-mergestas rate 14 2023 96 Tat shield 07 2021 300 10,5 2022 40.0 2024 60.0 21.0 2025 74.0 25.3 WTS 15.0 Build a Model 9) You will wicces in