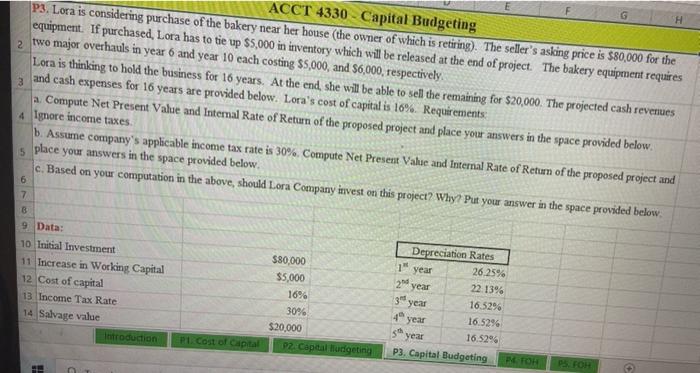

G ACCT 4330 - Capital Budgeting P3. Lora is considering purchase of the bakery near her house (the owner of which is retiring). The seller's asking price is $80,000 for the equipment. If purchased, Lora has to tie up $5,000 in inventory which will be released at the end of project. The bakery equipment requires 2 two major overhauls in year 6 and year 10 each costing $5,000, and $6,000, respectively Lora is thinking to hold the business for 16 years. At the end, she will be able to sell the remaining for $20,000. The projected cash revenues 3 and cash expenses for 16 years are provided below. Lora's cost of capital is 16%. Requirements: a. Compute Net Present Value and Internal Rate of Return of the proposed project and place your answers in the space provided below. 4 Ignore income taxes b. Assume company's applicable income tax rate is 30%. Compute Net Present Valuc and internal Rate of Return of the proposed project and 5 place your answers in the space provided below. c. Based on your computation in the above, should Lora Company invest on this project? Why? Put your answer in the space provided below 6 7 B 9 Data: Depreciation Rates 10 Initial Investment $80,000 26.25% 11 Increase in Working Capital $5,000 22. 13% 12 Cost of capital 16% 3 year 16.52% 13 Income Tax Rate 30% 16.52% 14. Salvage value $20,000 year 16.52% Introduction Cost of Capital P2 Captal budgeting P3, Capital Budgeting PROH PS. FOH 1 year 2 year 4 year sh G ACCT 4330 - Capital Budgeting P3. Lora is considering purchase of the bakery near her house (the owner of which is retiring). The seller's asking price is $80,000 for the equipment. If purchased, Lora has to tie up $5,000 in inventory which will be released at the end of project. The bakery equipment requires 2 two major overhauls in year 6 and year 10 each costing $5,000, and $6,000, respectively Lora is thinking to hold the business for 16 years. At the end, she will be able to sell the remaining for $20,000. The projected cash revenues 3 and cash expenses for 16 years are provided below. Lora's cost of capital is 16%. Requirements: a. Compute Net Present Value and Internal Rate of Return of the proposed project and place your answers in the space provided below. 4 Ignore income taxes b. Assume company's applicable income tax rate is 30%. Compute Net Present Valuc and internal Rate of Return of the proposed project and 5 place your answers in the space provided below. c. Based on your computation in the above, should Lora Company invest on this project? Why? Put your answer in the space provided below 6 7 B 9 Data: Depreciation Rates 10 Initial Investment $80,000 26.25% 11 Increase in Working Capital $5,000 22. 13% 12 Cost of capital 16% 3 year 16.52% 13 Income Tax Rate 30% 16.52% 14. Salvage value $20,000 year 16.52% Introduction Cost of Capital P2 Captal budgeting P3, Capital Budgeting PROH PS. FOH 1 year 2 year 4 year sh