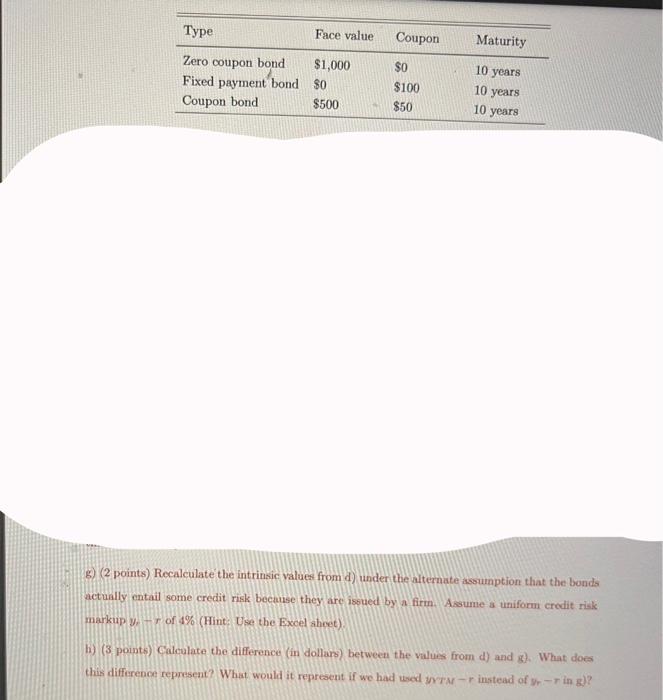

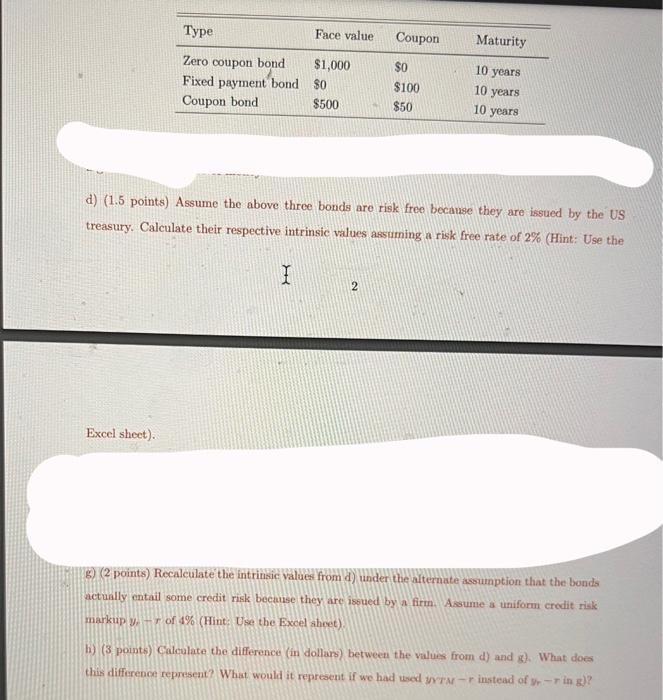

g) (2 points) Recalculate the intrinsic values from d) under the alternate assuuption that the bonds actually entail some credit risk becunse they are issued by a firm. Assume a uniform credit risk markup y, rof 4% (Hint Use the Excel aheet). hi) (3 points) Caleulate the difference (in dollars) between the values from d) and g). What does this differeace represent? What would it repreaent if we had used yorM r instead of y yr r in g)? d) (1.5 points) Assume the above three bonds are risk free because they are issued by the US treasury. Calculate their respective intrinsic values assuming a risk free rate of 2% (Hint: Use the Excel sheet). (g) (2 points) Recalculate the intrinsic values from d) under the Giternate asounption that the bonds actually entail some credit risk becanse they are isshed by a firm. Assume a uniform credit riak markup yrr of 4% (Hint Use the Excel ahmet). hi) (3 points) Calculate the difference (in dollars) between the values from d) and g. What does this differenoe represent? What would it represent if we had used iorM r instead of yrr in g)? g) (2 points) Recalculate the intrinsic values from d) under the alternate assuuption that the bonds actually entail some credit risk becunse they are issued by a firm. Assume a uniform credit risk markup y, rof 4% (Hint Use the Excel aheet). hi) (3 points) Caleulate the difference (in dollars) between the values from d) and g). What does this differeace represent? What would it repreaent if we had used yorM r instead of y yr r in g)? d) (1.5 points) Assume the above three bonds are risk free because they are issued by the US treasury. Calculate their respective intrinsic values assuming a risk free rate of 2% (Hint: Use the Excel sheet). (g) (2 points) Recalculate the intrinsic values from d) under the Giternate asounption that the bonds actually entail some credit risk becanse they are isshed by a firm. Assume a uniform credit riak markup yrr of 4% (Hint Use the Excel ahmet). hi) (3 points) Calculate the difference (in dollars) between the values from d) and g. What does this differenoe represent? What would it represent if we had used iorM r instead of yrr in g)