Question

G. Assume that instead of the Expected Overhead Costs originally noted, Overhead Costs are allocated to units based on two different labor-based activity bases: Welding

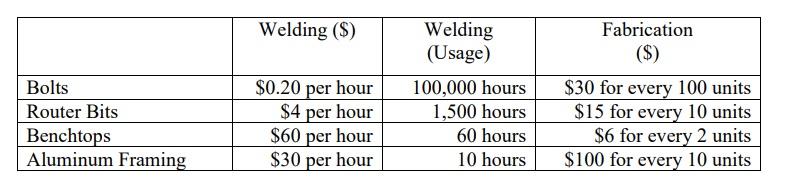

G. Assume that instead of the Expected Overhead Costs originally noted, Overhead Costs are allocated to units based on two different labor-based activity bases: Welding and Fabrication. Overhead costs applied via welding are allocated to all units based on total per hour labor costs, while those of fabrication are allocated to all units based on the number of units assembled for the day. Estimate the total overhead costs for each product again when applying overheads costs using the following allocation methods.

H. Based on your answers to Part G, which product has the largest change in total overhead costs (positive or negative)? What contributes most to the change?

I. Based on your answers to Part G above, Estimate the per unit costs for each product again when applying the new overheads costs. (Note: Assume the same production units, Direct Material Costs, and Direct Labor Costs from Parts A F; Only Overhead Costs change as part of Part G.)

J. Based on your answers to Part G and Part H, which product has the largest change in per unit price (positive or negative)? What contributes most to the change?

Welding ($) Bolts Router Bits Benchtops Aluminum Framing $0.20 per hour $4 per hour $60 per hour $30 per hour Welding (Usage) 100,000 hours 1,500 hours 60 hours 10 hours Fabrication ($) $30 for every 100 units $15 for every 10 units $6 for every 2 units $100 for every 10 units Welding ($) Bolts Router Bits Benchtops Aluminum Framing $0.20 per hour $4 per hour $60 per hour $30 per hour Welding (Usage) 100,000 hours 1,500 hours 60 hours 10 hours Fabrication ($) $30 for every 100 units $15 for every 10 units $6 for every 2 units $100 for every 10 unitsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started